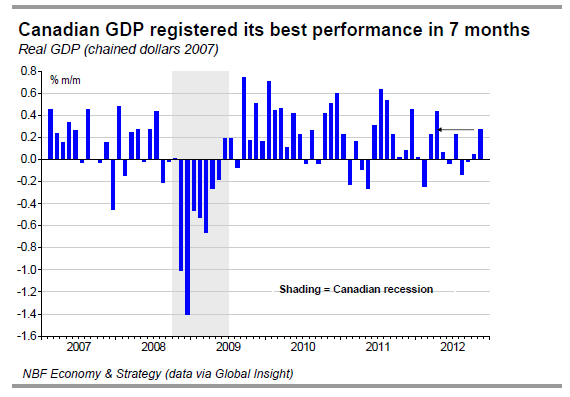

– GDP for the month of November showed a 0.3% increase, one tick higher than consensus expectations. That was the best performance in 7 months. The goods sector saw a 0.6% increase in output with gains in almost all sub-sectors, including a 0.7% advance in manufacturing. That said, output in the goods sector is now at the same level it was at the end of 2011. The services sectors rose just 0.1% in November as gains in retail and wholesale offset declines elsewhere. Industrial production rose a sharp 0.8%, in line with the manufacturing rebound. With November's gains, Canada is on track for Q4 GDP growth of around 1% annualized, in line with the Bank of Canada's latest estimates for the quarter. So the stronger-than-expected November data is unlikely to prompt a rethink at the BoC of its recent dovish turn. In any case, the output gap isn't closing until at least the second half of next year.

The Survey of Employment, Payrolls and Hours (SEPH) which polls establishments and lags the more closely watched Labour Force Survey by roughly two months, showed that Canada gained just 3,100 jobs in November. That came after large job losses in the prior two months, taking the net jobs tally over the September-November period to -48,000. Average weekly earnings rose 0.5% in November, taking year-on-year gains to 3.2%. Earnings are currently tracking +2.1% annualized, less than half the pace seen in Q3. Average weekly hours worked rose 0.3% to 33.2 (from 33.1 in October). Annual wage growth in sectors including mining/oil/gas (+4.9%), forestry (+9.5%), management (+9.5%) and construction (+6.6%) were above the national average.

Statistics Canada revised the Labour Force Survey data using its latest estimates for seasonal factors. The revisions were minor, trimming the jobs count for 2011 and 2012 marginally, while raising the 2010 tally. That left overall jobs created over the last three years roughly unchanged at 808K, with 310K coming in 2012 alone (versus 312K before revisions). The 2012 tally was trimmed a bit, because the 12.3K downward revision to the goods sector (to 74K) was a bit larger than the 10.7K upward revision to the services sector (to 236K). But the composition of jobs improved a bit for 2012, with slightly more full time jobs (+1.9K to 309K) and more paid jobs (+5.2K to 340K).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Economic Indicators Review: Canada

Published 02/05/2013, 05:57 AM

Updated 05/14/2017, 06:45 AM

Economic Indicators Review: Canada

Canada

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.