Crypto critics and skeptics often like to point out the high use of energy that is consumed by the Bitcoin network. Most proponents, including myself, regularly refute these claims as simply being the cost of doing business.

The video I'm about to show you isn't new but it's something that I saw for the first time today and it blew my mind.

Andreas Antonopoulos is arguably one of Bitcoin's most recognized names. In this clip, Andreas responds to the question of energy consumption in a rather unique way.

Not only does he make a comparison between the energy consumption of traditional means of payment but he also explains that the energy arbitrage that is being committed by the Bitcoin network is arguably the most efficient use of surplus energy that might otherwise go to waste.

No doubt, if more and more cryptocurrencies tried to adopt the Proof of Work, mining protocol it could be wasteful, but Andreas believes that at least one is, in fact, necessary in order to maintain the exceptional security of all cryptocurrencies.

Today's Highlights

Trade War On Hold

Efficiency in Oil

Ready for Risk

Please note: All data, figures & graphs are valid as of May 21st. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

The US Secretary of the Treasury Steven Mnuchin has announced over the weekend that the trade war between the United States and China is officially on hold.

Speaking on Fox News Sunday, Mnuchin outlined the framework under which the de-escalation is taking place as well as explaining what happened with ZTE (HK:0763) and why. Arguably, not a very forthcoming explanation, but that's probably as good as we're going to get.

Markets, on the other hand, do not seem to be on hold. Nor are they showing any real signs of relaxation following Mnuchin's announcement. The most notable move, of course, is the US Dollar, which is flying this morning.

The purple circle here is the weekend gap...

Crude Oil's Reaction

Strangely enough, crude oil is burning ever higher on the announcement. I can't personally come up with any fundamental reasons why the Secretary's announcement should have a positive effect on the price of oil, and that's after reading several articles that try to make that very claim.

If anything, the stronger USD should serve to send the sticky stuff lower. Looking at the price, it becomes a bit more clear. The high of $72 per barrel was actually triggered last Thursday (yellow circle). The gap from the weekend (purple circle) was so weak that we could consider the Trade War news to have had a neutral effect.

Keep in mind that today is Whit Monday in the EU and Victoria Day in Canada, so volumes could be light throughout the day.

Cryptos in Green

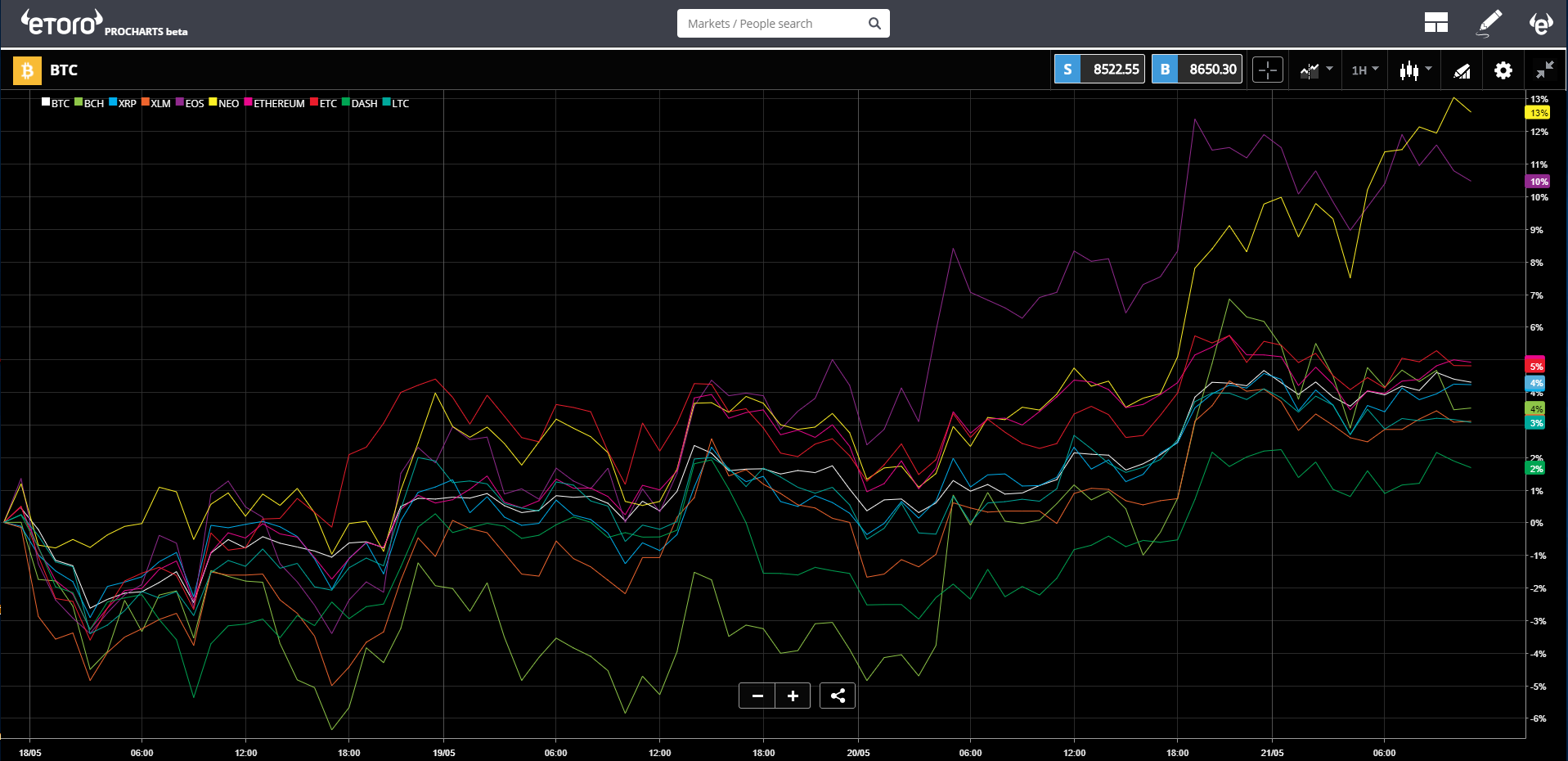

The weekend has gone well in crypto-land with all of the 10 tokens listed on eToro rising.

Looking at the landscape, we can easily see that cryptotraders are piling on the risk again. This is apparent by the fact that the most experimental of the bunch, EOS and NEO are outperforming the rest by a wide margin. Whereas two of the most established coins, Litecoin and Dash, have underperformed.

This type of irrational behavior is unfortunately rather typical of financial markets. Both EOS and NEO are far from operating at full capacity and investors see this as an opportunity to get in before "the revolution" takes place. When in fact, it would make more sense to be looking at networks that have already stood the test of time and are in fact growing in their adoption and use.

No matter. the risk/reward slider doesn't lie. Those who take on greater risks might end up being rewarded for them but if the respective projects don't end up materializing, prices could come crashing as well. Whereas, the more established networks are less susceptible to those type of wild gyrations.

Risk Efficiency

Interestingly enough, it seems that a similar dynamic is playing out in the traditional markets as well. Here we can see three different ETFs that cover different parts of the market.

White = Russell 2000 (NYSE:IWM) - Smallcap Stocks

Blue = S&P Midcap (NYSE:IJH) Stocks

Green = S&P Largecap (NYSE:IVV) Stocks

Notice how investors are seeking out the extra risk as they speculate that the smaller companies will grow faster than the larger ones.

Wise investors will no doubt keep a diversified portfolio. One that holds a very small amount of ultra-high-risk assets, and includes plenty of different types of markets from crypto to stocks to ETFs and everything else.

Let's have an amazing week ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.