Investing.com’s stocks of the week

Last Week Wrap Up

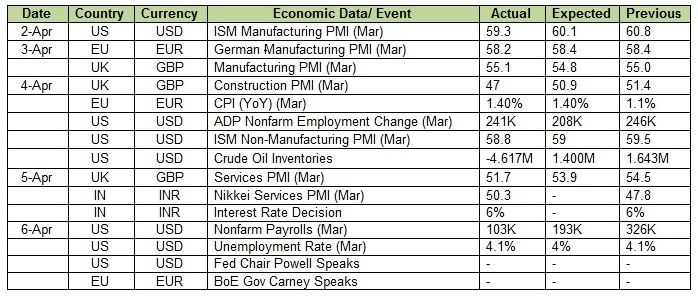

US: The data releases in the US included Manufacturing PMI and labor indicators, all of which showed disappointing numbers. The only gain in the dollar was because of the US-China trade war developments. The dollar index gave a high of 90.60 and a low of 89.82 while it closed at key levels of 90.07.

Euro Zone: The EUR/USD pair opened at 1.2320 levels, but with weak German manufacturing data and stable inflation figures, it fell down and closed at 1.2279 levels with no positive support from Gov Carney’s comments.

UK: The GBP/USD pair opened lower at 1.4029 levels and traded in a range bound manner in the whole week due to the lack of any strong market moving news/economic data. The pair posted some gains, in spite of continuous disappointing data, on the back of the dip in the dollar and closed at 1.4087 levels.

India: The USD/INR pair fell on the back of the weakness in dollar and positive news in the Indian market as the MPC adopted a dovish stance and decreased their inflation forecasts. The currency pair opened at 65.08 levels and gave a closing at 64.91 levels.

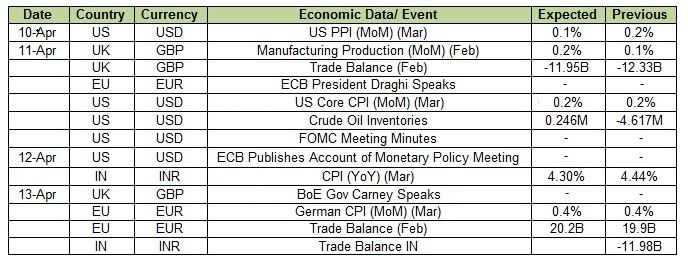

Week Ahead