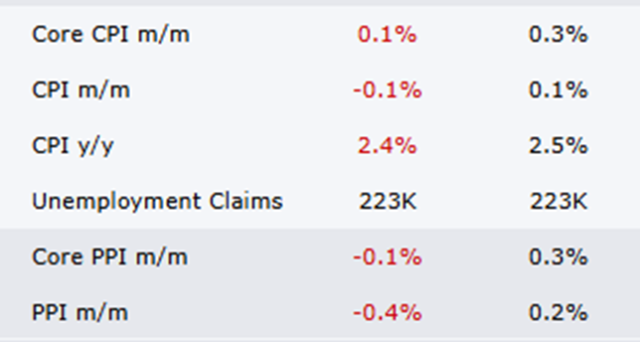

All the inflation data is out (CPI yesterday, PPI today), and it is ice cold. The actual data (left column) is way, way below the anticipated (right). In normal times – – and these are NOT – – the bulls would be celebrating this with +200 on the /ES. Instead, it’s slowly sinking in that deflation is creeping into our lives, and that’s not something to celebrate.

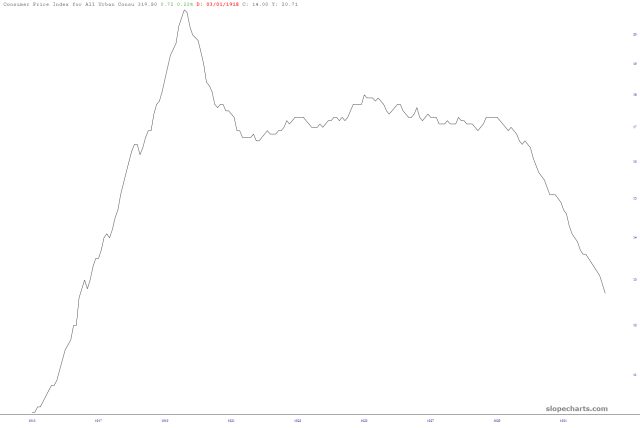

Indeed, none of us were even alive during any deflationary period until now. The last time this happened was in the late 1920s and early 1930s, and I vaguely remember that was an interesting period of economic history in the world.

In the markets, US Treasury Bonds continue to sink, as the world is correctly concluded that the U.S. is bankrupt, not trustworthy, and headed for financial ruin, so it’s not exactly a peachy-keen credit risk.

Likewise, folks are realizing that the U.S. dollar is gently used toilet paper, and that the better thing to old is real money, otherwise known as gold.

As for “digital gold“, Bitcoin, is has remained surprisingly robust inasmuch as it never cracked the $73,500 level. If and when it does, it will exacerbate the bearish feelings that have spread o’er the land of assets.

Now let’s talk about Tim’s feelings which, let’s face it, is why we’re all here.

I promised myself yesterday afternoon that I wouldn’t look at a single quote until this morning, and I kept that promise. It was like taking a vow of chastity and strolling all evening through an orgy, averting my eyes every step of the way. I simply didn’t want to torture myself anymore, because the past couple of weeks have felt like at least a year. Can you even believe that Trump pulled out that tariffs poster only last Wednesday? It seems like a lifetime ago!

I ended my trading Thursday INCREDIBLY short, and I live in abject terror that what happened two days ago (intraday) would happen in some form overnight, and I’d want up to horrific numbers.

Instead, when I ambled over to my display, the stock futures were up very modesty, just like the old days. They’ve slipped somewhat into the red, which I appreciate, but things seem eerily and freakishly calm right now, all things considered.

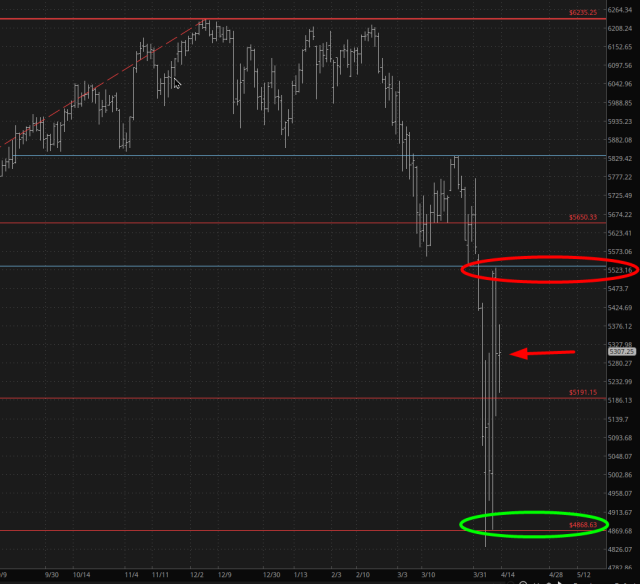

The thing is, we’re kind of in no man’s land (arrow) right now, smack dab in the middle of the very obvious place to buy (green oval, where I bought XOP and EFA) and the very obvious place to short (red oval, where I shorted everything that had the misfortune of having a ticker symbol). So, I feel quite “at risk” right now, particularly since, I dunno, Powell might pull some stunt this weekend to save his billionaire bond butt buddies.

What I can say, though, much longer-term terms, is that our time is here. This is expressed by one simple ratio chart that I’ve been talking about for months and months, which is the All World Index divided by Gold.

My thesis all this time has been BUY gold and SHORT equities, based on this chart. For oh so long, the charting was hammering out its top, teasing us with its completion.

That completion is here. The time is now. Short-term wiggles aside, the world has changed forever.