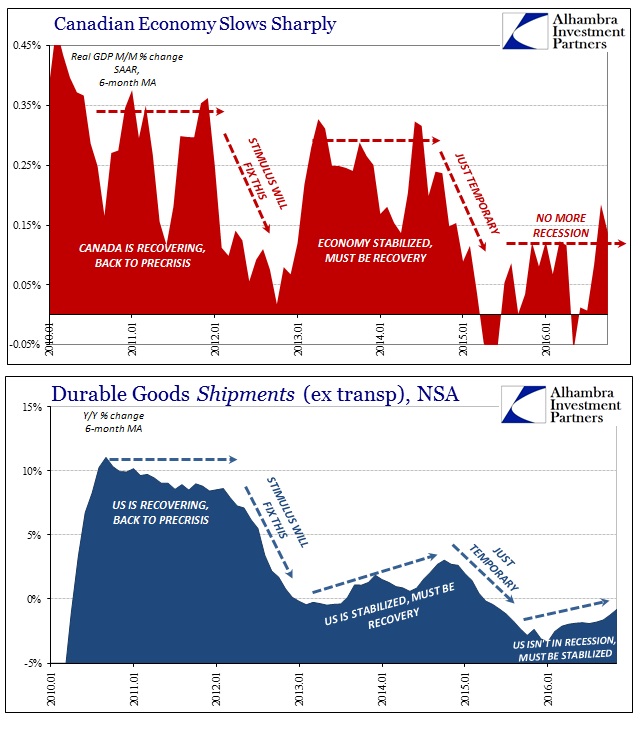

Canada’s economy remains the distinct enigma of the developed world, where the binary business cycle breakdown is perhaps most conspicuous. When oil prices first crashed to end 2014 and start 2015, even economists expected Canada’s economy to suffer, so exposed as it was and remains to the energy sector. But after two rough quarters to begin last year, that was supposed to be the full extent of it. Ever since the middle of 2015, economists have been predicting growth to resume. Instead, Canadian growth, as the rest of the world, continues to be at best uneven, unusually susceptible to contraction.

From the convention of recession/not recession, this was not how it was supposed to be. This article from September 2015 perfectly demonstrated the mainstream concept of growth/contraction:

Well, so much for Canada’s recession.

After pulling back for two straight quarters, the economy is showing new resilience — rebounding in subsequent months and providing hope of more growth for the rest of the year.

“Growth looks like it’s going to be pretty solid in the third quarter,” said Benjamin Reitzes, senior economist at BMO Capital Markets.

“Most definitely, this is among the shortest and most mild (recessions) in Canadian history.”

When quarterly GDP growth was once more abysmal in Q2 2016, it was similarly written off as a product of literal conflagration (Alberta wildfires) soon to be overcome and surpassed by looming “stimulus.” Canadian economists were again optimistic during the summer once the fires died down, but Q3’s better numbers haven’t been the start of recovery, either – nor should that have been the expectation. As I wrote in August:

Given the track record of “stimulus” all around the world, perhaps a little more skepticism is warranted for an economy “leaning heavily on Ottawa”? After all, Canada’s problems aren’t really Canada’s problems. At best, perhaps fiscal spending and payments might temporarily offset weakness (if even that), but it should be made clear that weakness is Canada’s continued future.

Statistics Canada reported last week that monthly GDP had contracted yet again. In October, GDP was down nearly 0.3% from September. There were no wildfires or even energy to blame this time:

The Canadian economy contracted in October, falling short of expectations as manufacturers recorded their largest monthly decline in output in nearly three years.

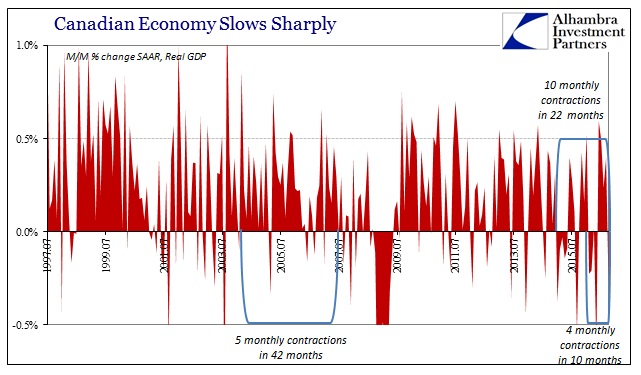

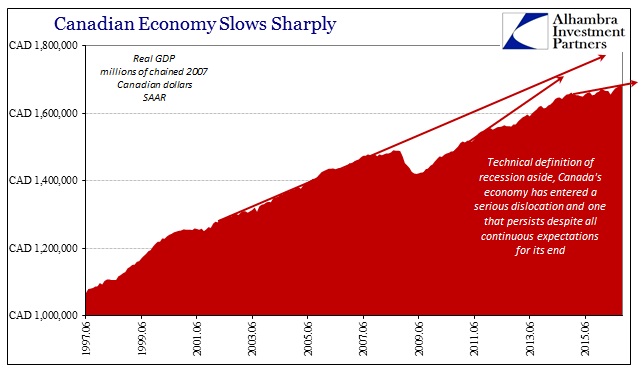

What we see more clearly in Canada is the same uneven economy that exists practically everywhere. In the 42 months from the start of 2004 until the middle of 2007, monthly GDP was negative in just five of them. Over the past 42 months through October, Canadian GDP has contracted instead thirteen times; ten just since the start of 2015. And despite all continuous recovery predictions, there have been four monthly contractions this year alone. In other words, in just 10 months of purported recovery, Canadian GDP has been negative already almost as many times as during the entire three and a half years of actual growth in the middle 2000’s.

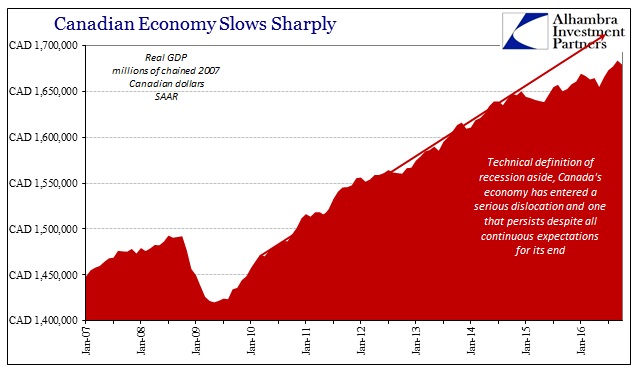

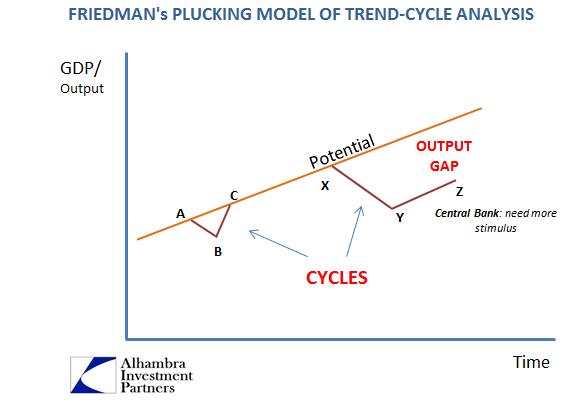

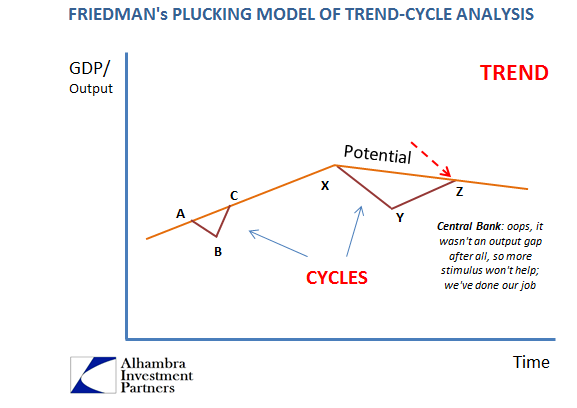

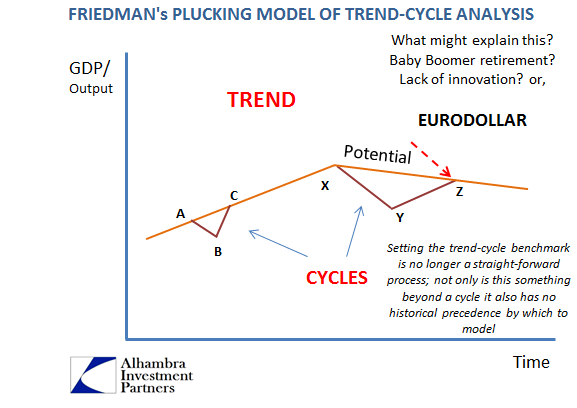

The result is a trajectory that has become far too familiar. Canadians survived longer than others without this drag due to its energy-heavy emphasis, but without that boost their economy falls off and doesn’t ever recover just like all the rest. It starts off below trend as any recession would, but then remains below trend as if the trend itself had changed. This is a direct violation of conventional thinking about the business cycle, and the combined product of more negative quarters or months than there “should” be.

This is the distinct imprint of monetary processes related to the eurodollar’s direct effects on the global economy.

Thus, what really matters is not the individual declines and their relative size, rather it is their persistence and the enormous, growing cost of time. The latest monthly GDP estimate marks the start of a third year for Canada’s economy below the prior trend – a trend that was already less than recovery from the Great (and global) “Recession.”

Though the Canada’s fortunes are heavily influenced directly by the US economy, the energy sector makes it more explicit that all of it is being driven by global money. The replication of this pattern across so many global systems and economic accounts from within them leaves no other explanation.

Weakness is not a result of recession, so therefore recovery is not a reasonable expectation – just as it hasn’t been for our friends in the North.