Farm-in deal priced at a premium

Egdon has announced a second farm-in deal with TOTAL in the Gainsborough shale-gas play in the North of England involving the PEDL209 licence. The deal is priced at $3000/acre, which is higher than the recent farm-in deal at PEDL139/140 at $2000/acre. This implies a value of 7p/share on PEDL209, that we can now add to the 8p/share for PEDL139/140. TOTAL’s farm-in deals provide strong verification of the Gainsborough shale-gas play as one of the premier positions in the UK and give Egdon a full carry on three shale wells, therefore limiting any financial risk to shareholders. Our RENAV value has increased to 26.2p (vs 25.8p) with total unconventional value now 15p implying an overall value of 41p.

Egdon farm-out deals: Implied value 15.0p

TOTAL’s second farm-in deal with Egdon gives further strong verification of the value attributed to the Gainsborough shale gas play, in what can now be considered one of the premium plays in the UK. The deal implies a value for Egdon in PEDL209 of $3000/acre and is priced at a premium to the most recent deal at PEDL139/140 and to the Cuadrilla/Centrica deal, both valued at $2000/acre. The inferred value of PEDL209 is 7p/share, and PEDL139/140 is 8p/share, making a total unconventional value of 15p/share. TOTAL has substantial experience of shale assets globally, notably with exploration assets in Argentina, Denmark, Poland, and proven assets in the Barnett Shale in the US. This makes it a strong partner technically at the drillbit as well as financially, given its size.

Exploration: More active 2014 programme

In our last note on Egdon we highlighted the company’s substantial conventional value, which is worth 18.3p risked (220.1p unrisked).

Valuation: Exploration drives upside, risked NAV 26p

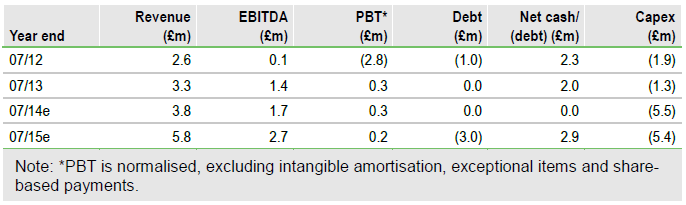

We have marginally increased our core NAV to 7.9p (vs 7.5p previously) due to the inclusion of cash from the TOTAL farm-in deal. Consistent with our previous analysis, we value Egdon’s conventional exploration portfolio at 18.3p per share, which implies a 26.2p RENAV, with the acreage farmed out to TOTAL now adding a further 15p/share to this valuation.

To Read the Entire Report Please Click on the pdf File Below