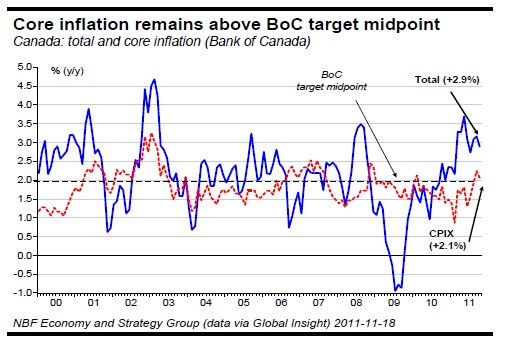

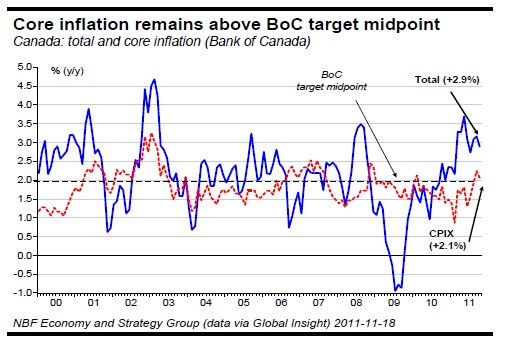

Canada – In October, headline CPI decelerated to 2.9% year over year from 3.2% in September. Core CPI slipped to 2.1% from 2.2%. On a monthly basis, headline

CPI rose 0.2% after increasing by as much the month before. Core prices jumped 0.3% after springing 0.5% the previous month. On a seasonally adjusted basis, total and core CPI advanced 0.3% and 0.2%, respectively, month over month. Five of eight major components were up on the month (s.a.), led by transportation (+1.3%) and shelter (+0.6%). Declines were observed in recreation, education, and reading (-0.2%) as well as alcoholic beverages and tobacco products (-0.1%). Although the annual inflation rate eased in October, the underlying trend was not reassuring. Despite relatively steep price hikes over the past four months in the purchase, leasing, and rental of passenger vehicles and in electricity, the base effect from last year contributed to the lower inflation reading in October. Since June, only three of the eight broad components of the CPI have had inflation below the Bank of Canada’s target midpoint. This suggests that the upward pressure on prices is emanating from several sources.

In September, Canadian factory shipments rose 2.6%, double the consensus forecast. The 13.7% increase in petroleum and coal products was the main driver, but there were decent gains in several other sectors as well, including transportation equipment (+7.1%). Ten of the 21 industries saw increases. In volume terms, shipments were up 1.8%. The inventory-to-sales ratio sank to 1.3, a third consecutive decline, which bodes well for future production.

United States – In October, the consumer price index dipped 0.1% from the previous month. Energy (-2%) was a key driver, as gasoline prices fell. Food prices cooled (+0.1%) after a string of hot months. The monthly drop in the headline CPI brought the annual inflation rate down four ticks to 3.5%. Excluding food and energy, prices edged up 0.1%, taking the year-on-year core CPI up a notch to 2.1%. On a 3-month annualized basis, core CPI was running at 1.75%, its slowest pace since January. Motor vehicle prices retreated for a second month in a row, as shortages eased after production was disrupted earlier this year. There was softness in the prices of other items as well, including computers and recreation. Price pressures moderated in the United States as core producer prices were flat for the first time since November 2010.

Again in October, retail sales proved stronger than expected, shooting up 0.5% overall from the preceding month. Excluding spending on the more volatile segments of gasoline and cars, retail sales grew a robust 0.7%. Still in October, industrial production progressed 0.7% after a revised contraction of 0.1% in September (originally reported as a 0.2% gain). A surge in auto production (3.1%) and mining output (2.3%) contributed to the strong report. Housing starts fell marginally to 628,000 units in October from their downwardly revised pace of 630,000 in September. Building permits in the month jumped 10.9% to 653,000, their highest level since March 2010 when a homebuyer tax credit helped boost housing activity.

Euro area – The flash estimate for Q3 GDP showed a 0.6% annualized increase for the euro area. France and Germany grew at an annualized pace of a less than 2%, while Spain was flat. It should be noted that the flash estimate covers only 80% of the area’s 17 member nations. Italy, which registered the steepest plunge in industrial production of the lot in September, has yet to release its GDP figures. Consequently, once Italy included, the euro area’s growth rate should prove even weaker. The Q3 handoff was particularly poor, as real retail spending and industrial production shrank 0.7% and 2%, respectively, in September. With more austerity measures on the euro area’s horizon, the outlook remains bleak.

CPI rose 0.2% after increasing by as much the month before. Core prices jumped 0.3% after springing 0.5% the previous month. On a seasonally adjusted basis, total and core CPI advanced 0.3% and 0.2%, respectively, month over month. Five of eight major components were up on the month (s.a.), led by transportation (+1.3%) and shelter (+0.6%). Declines were observed in recreation, education, and reading (-0.2%) as well as alcoholic beverages and tobacco products (-0.1%). Although the annual inflation rate eased in October, the underlying trend was not reassuring. Despite relatively steep price hikes over the past four months in the purchase, leasing, and rental of passenger vehicles and in electricity, the base effect from last year contributed to the lower inflation reading in October. Since June, only three of the eight broad components of the CPI have had inflation below the Bank of Canada’s target midpoint. This suggests that the upward pressure on prices is emanating from several sources.

In September, Canadian factory shipments rose 2.6%, double the consensus forecast. The 13.7% increase in petroleum and coal products was the main driver, but there were decent gains in several other sectors as well, including transportation equipment (+7.1%). Ten of the 21 industries saw increases. In volume terms, shipments were up 1.8%. The inventory-to-sales ratio sank to 1.3, a third consecutive decline, which bodes well for future production.

United States – In October, the consumer price index dipped 0.1% from the previous month. Energy (-2%) was a key driver, as gasoline prices fell. Food prices cooled (+0.1%) after a string of hot months. The monthly drop in the headline CPI brought the annual inflation rate down four ticks to 3.5%. Excluding food and energy, prices edged up 0.1%, taking the year-on-year core CPI up a notch to 2.1%. On a 3-month annualized basis, core CPI was running at 1.75%, its slowest pace since January. Motor vehicle prices retreated for a second month in a row, as shortages eased after production was disrupted earlier this year. There was softness in the prices of other items as well, including computers and recreation. Price pressures moderated in the United States as core producer prices were flat for the first time since November 2010.

Again in October, retail sales proved stronger than expected, shooting up 0.5% overall from the preceding month. Excluding spending on the more volatile segments of gasoline and cars, retail sales grew a robust 0.7%. Still in October, industrial production progressed 0.7% after a revised contraction of 0.1% in September (originally reported as a 0.2% gain). A surge in auto production (3.1%) and mining output (2.3%) contributed to the strong report. Housing starts fell marginally to 628,000 units in October from their downwardly revised pace of 630,000 in September. Building permits in the month jumped 10.9% to 653,000, their highest level since March 2010 when a homebuyer tax credit helped boost housing activity.

Euro area – The flash estimate for Q3 GDP showed a 0.6% annualized increase for the euro area. France and Germany grew at an annualized pace of a less than 2%, while Spain was flat. It should be noted that the flash estimate covers only 80% of the area’s 17 member nations. Italy, which registered the steepest plunge in industrial production of the lot in September, has yet to release its GDP figures. Consequently, once Italy included, the euro area’s growth rate should prove even weaker. The Q3 handoff was particularly poor, as real retail spending and industrial production shrank 0.7% and 2%, respectively, in September. With more austerity measures on the euro area’s horizon, the outlook remains bleak.