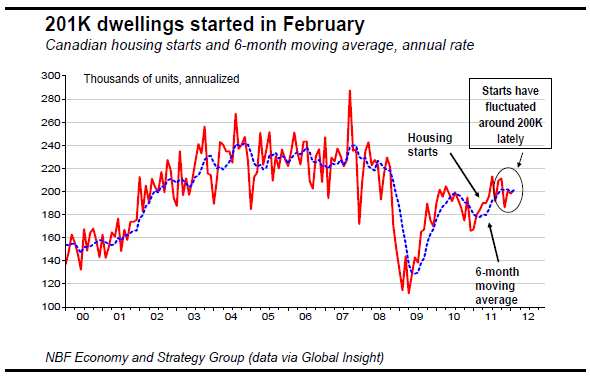

– In February, Canadian housing starts edged up to 201K units, roughly in line with consensus expectations. Urban starts sprang 6.0K, or 3.4%, to 182.8K. Rural starts fell 3K to 18.3K. Urban singles jumped 2.3K, or 3.5%, to 67.4K while multiples rose 3.7K, or 3.3%, to 115.4K. On a regional basis, starts in Quebec rebounded to 47.2K from an unusually low level of 35.4K in January, but this was offset by a 12.8K decline to 66.5K in Ontario. Otherwise, a moderate increase in the Prairies and B.C. more than counterbalanced a small drop in the Atlantic Provinces. Starts were up in 5 of 10 provinces.

In the past nine months, housing starts have fluctuated around the 200K mark. We doubt this trend will persist through the rest of the year. The 12.3% slump in building permits in January suggests residential construction will moderate in the coming months. While not indicating overbuilding as yet, the number of unoccupied new multiple dwellings rose in January for a second month in a row. In our view, escalating prices will probably knock some potential buyers out of the game and thus contribute to some slowdown in the multiples segment. As the presale levels needed to trigger starts will become harder to achieve, some projects could be delayed. Still, we expect new housing starts to reach a respectable 185K in 2012. However, housing starts will not be a significant contributor to economic growth in 2012.

As widely expected, the Bank of Canada left its overnight rate unchanged at 1.00%. The BoC acknowledged that uncertainty surrounding global growth had diminished somewhat as Europe's financial markets showed signs of stabilizing. It would have been hard not to do so in light of the fact that the yield spread between Italian and German bonds had narrowed substantially since last November. However, according to the BoC, the recent oil price spike could become a threat to global growth if it persisted. Regarding the domestic inflation outlook, the BoC saw a somewhat firmer profile for core and total CPI than previously anticipated as a result of reduced economic slack and higher oil prices. With considerable monetary policy stimulus in Canada, households were expected to add to their debt burden. Although Governor Carney had indicated the mounting household debt situation as a risk concern in the past, this was the first time it was explicitly referred to as the biggest domestic risk in a press release regarding the rate-setting decision. This raises the question whether the Bank was not acknowledging that we were drawing nearer to the point where a monetary policy intervention would be required to preserve financial stability. For now, we continue to expect the BoC to resume the normalization of policy rates by mid-2013. This said, the extent of the fiscal drag deriving from the federal and provincial budgets (especially Ontario) remains unknown at this point. The gradual reduction in monetary stimulus over time will need to be paced accordingly.

In January, Canada’s merchandise trade surplus narrowed to C$2.1 billion from C$2.9 billion the prior month. This was in line with consensus expectations. Exports fell 2.3%. Declines were broad based and included an 11.9% drop in both machinery/equipment and industrial goods/materials, which more than offset a 6.1% increase in auto exports. Imports sank 0.6%, as gains in autos (+7%) were more than offset by declines in other categories, including machinery/equipment (-1.7%). In real terms, exports sagged just 0.2% (not too bad after increasing 5.9% the prior month) while imports rose 0.9%.

In February, 2.8K jobs were lost in Canada according to the Labour Force Survey. This flew in the face of consensus expectations for a 15K gain. However, given the drop in the youth participation rate, the unemployment rate slipped two ticks to 7.4%. For the fourth month running, goods-producing industries (+17.8K) outdid the services sector (-20.7K) on the labour front. The goods sector was buoyed by a comeback in construction and further gains in manufacturing. Full-time employment advanced 9.1K after receding for two months while parttime employment retreated by 12K. Private-sector employment shrank (-1.7K) for the first time in four months. Employment creation was weak across much of the nation, with Ontario, Alberta and Saskatchewan registering losses and Quebec essentially treading water.

Elsewhere, Canadian labour productivity rose 0.7% in Q4 as real GDP grew while hours worked decreased. However, those who worked made more money as hourly compensation rose 1.5%, its highest quarterly increase in over two years. Labour productivity in the prior quarter was revised up two ticks to 0.6% (not surprising given the upward revision to Q3 GDP).

United States – The U.S. economy is definitely the bright spot in global economic activity these days. In February, the U.S. labour market added 227K jobs, easily topping consensus expectations for a 210K gain. This was the third over-200K print in a row. The cherry on the cake was the upward revision to the prior two months, which added another 61K jobs to the tally. The private sector saw employment expand by 233K jobs on the month. Manufacturing expand payrolls (+31K) once again, but gains were broad based across several more sectors. Government, however, continued to shed jobs (-6K). Average hourly earnings rose 0.1%, while hours worked per week were flat at 34.5. The unemployment rate held steady at 8.3%.

Separately, non-farm business sector labour productivity increased 0.9% annualized in 2011Q4 while unit labour costs grew 2.8%. Again in January, factory orders fell 1%, which was better than the 1.5% drop consensus expected. Moreover, the prior month was revised up three ticks to 1.4%. Durable goods orders decreased 3.7%, which was slightly better than the 4% drop in last week's advance report. Nondefence capital goods orders excluding aircraft slid 3.9%, which was also better than the 4.5% decline initially reported. Total factory shipments rose 0.9% on impulse from non-durables, after increasing 0.8% the prior month. Shipments of non-defence capital goods ex-aircraft (a proxy for investment spending) fell 3%, roughly unchanged from the initial estimate.

The U.S. non-manufacturing ISM index for February rose to a consensus-topping 57.3 driven by higher new orders, which climbed two points to 61.2. After surging the previous month, the employment subcomponent gave up two points to 55.7. The composite ISM (which takes into account both the non-manufacturing and manufacturing sectors), rose two ticks to 56.7, its highest mark in months.

In January, the trade deficit widened to $52.6 billon. This represented a 4.3% increase over the $50.4-billion deficit recorded in December. Exports swelled 1.4% to $180.8 billion while imports grew 2.1% to $233.4 billion.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Economic Indicators Review: March 13, 2012

Published 03/13/2012, 01:41 AM

Updated 05/14/2017, 06:45 AM

Economic Indicators Review: March 13, 2012

Canada

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.