Earnings aren’t the big news this week, with the focus squarely on top-tier economic reports about jobs and the broader economy. The market will be reading these reports with the Fed’s coming meeting in mind, weighing the odds whether the September 17/18 FOMC meeting will finally usher in the long-awaited ‘Taper’.

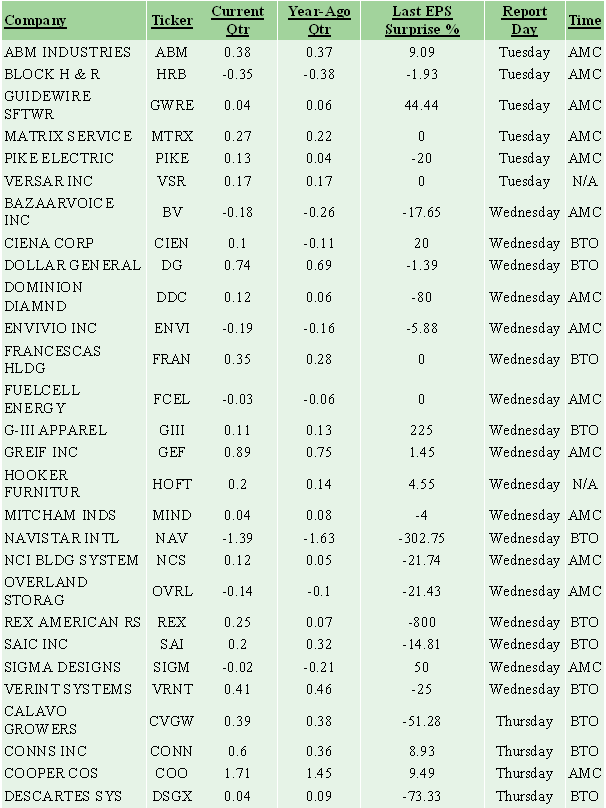

The earnings season may no longer be front and center, but it isn’t (technically) over yet, with 41 companies coming out with results this week, including 3 S&P 500 members. For all practical purposes, however, the Q2 earnings season is already over, with results from 494 S&P 500 companies already out (as of Friday, August 30th). Only three of the 16 Zacks sectors have a few reports still awaited and this week’s reports from H&R Block (HRB), Dollar General (DG) and SAIC (SAI) will push us further to the finish line.

Most of the recent results have been from the Retail sector and they have broadly been on the weak side. The soft tone set by results from Wal-Mart (WMT), Macy’s (M) and others earlier in the sector’s reporting cycle largely remained in place, with most of the apparel and other soft-line retailers failing to impress. The Q2 earnings and revenue growth numbers for the sector aren’t bad; they are in fact better than what the sector produced in Q1 and the last few quarters.

But many more retailers came out short of expectations, with the earnings and revenue beat ratios for Q2 materially weaker than Q1 and the four-quarter average. The overall tone of guidance was on the weak side as well, prompting analysts to cut their estimates for the sector. Total earnings for the sector are expected to be up +6.5% in Q3, down from +17.3% growth pace expected in mid-July.

The downward adjustment to Q3 expectations is fairly pronounced in Retail, but the issue is hardly confined this sector alone, as estimates have come down for all sectors. Total earnings in Q3 for the S&P 500 as a while are currently expected to up +1.9% from the same period last year, which is down from +5.2% expected in early July. Basic Materials, Industrials, and Technology are the other major sectors experiencing material negative estimate revisions.

The Q2 Earnings Scorecard

Total earnings for the 494 S&P 500 companies that have reported results already are up +2.5%, with 65.6% beating earnings expectations and a median surprise of +2.9%. Most of this growth has come from top-line gains, with total revenues for these 494 companies up +1.9% and 51.8% beating revenue expectations, with a median revenue surprise of +0.2%.

The earnings growth rate of +2.5% compares to +2.3% earnings growth rate in Q1 and the 4-quarter average growth pace of +2.8% for the same set of 494 companies. The earnings beat ratio, which was tracking a bit lower earlier in the reporting cycle, eventually caught on with historical levels. On the revenue side, the growth of +1.9% compares to +1.6% in Q1 and the 4-quarter average of +2.8% for this group of 494 S&P 500 companies. The revenue beat ratio of 51.8%, however, is decidedly better than what we saw in Q1 (42.1%) and the 4-quarter average (45.9%).

Strong results from the Finance sector played a big role in giving respectability to the aggregate Q2 data. It is very hard to be satisfied with the picture once Finance is excluded from the numbers. Total Finance sector earnings are up +30% on +8.5% higher revenues, with beat ratios of 76.9% for earnings and 65.4% for revenues. Finance’s performance has been way better than what we have seen from the group in recent quarters.

Earnings growth was particularly strong at the large national and regional banks, with total earnings at the Major Banks industry, which includes 15 banks like J.P. Morgan (JPM), Bank of America (BAC), Key Corp (KEY) and alone accounts for more than 40% of the sector’s total earnings, were up +8.4% from the same period last year. Total earnings for the Major Banks still remained below the group’s record tally in Q1. The insurance industry, the second largest contributor to Finance sector earnings, had to deal with tough comparisons, resulting in negative growth in Q2. The brokerage firms benefited from easier comps, with total earnings for the Brokerage/Investment Management industry up +16%.

Not So Good Outside Finance

Strip out Finance and total Q2 earnings growth for the S&P 500 turns negative – down -2.9%. This is weaker than what these same companies reported in Q1. Weakness in the Technology sector spotlights the broad growth challenge outside of Finance, though Basic Materials (total earnings down -11.1%) and Energy (-12.7%) also played roles.

Total Technology sector earnings are down -10.1% on +0.4% higher revenues, the weakest performance from the sector in a while. Technology is a big area, ranging from hardware makers like Apple (AAPL) and Dell (DELL) to software vendors like Adobe (ADBE) and Microsoft (MSFT) and chipmakers like Intel (INTC). The hardware and software industries individually bring in roughly 45% and 35% of the Technology sectors total quarterly earnings. In Q2, the modestly positive growth for the software industry was more than offset by weakness at the hardware vendors.

Had Technology been not such a big drag on overall results, the aggregate picture would be somewhat better. Excluding Technology, total S&P 500 earnings would be up +5.4% in Q2.

Expectations for Second half & Next year Remain Positive

The predominant negative tone of company guidance has started showing up in expectations for Q3 and the second half of the year. As a result, full-year 2013 earnings growth expectations have come down despite the typical positive earnings season outperformance in Q2. The recent downtrend in estimates notwithstanding, there is still plenty of room for estimates to come down.

The chart below plots the current Q3 and Q4 growth expectations in the context of where growth has been over the last few quarters. The current +1.9% expected growth rate in Q3 is down from +2.5% two weeks back and +5.2% in early July.

The chart below looks at the same data as is in the chart above, but takes Finance out of the numbers. As you can see, a lot of the expected growth in the second half of the year, particularly Q4, is from sectors outside of the Finance sector.

Given what we have seen thus far in Q2 and in the last few quarters from sectors outside of Finance (above chart), it doesn’t seem reasonable to expect a strong growth ramp up later this year. What this means is that we will see further acceleration in negative estimate revisions in the coming days as retailers and others guide lower towards Q3 and beyond.

Monday-9/2

- Markets closed for Labor Day.

- The August Manufacturing ISM report is the key report in the morning, with expectations of a modest pullback from the prior month’s 55.4 level.

- H&R Block (HRB) and ABM Industries (ABM) are the only notable earnings reports today, both reporting after the close.

- Automakers will be reporting the August motor vehicle sales numbers throughout the day, with overall annualized sales expected to modestly inch up from July’s 15.7 million level. We will also get the August Trade Deficit numbers in the morning and the Fed’s Beige Book in the afternoon.

- Dollar General (DG), Ciena (CIEN), and G-III Apparel (GIII) are the only notable reports in the morning.

- Zacks Earnings ESP or Expected Surprise Prediction, our proprietary leading indicator of earnings surprises, is showing Dollar General coming out with a positive earnings surprise.

- In addition to Jobless Claims, we will get the August ADP jobs report and the service sector ISM index report. The expectation is for ADP jobs of 190K, down from July’s 200K tally.

- Electronics retailers Conns (CONN) is the only notable earnings report in the morning, while Smith & Wesson (SWHC) and VeriFone (PAY) report after the close.

- Zacks Earnings ESP is showing Conns coming out with positive earnings surprise.

- The August non-farm payroll report is expected to show headline job gains of 165K compared to July’s 162K level. Given recent trend in Jobless Claims, the hope will be that the actual numbers come out better than expected.

- Smithfield Foods (SFD) is the only notable company reporting results today.

Original post