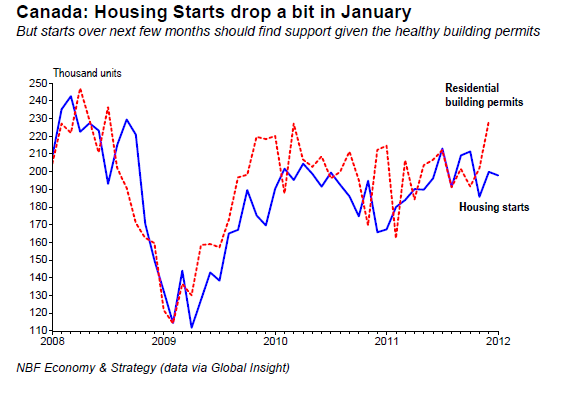

– Housing starts edged down to 197.9K units in January from a downwardly revised 199.9K in December. That was nonetheless much better than consensus expectations. Urban single family starts decreased 5.5K, or 7.8%, to 64.9K while multiple starts edged up 0.5K, or 0.4%, to 111.7K. On a regional basis, starts declined markedly in Quebec (from 50.0K to 35.5K) and in Nova Scotia (from an unusually high 8.5K to 2.7K), and moderately in Alberta (from 28.3K to 25.4K) and in PEI (from 0.8K to 0.7K). Starts were up in the other six provinces. While we’re not expecting stellar numbers for residential construction in 2012, housing starts should get some support in the coming months if the strong building permit applications are any guide.

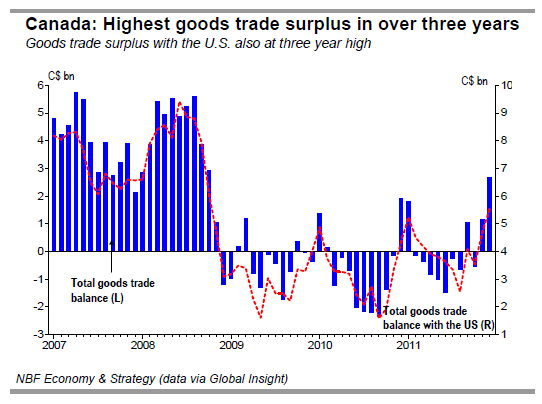

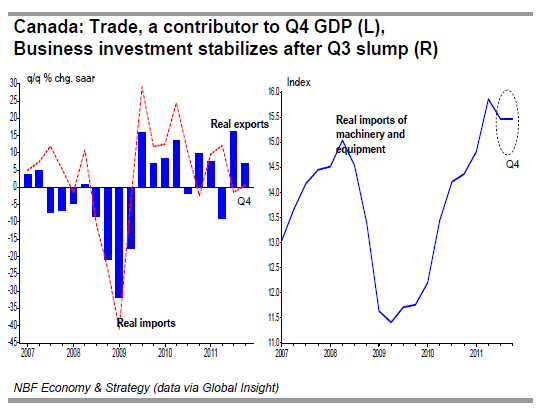

The merchandise trade surplus soared in December to C$2.7 bn, more than triple consensus expectations. That was the highest surplus in three years. The prior month was revised up a bit to a surplus of C$1.2 bn. In December, exports rose 4.5% with broad-based gains, including the 9.2% increase in machinery and equipment. Imports rose only 0.8% as declines in energy imports (- 7.5%) largely offset increases in other categories. In real terms exports rose 5.1% while imports fell 0.5%. With December's hot numbers, trade is set to be a contributor to GDP. With the increase in volumes, Canadian exports are tracking +7% annualized in the final quarter of year, after a 16.2% increase in Q3. The rise in real imports of machinery and equipment in December (+1.7%) allowed the quarter to end flat for that component, pointing to a stabilization in business investment in Q4, after a sharp contraction in the prior quarter.

The Ivey PMI rose to 64.1 on a seasonally-adjusted basis in January, topping consensus expectations for a drop to 59.7. However, the purchasing managers were less upbeat than the prior month with regards to employment, inventories, deliveries and prices, with all of those PMI indices falling in the first month of 2012 (although all of the indices except the deliveries index, remained well above 50). The fact that the index remains well north of 50 (i.e. more respondents than not saying that their purchases were higher) is consistent with further expansion of GDP through the Q4-Q1 period. We expect growth to be soft over that period, at around 2% annualized.

Alberta’s 2012-13 budget was presented last week and the target of a balanced budget by 2013-14 was confirmed. Fiscal discipline was evident in the budget with spending growth limited to just 3.3% next fiscal year and 3.0% on average for the following two years. And that despite forecasted revenue growth of 4.6% next year and 10% for the subsequent two years.

United States – Initial jobless claims fell to 358K in the past week, from an upwardly revised 373K. The 4- wk moving average fell 11K to 366.3K, the lowest in over three years. That’s further evidence that the US labour market is on an upswing.

The trade deficit widened to $48.8 bn in December from an upwardly revised $47.1 bn. While in nominal terms, imports grew faster than exports (due to the larger amount of crude imports), in real terms, both exports and imports grew 1.4%.

Europe – The European Central Bank left its target interest rate unchanged at 1% stating that it saw “some tentative signs of a stabilisation in economic activity”. The ECB loosened the requirements for financing by banks by saying that it was accepting “additional performing credit claims as collateral”. The end-February LTRO should be well bid as a result.

The Greek government presented its austerity plan that includes 300 million euros in government spending cuts, a 15,000 immediate reduction in government payrolls, and a 22% cut in the minimum wage. Markets rallied on the news on Thursday, but quickly reversed those gains as the plan was deemed unsatisfactory by European finance ministers who opted to delay releasing a bailout package to Greece. There continues to be uncertainty not just about whether Greece can increase the size and scope of its austerity plan, but whether any revised plan will be carried out after the April elections. Further impasse on those issues cannot last much longer if Greece is to receive bailout money to roll over maturing debt on March 20th. The worst case scenario is a disorderly default of Greek debt come March, something that would trigger credit default swaps, precipitate a Greek exit from the eurozone, and potentially trigger a global financial crisis.

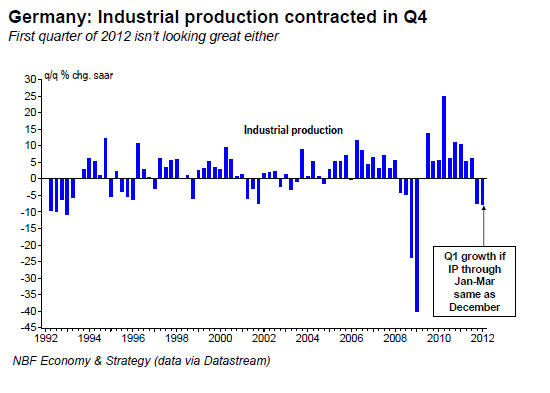

German industrial production plummeted nearly 3% in December, causing Q4 IP to contract at an annualized pace of 7.4%, the worst quarterly drop since the 2009 recession. That makes a Q4 GDP contraction all the more likely for Germany. The handoff from December IP was so bad that the first quarter of 2012 is now tracking -7.7% annualized, assuming no change in industrial output through March. Clearly, for Germany to avoid a recession (i.e. negative growth in both Q4 and Q1), its IP will have to pick up significantly over the January-March period.

The Bank of England left its target interest rate unchanged at 0.5%, but increased its QE program by £50 bn to a total of £325 bn.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Economic Indicators Review: Week of February 13, 2012

Published 02/14/2012, 01:56 AM

Updated 05/14/2017, 06:45 AM

Economic Indicators Review: Week of February 13, 2012

Canada

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.