Germany is the powerhouse of Europe. It led the way after the global financial crisis and propped up the rest of the region at the depths of the Euro crisis. But there are some worrying economic signs coming out of the engine room of Europe, which is making an ECB stimulus plan look all the more necessary.

Germany makes up around 28.57% of Eurozone-wide GDP, with €2.74 trillion out of a totalof €9.58 trillion for the 18 countries that use the Euro. It certainly punches above its weight considering it only has a population of 24.2% of that region, or 80.6 million out of 332.8m. Germany has the 4th largest economy in the world by nominal GDP behind the USA, China and Japan and as a pointless piece of info: two thirds of the world’s leading trade fairs take place in Germany.

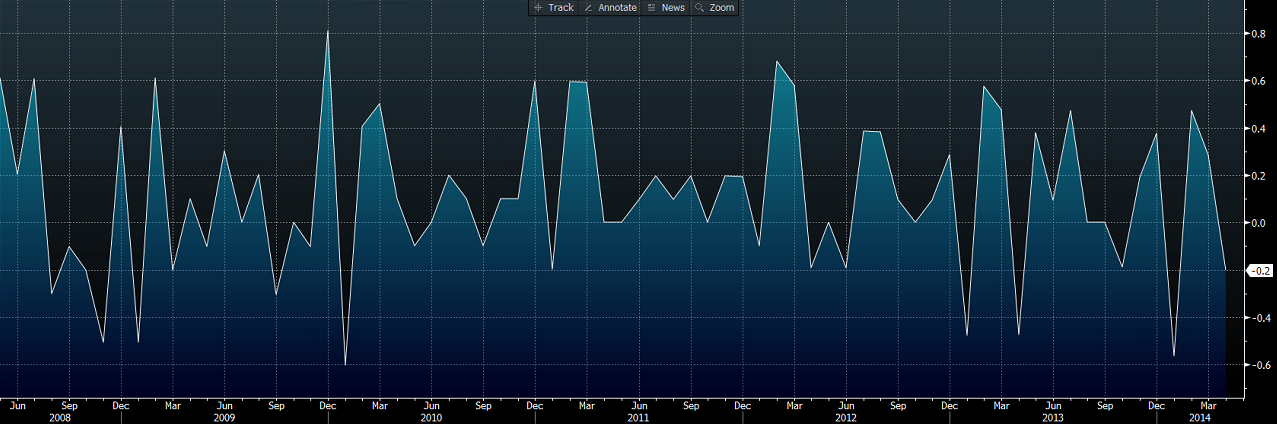

The CPI figures are the latest in a series of worrying economic statistics out of Germany. They show a surprising -0.2% fall in prices in April versus an estimated +0.3% change. Faltering CPI in the Eurozone will be one of the main reasons the ECB is thinking about implementing a new round of stimulus and the more results like this out of Germany, the more likely stimulus becomes.

German CPI

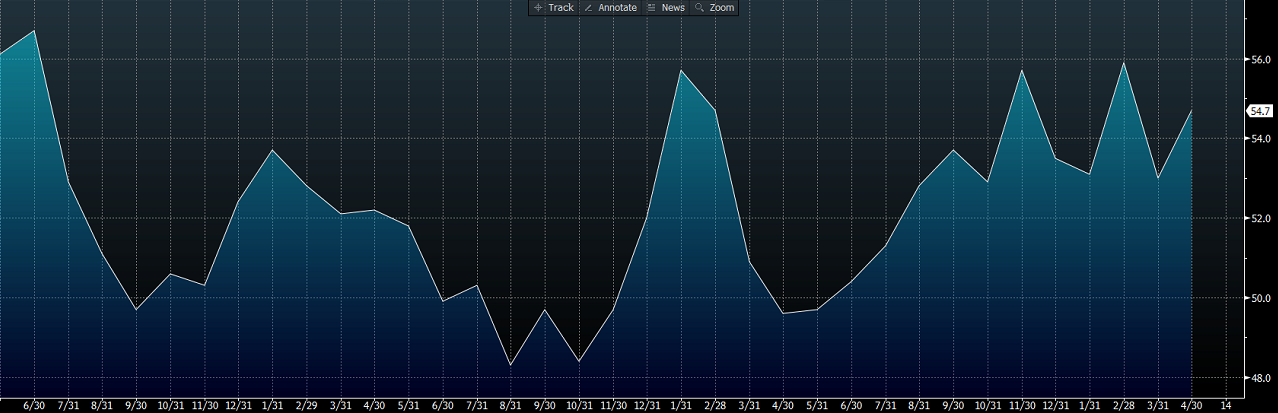

Further worrying signs can be found in the various PMI figures that have been published recently. The service sector, which makes up a staggering 71% of the German economy, published a PMI of 54.7last month; this was up slightly from a month earlier, but down from the 55.9 in February. Looking at the graph below, we can see it faltering as the trend flattens out. Manufacturing PMI posted a slight drop, sliding to 54.1 from 54.2.

German Services PMI

Manufacturing order figures also showed a worrying trend, down -2.8% from 0.6% a month ago, versus an expected 0.3% rise. Industrial production fared no better with a fall of -0.5% from 0.4% last month. The consensus estimate was for a 0.2% increase. The Wholesale Price Index offered a glimmer of hope up 0.2% from a month ago.

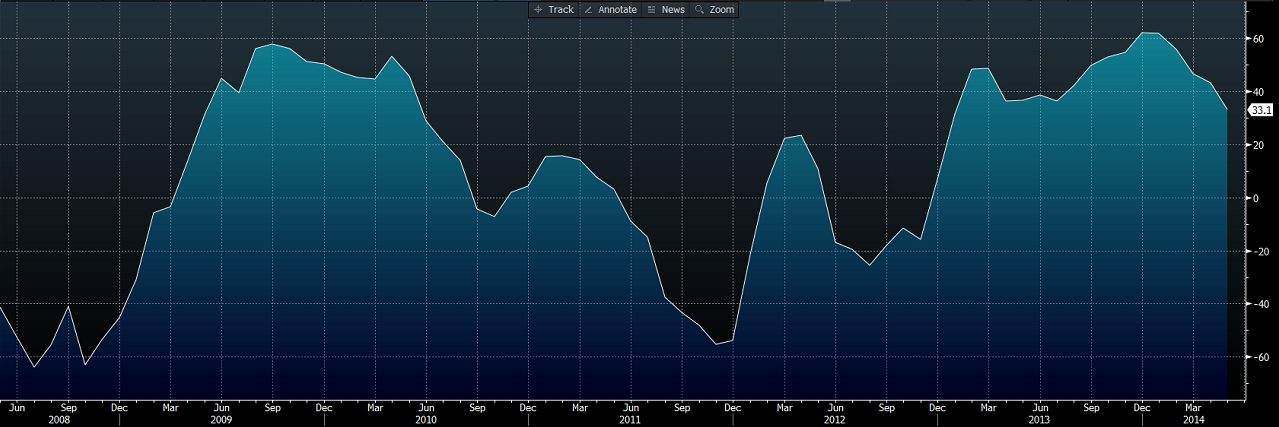

The real shock to the markets recently came in the Economic Sentiment Survey, whichfell to 33.1 from 43.2 a month ago. The market was estimating 40.5, so this was bitterly disappointing.This is a survey of institutional investors and analysts which asks for their 6 month outlook for Germany. A positive number indicates optimism, so all is not lost at this stage, but considering December and January’s figures were around the 62 mark, the trend is clear.

ZEW German Expectation of Economic Growth

Germany is an innovative and industrious country that relies heavily on its export sector, especially services and manufacturing equipment, so the Trade Balance figure gives us a good indication of the health of the economy as a whole. The (seasonally adjusted)Trade balance was in a surplus of€14.8B from €15.8B a month earlier. The estimate was for€16.9B surplus so again the market was disappointed. This is the lowest the trade balance has been since September of last year, however, exports were up 1.9% from a year earlier, it’s just that imports were up by 5.6% in the same period. A strong Euro would have contributed to this, weakening competitiveness for German exports, so it is no surprise the ECB dislikes a strong Euro. If the ECB adds stimulus when it meets in June, it will surely have an impact on the Euro, weakening it and bringing back German competitiveness.

Unemployment figures provided a change from all of the disappointing economic news with a change of25,000fewer unemployed people. This is much better than the drop of 10,000 the market was expecting and the 12,000 drop from a month ago.Furthermore,the consumer confidence index stayed even at 8.5 up from 6.2 a year ago, so at least we have some good news to balance out the gloom.

The German economy is showing some worrying signs of slowing down its economic recovery. With it making up almost a third of the Eurozone, it is a good barometer of the overall strength of the Euro economy. It is easy to see the need for the ECB to act, particularly when we look at German CPI. The situation is not disastrous yet, but there are certainly indications that if something is not done soon, this fragile recovery may come to a grinding halt.