Hedge Fund manager David Einhorn of Greenlight Capital is noted for his investment prowess as well as his poker skills. So when he makes a move people watch and try to learn. But his latest reported move in Lam Research (O:LRCX) looks like it may be one to ignore, or maybe even reverse.

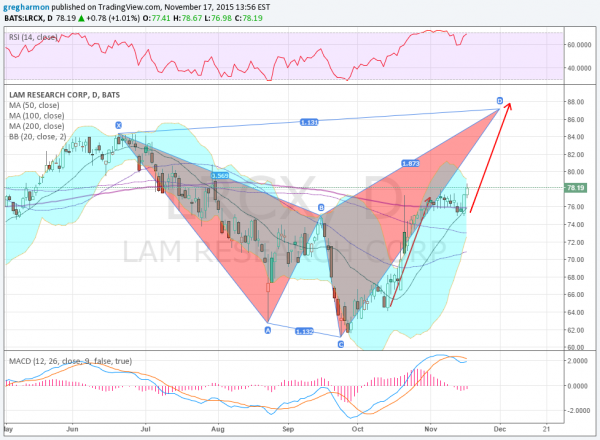

Einhorn is reported to have sold his entire stake in Lam Research. While this likely happened a few weeks ago, the stock is looking pretty good right now. The chart below shows a double bottom with the market low in August and then again in September. Now moving higher, there are two patterns that both point to more upside.

The first is the bearish Shark harmonic. This pattern gives a upside Potential Reversal Zone (PRZ) at 87.16, where it may reverse lower. The second is the move higher from 64 into consolidation and now a break higher. This break targets a move to 88.

Momentum is on the side of higher prices too. The RSI is bullish and the MACD, although flat, is turning back higher. There is 10% short interest to fuel a move and the squeezing Bollinger Bands® suggest it will happen soon. Watch for the break and if it is to the upside, pick up the cards Einhorn has cast away.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.