The US economy added a mere 126k jobs in March 2015, compared with a monthly average of 281k over the previous six months. The news missed market expectations by the largest margin since December 2009. The latest data break the strong performance of the US labour market in recent months, but also bring it in line with other indicators of economic activity, which have shown a significant slowdown in the first quarter of 2015. Most forecasters now expect GDP growth in the first quarter to be in the region of 0-1%, and have proposed eight reasons to explain the slowdown.

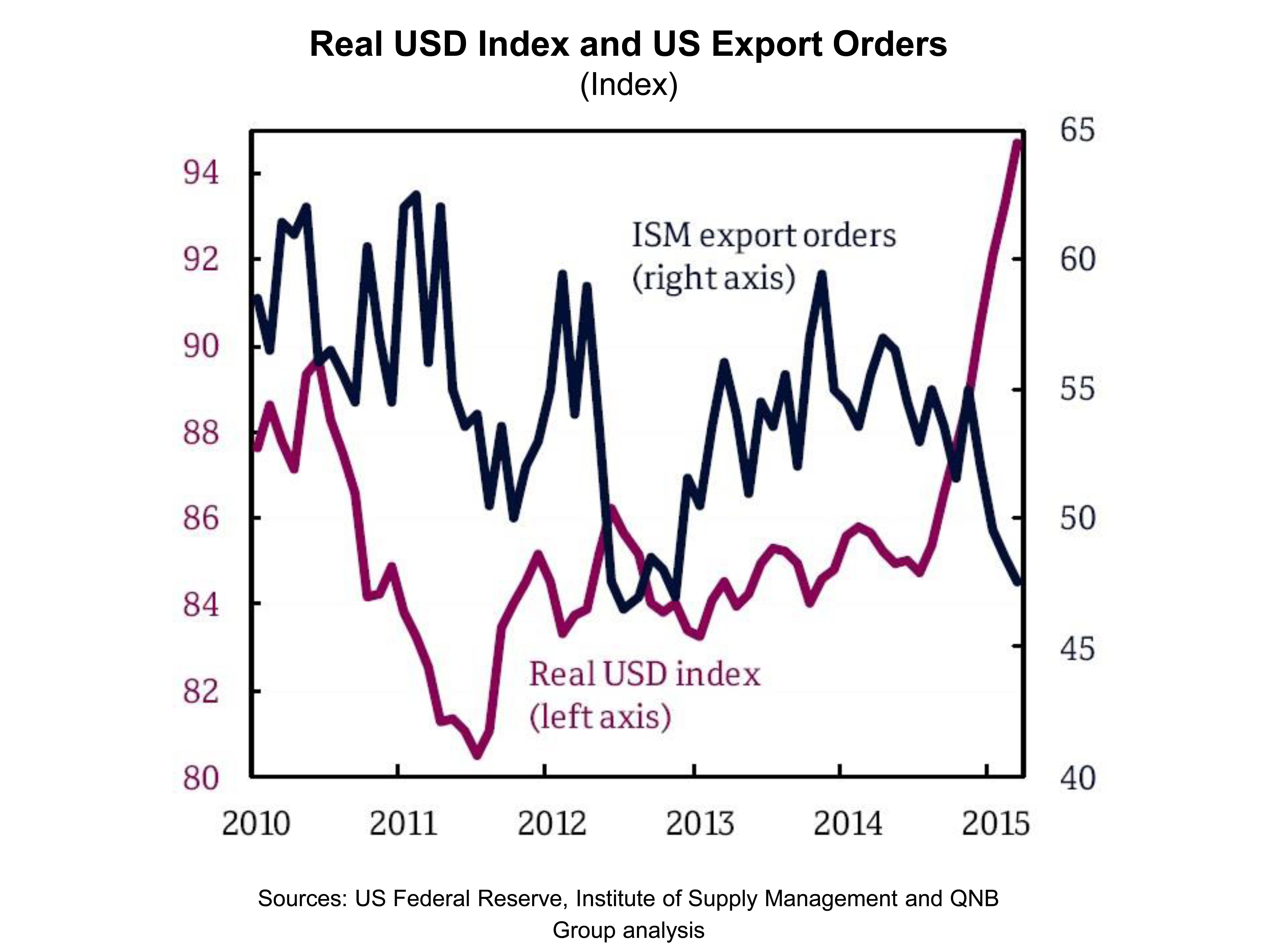

1. A stronger US dollar hurting exports. Since June 2014, the Federal Reserve’s (Fed) broad real dollar index has gone up by 11.5%, reducing the competitiveness of US exports. This is due to the large quantitative easing programmes in the Euro Area and Japan as well as the wave of monetary easing by about two dozen central banks around the world. Some of the impact of the stronger US dollar is already being felt, with the ISM export orders falling substantially since June 2014. Going forward, the expected appreciation of the US dollar could continue to be a drag on US growth and corporate profits.

2. Tighter financial conditions. Although US government bond yields have fallen in the first quarter compared to the previous quarter, broader measures show a tightening in financial conditions for households and corporates. Interbank and corporate credit spreads have widened. Furthermore, house prices seem to have eased in 2015, which reduces the household’s ability to obtain credit. Tighter financial conditions may have contributed to the slowdown of the US economy. And a potential interest rate hike by the Fed could tighten financial conditions further.

3. Deflation. Annual inflation in the US consumer price index dipped below zero in January and stood at 0.0% in February. It may decline further in the coming months due to lower oil prices, increasing the risk of prolonged deflation. Deflation can hamper economic activity because it encourages consumers to delay spending in anticipation of lower prices in the future. Deflation also increases real interest rates, which hurt investment. But while deflation remains a risk, there is little evidence that it has taken hold of the economy. Market and survey measures of inflation expectations in the US remain well anchored and do not show signs of expected deflation. Furthermore, nominal wages are still growing, suggesting that the risk of a wage-price deflationary spiral remains remote.

4. Low wage growth. The slow growth in wages has been proposed as a possible reason for the slowdown in economic activity. We do not see any evidence of this. Real average hourly earnings have grown by an estimated 1.5% in Q1-2015 over Q4-2014. Furthermore, due to the strong performance of the US labour market, the number of employed people in the economy has increased by 0.4% over the same period. This suggests that the aggregate spending power among workers in the US economy has in fact gone up, but it is yet to be reflected in their consumption.

5. Lower oil prices driving investment spending down. Capital spending in the oil and gas sector is expected to decline by 20-40% in 2015 in response to lower oil prices. Investment cuts will of course negatively impact GDP. But lower oil prices will also increase consumers’ disposable income (i.e. income excluding spending on gasoline). With consumption accounting for a much larger share of GDP compared to investment (68% versus 17%), the overall impact on GDP from lower oil prices is likely to be positive, but with a lag. For while it may take time for consumption to pick up, investment cuts are more immediate. Therefore, GDP is likely to suffer in the first quarter due to investment cuts but we expect the positive contribution from consumption to dominate in the coming quarters.

6. Weather. Colder-than-usual weather and snowstorms have distorted economic activity in the first quarter, but this is only a temporary factor. In fact, a bounce-back in activity in the coming quarters would be expected as businesses make up for the weather-imposed stoppages.

7. Strikes. Labour strikes at ports on the US West Coast have disrupted foreign trade and reduced shipping activity. These strikes are estimated to have had a negative but small impact on US GDP, but they are not expected to continue in the remainder of 2015.

8. Seasonality. US GDP growth has tended to be weaker in Q1 relative to the other quarters in recent years. From 2010 to 2014, growth in the first quarter averaged 0.6% compared to 2.9% for the other quarters. This may be due to a flaw in the seasonal adjustment procedures, which is unlikely to be an issue beyond Q1.

In conclusion, the outlook for the US economy depends on whether the positive impulses from lower oil prices, higher real wage growth and the disappearance of temporary first quarter factors (weather, strikes and seasonality) could outweigh the negative impact of a stronger US dollar and the tightening in financial conditions. Key to this is the behaviour of the US consumer who is enjoying a buoyant labour market, increasing real wages and lower gasoline prices. The US consumer has never had it better in recent years and his confidence is at a post-crisis high, but the world is waiting for him to spend more.