Edwards Lifesciences Corporation (NYSE:EW) reported third-quarter 2017 adjusted earnings per share (EPS) of 84 cents, which missed the Zacks Consensus Estimate of 86 cents by 2.3%. However, adjusted earnings improved 23.5% year over year, primarily driven by strong sales growth at the company’s transcatheter heart valves business.

Excluding one-time items, net income in the third quarter came in at $170.1 million or 79 cents per share, up 20.3% or 21.5% year over year, respectively.

Sales Details

Edwards Lifesciences’ third-quarter sales improved 11.1% to $821.5 million. However, the figure missed the Zacks Consensus Estimate of $834 million by 1.5%. Underlying sales increased 12.9% (including the impact of Germany stocking sales as customers in the nation chose to purchase additional inventory of the SAPIEN 3 valve in anticipation of a potential supply interruption resulting from recent intellectual property litigation).

Revenues were primarily driven by considerable growth in transcatheter heart valve sales as well as strong performance by Surgical Heart Valve Therapy and Critical Care product lines too across all regions.

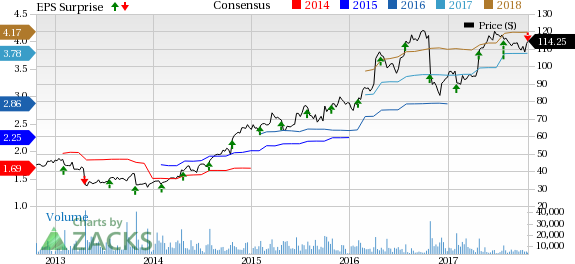

Edwards Lifesciences Corporation Price, Consensus and EPS Surprise

Segments Details

For the third quarter, the company reported Transcatheter Heart Valve Therapy (THVT) sales of $481.2 million, reflecting 17.3% growth over the prior-year quarter. In the United States, THVT sales in the quarter totaled $311.6 million, up 20.1% year over year. Growth was driven by excellent clinical performance by SAPIEN 3 as well continued strong therapy implementation across all regions.

Surgical Heart Valve Therapy sales in the quarter were $195.6 million, up 2.4% from the prior-year quarter. This was led by strong demand for the EDWARDS INTUITY Elite valve system and strong uptake of core products outside the United States, partially offset by the continuing shift from surgical aortic valves to the SAPIEN 3 valves in the United States and Europe.

Critical Care sales were $144.7 million in the reported quarter, representing an increase of 4.5% from third-quarter 2016. Solid growth across all product categories was driven by strong growth in the company's core products and the Enhanced Surgical Recovery Program, mainly in the United States and Asia Pacific.

Margins

In the third quarter, gross margin expanded 120 basis points (bps) to 74% owing to a more profitable product mix, led by growing sales of transcatheter valves as well as a favorable comparison of supply chain expenditures. This was however partially offset by expenses incurred due to flooding from Hurricane Maria in Puerto Rico and the shutdown of the company's manufacturing plant in Switzerland.

SG&A expenses rose 6.5% year over year to $244.6 million on account of sales and personnel-related expenses, primarily in the Transcatheter Valve (THV) segment.R&D expenditures increased 26.5% year over year to $142.9 million owing to continued investments in the company’s transcatheter aortic valve and mitral valve program. Adjusted operating margin in the quarter expanded 50 bps to 26.9% as the rise in revenues outweighed the increase in operating expenses.

Cash Position

Edwards Lifesciences exited the third quarter with cash and cash equivalents and short-term investments of $1.4 billion, compared with $1.13 billion at the end of the second quarter. Long-term debt in the quarter totaled $1.03 billion, compared with $1.02 billion reported in the previous quarter.

Cash flow from operating activities was $310.8 million in the third quarter, compared with $197.7 million in the previous quarter. Excluding capital spending of $42.3 million, free cash flow was $268.5 million. During the quarter, average diluted shares outstanding were 216.2 million.

2017 Guidance Stays

Edwards Lifesciences has reaffirmed its full-year 2017 sales expectations at the high end of the previously projected range of $3.2-$3.4 billion. The Zacks Consensus Estimate for full-year revenue is $3.40 billion, coinciding with the high end of the guided range. Adjusted EPS expectations have also been reinstated at $3.65–$3.85. The Zacks Consensus Estimate for full-year adjusted EPS stands at $3.78, within the company’s guided range.

For the fourth quarter of 2017, the company projects sales (after adjusting for the effect of Germany stocking sales) between $855 million and $895 million. The Zacks Consensus Estimate for revenues is $874.2 million, within the company’s projected range. The company estimates adjusted EPS between 84 cents and 94 cents. Meanwhile, the Zacks Consensus Estimate for adjusted EPS is 92 cents, which is also within the company‘s forecasted range.

Our Take

Edwards Lifesciences exited the third quarter on a disappointing note with both earnings and revenues lagging the respective Zacks Consensus Estimate. The company’s business was affected by the recent natural disasters in the Caribbean and the United States. Edwards Lifesciences has principal manufacturing locations for its Critical Care products in Puerto Rico and the Dominican Republic. In Puerto Rico, the company had to discontinue production due to floods which affected the top line to some extent. The company also had to postpone a number of procedures in Houston and Florida. Per management, natural disasters negatively impacted third-quarter sales to the tune of $2 million.

Nevertheless, strong transcatheter valve sales in the domestic market as well as overseas is a major positive. The company also performed well on its gross margin front, which raises optimism.

Management expects to gain traction in the ever-expanding TAVR market, based on increasing preference in favor of transcatheter aortic valve replacement as well as compelling clinical evidence, leading to strong adoption of THV therapy. However, tough competition in the cardiac devices market and reimbursement issues continue to pose challenges.

Zacks Rank & Key Picks

Currently, Edwards Lifesciences has a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical sector are PetMed Express, Inc. (NASDAQ:PETS) , Abbott (NYSE:ABT) and Intuitive Surgical, Inc. (NASDAQ:ISRG) . Notably, PetMed sports a Zacks Rank #1 (Strong Buy), while Abbott and Intuitive Surgical carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported EPS of 43 cents for the second quarter of fiscal 2018, up 79.2% from the year-ago quarter’s 24 cents. Also, gross margin expanded 548 bps year over year to 35.2% in the reported quarter.

Abbott reported third-quarter 2017 adjusted earnings from continuing operations of 66 cents per share, up 11.9% year over year. Also, third-quarter worldwide sales came in at $6.83 billion, up 28.8% year over year.

Intuitive Surgical posted adjusted earnings of $2.77 per share in the third quarter of 2017, up 34.5% on a year-over-year basis. Also, revenues increased 18% year over year to $806.1 million.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Abbott Laboratories (ABT): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Original post