This is the time of the month that Econintersect begins to prepare their economic forecast for August 2012. Sitting here working on the forecast and listening to CNBC in the background – the images in my head are one of an economic roller coaster with an abyss in the distance.

This past week saw many economic ups and downs:

- Consumer sentiment worsens (bad)

- Initial unemployment claims down significantly (good)

- Spain debt financing at post-Euro high, all while further evidence that Europe/UK in recession (bad)

- European Central Bank President Mario Draghi says he will save the Euro (good)

- Soft existing home sales and pending home sales (bad)

- Durable goods new orders strong (good)

- GDP at 1.5% (I don’t know if it is good or bad – the data is mixed and the BEA reset the baseline).

I have no special crystal ball to share about the timing of any upcoming recession. All I can say is the data we have seen for June (which is subject to revision) shows an expanding economy. Going with the big four economic elements the NBER considers other than GDP – the latest data was improving.

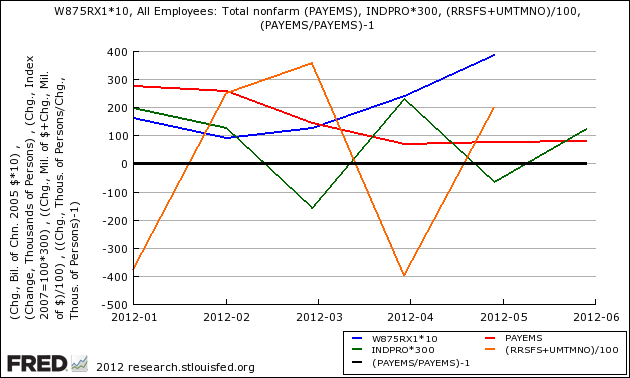

Month-over-Month Growth Personal Income less transfer payments (blue line), Employment (red line), Industrial Production (green line), Business Sales (orange line).

Personal income was in a 3-month improving trend, employment has been growing for two months, all while industrial production has been up and down but, overall, expanding for the last 3 months. The final data is not in on noisy business sales for June – but this too seems likely to be positive based on advance data.

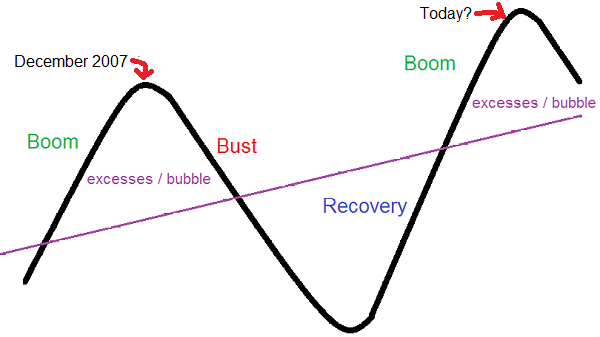

I keep getting a flashback to Econ 101, and business and economic cycles. I keep wondering how another recession could be upon us without a typical expansion cycle – where was the boom part of the cycle? Was I asleep? The Great Recession it seems was artificially terminated by extra-ordinary fiscal and monetary moves, and the extra-ordinary measures may be expiring before its excesses cleared.

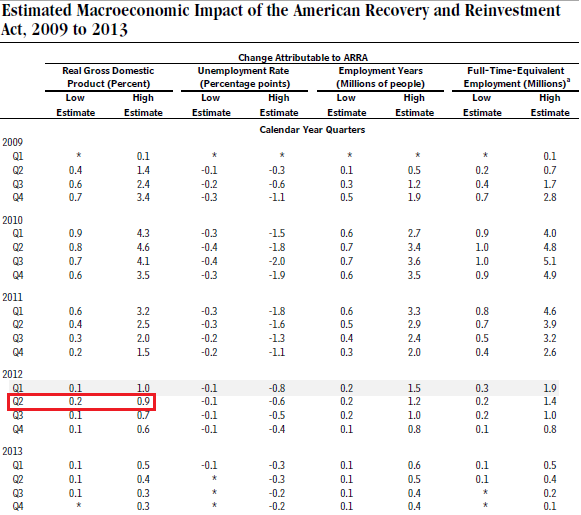

As GDP was released, and the Real (inflation adjusted) growth came in at 1.5%, I flashed back to the CBO study on the effects of stimulus on GDP.

Doug Short’s and my analysis on GDP shows that if you exclude inventory build, Real GDP would be less than 1.2%. If you use the CBO’s estimate of the high effect of stimulus on GDP, that means unstimulated GDP was only 0.3%. Even without considering the winding down of stimulus effects, GDP has now been declining for six months. Add to this the potential effects of the expanding Eurocrisis, and it is hard to see the bottom of this downward trend.

I am a passenger on this roller coaster ride who hopes there is no abyss.

Other Economic News this Week:

The Econintersect economic forecast for July 2012 shows continues to show moderate growth. Overall, trend lines seem to be stable even with the fireworks in Europe, and emotionally cannot help thinking this is the calm before the storm. There are no recession flags showing in any of the indicators Econintersect follows which have been shown to be economically intuitive. There is no whiff of recession in the hard data – even though certain surveys are at recession levels.

ECRI stated in September 2011 a recession was coming, and now says a recession is already underway. The size and depth is unknown. A positive result is this pronouncement has caused much debate in economic cyberspace.

The ECRI WLI index value remains in negative territory – but this week is again “less bad.” The index is indicating the economy six month from today will be slightly worse than it is today. As shown on the graph below, this is not the first time since the end of the Great Recession that the WLI has been in negative territory, however the improvement from the troughs has been growing less good.

Current ECRI WLI Index

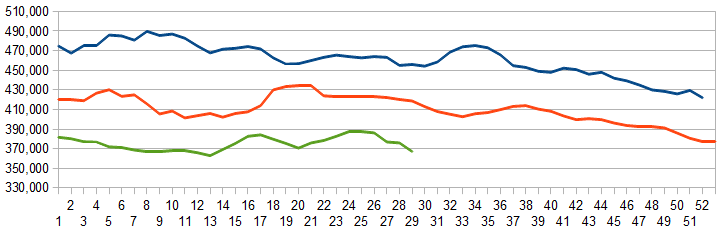

Initial unemployment claims decreased from 386,000 (reported last week) to 353,000 this week. Last week’s decline appears to have been an anomaly as some pundits suggested. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – declined from 375,500 (reported last week) to 367,250. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks' releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2010 (blue line), 2011 (red line), 2012 (green line).

Data released this week which contained economically intuitive components (forward looking) were:

- Rail movements (where the economic intuitive components continue to be indicating a moderately expanding economy – however this past week's data was very marginal);

- Both GDP and CFNAI data are rearview looks at the economy.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks.

Bankruptcy this week: None