This past week I have continued to ponder my friend Lakshman Achuthan’s renewed recession call where he stated:

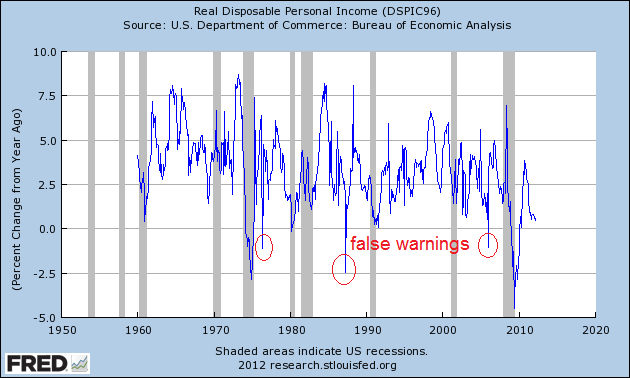

For the past three months, year-over-year real personal income growth has stayed lower than it was at the start of each of the last ten recessions.

Lakshman cannot explain the real elements from his economic forecasting tools as they are proprietary – and must provide examples from data sets which are in the public sector. Every recession is different, and likely ECRI is seeing weakness across a wide range of their proprietary indicators.

Yet, the problem in using personal income to explain a recession is coming is that there have been several false warnings where a recession did not occur.

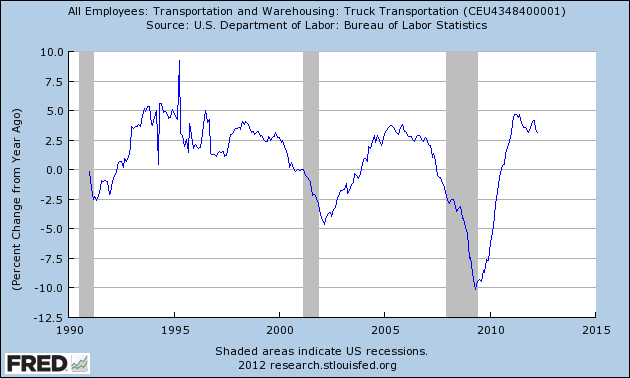

In any event, personal income is not a reliable tool by itself to warn a recession is eminent. Earlier this month, one of my favorite forecasting tools (truck transport employment) also showed weakness – but remained far away from the 6 month warning it has provided for recent recessions. I use the zero growth year-over-year for a recession warning.

Using truck transport employment data on its own to warn of a recession is not a good idea as there might be factors which effected truck transport employment disproportionate to the overall economy. And I tend to distrust data before 2000 as the economic dynamics have changed.

It is hard to identify economic sectors gaining traction (improvement in the rate of growth) – and stubbornly a little voice in the back of my head keeps screaming “what does not go up goes down”. I refuse to accept that a healthy economy should continue to grow a such a “moderate” (e.g. crappy, sickly, disappointing) rate if something was not fundamentally wrong.

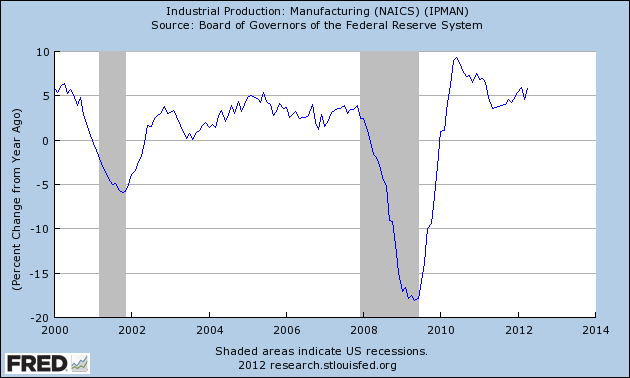

Yet, this past week the economically intuitive manufacturing subindex of Industrial Production was released. The manufacturing component of IP is growing 5.8% year-over-year (adjusted), and represents one of the strongest segments of the economy. It has a positive growth trend line, and has rebounded from last months decline.

There is no certainty in economics. Statistically, certainty can only come with a significant number of economic cycles under controlled conditions. Even a hundreds cycles are not enough to conclude statistical certainty – and the dynamics and conditions relating to each recession were different.

I continue to take ECRI’s recession call seriously – but I cannot provide at this time any evidence to support a recession is coming.

Other Economic News this Week:

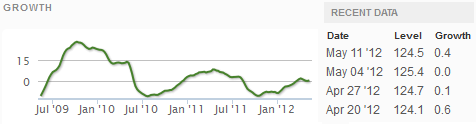

The Econintersect economic forecast for May 2012 shows moderate growth. There was some improvement in the government pulse point, but degradation in some of our transport related pulse points. Overall, the pluses and minuses balanced out.

ECRI has called a recession. Their data looks ahead at least 6 months and the bottom line for them is that a recession is a certainty. The size and depth is unknown but the recession start has been revised to hit around mid-year 2012.

This week ECRI’s WLI index value has been jumping around due to backward revision. The negative values seen in the last few weeks have now disappeared. However, this index is still showing the economy six month from today will be as bad as it is today.

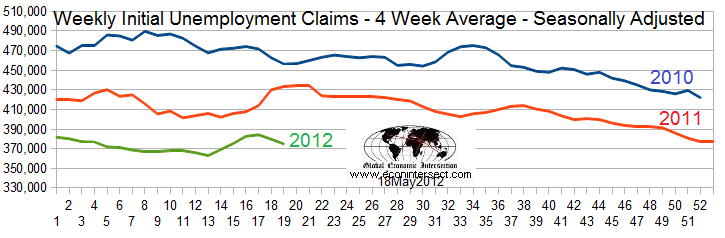

Initial unemployment claims essentially increased from 365,000 (reported last week) to 370,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – fell from 383,500 (reported last week) to 375,000. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Data released this week which contained economically intuitive components (forward looking) were rail movements and the import portion of container imports. Rail movements data this week is still indicating a moderate expansion if one ignores coal. Container Imports are finally growing year-to-date, but the growth is sickly at less than 1.0%.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks.

Bankruptcies this Week: Ally Financial subsidiary – Residential Capital, LightSquared (fka Sky Terra Communications)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Economy Continues To Grow Under The Shadow Of Recession

Published 05/20/2012, 01:30 AM

Updated 05/14/2017, 06:45 AM

Economy Continues To Grow Under The Shadow Of Recession

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.