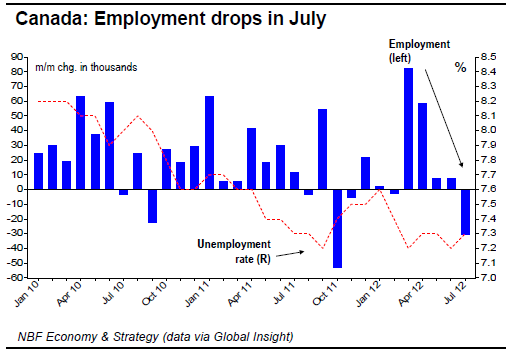

– In July, the Labour Force Survey flew in the face of consensus expectations, posting a net loss of 30K jobs instead of a net gain of 6K. As a result, the unemployment rate ticked up to 7.3%, though the damage was contained by the fact that the participation rate slid two notches to 66.5%.

Private-sector employment fell by 2K, a third straight monthly decline that erased a little more of the sharp gains registered in March and April.

The goods-producing sector retreated for a second consecutive month, giving up 13K jobs. Employment in the resources and manufacturing sectors slumped for a second month in a row, more than offsetting a strong rebound in the construction sector. The servicesproducing sector lost 17K jobs as gains in healthcare and social assistance, educational services, and finance, insurance, real estate and leasing were more than offset by drops elsewhere.

Full-time employment sounded a positive note, climbing by 21K after a 29K increase the prior month. However, part-time employment sank a further 52K after sagging by 22K the month before. Hours worked advanced 0.2%.

July's LFS report was disappointing overall, with the manufacturing sector in particular feeling the effects of slowing global demand. Averaging roughly 25K/month so far this year, full-time jobs provided a silver lining. In the first seven months of 2012, the labour market has lost some steam compared with the same period last year (+18K/month on average vs. +25K/month). Private-sector hiring from January to July this year has been at half the pace it was a year earlier. The number of hours worked is now tracking at +2.3% annualized in 2012Q3, down slightly from 2.6% in Q2. All told, the report is a reflection of an economy running at a GDP growth rate below 2%.

In June, building permits fell 2.5% in dollar terms, reversing in part the 7.1% gain of the preceding month. The performance, however, was a bit better than expected by consensus, which had anticipated a drop of 3.9%. The decline in June was entirely due to the non-residential sector (-12.3%). In contrast, the value of residential permits rose 4.2% for both singles and multiples. Decreases were recorded in the Maritimes and the two westernmost provinces, while Saskatchewan, Manitoba and Central Canada provided offset. In real terms (i.e., the actual number of residential units in Canada), permits for singles and multiples rose 5.1% and 3.6%, respectively.

In July, Canadian housing starts dropped to 208.5K, disappointing consensus expectations for a 213K print. The 6.1% decrease on the month was driven by multiples (-7.6%), though singles were down as well (-4%). On a regional basis, British Columbia saw the steepest decline in urban starts (-29%), reversing most of the prior month's outsized gains. Starts were down 18.4% in the Atlantic region and 8.8% in the Prairies. They were up slightly in Quebec and Ontario, though in the latter’s case, the increase did not make up for the losses recorded in the previous couple of months.

In June, Canada’s merchandise trade deficit widened to C$1.8bn, which was much worse than expected by consensus. This was the largest deficit posted since September 2010. Moreover, the prior month’s trade balance was revised downward. Exports rose 0.2% in the month, with declines in energy, industrial goods, machinery and equipment and agriculture counterbalanced by a 13.9% jump in auto exports. Imports climbed 2.3% as declines in the energy category were more than offset by increases elsewhere. In real terms, exports grew 0.3% while imports surged 2.5%. For 2012Q2, then, Canada’s merchandise trade deficit amounted to roughly C$3.3 billion, its worst showing since 2011Q2 when the Japanese earthquake and tsunami disrupted global trade. Results would have been even worse had it not been for strong vehicle sales in the United States, which gave Canadian auto exporters a boost. June’s non-energy trade deficit was the worse ever on record. This is cause for concern in that it is symptomatic of a soft global economy and what is arguably an overvalued Canadian dollar.

United States – In June, the trade deficit narrowed to $42.9 billion from $48 billion a month earlier. Exports rose 0.9% while imports dropped 1.5% thanks to lower imports of crude oil. In real terms, exports sprang 2.9% while imports sank 0.3% (this included a 3.3% decrease in barrels of crude oil). The U.S. trade numbers painted a rather mixed picture. The increase in exports is good to see, but the drop in imports, particularly as regards consumer goods (down a third month running), suggests that demand in the world's largest economy is being tested by a generally sluggish labour market and waning consumer confidence.

In other news, U.S. business non-farm labour productivity rose 1.6% annualized in 2012Q2, two ticks better than consensus expectations. The prior quarter was revised up four ticks from -0.9% to -0.5%. The rebound in Q2 productivity was the result of output (+2%) growing faster than hours worked (+0.4%). Unit labour costs climbed

1.7% after soaring by an upwardly revised 5.6% in Q1.

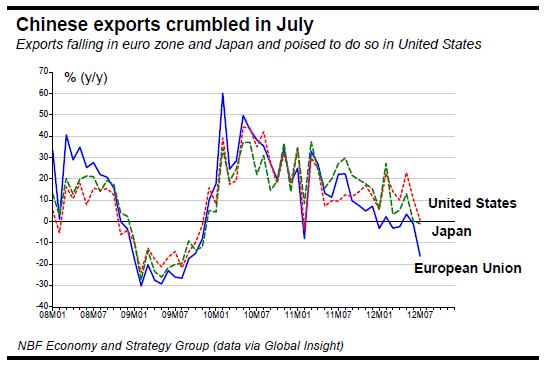

Chinese economic engine slowing – The latest data continue to suggest that the Chinese economy is undergoing a significant slowdown. In July, growth in industrial production cooled to 9.2%, its lowest annual rate since May 2009. As production let up, producer prices, too, showed signs of weaker demand. Indeed, the producer price index (PPI) slid 2.9% y/y, marking a fifth consecutive month of deflation. The last time the Chinese economy experienced such a sharp decline in producer prices was during the 2008-2009 financial crisis.

The nation’s consumer price index, too, has registered a sharp drop in recent months. In July, the CPI grew 1.8% y/y, well below the 6.5% observed 12 months before. Excluding food, consumer prices rose 1.5% y/y, down from the cycle high 3.0% recorded in June 2011. With the consumer goods PPI continuing along a disinflationary

trend, CPI can be expected to follow suit. In light of these negative developments, conventional wisdom suggests the Chinese authorities will now intervene forcefully in order to spur growth in 2012H2. Though we agree with this assumption, we are not sure of the impact that such action could have given the collapse in exports of late. Indeed, total exports were up only 1% y/y in July, their worst showing since January. Making matters worse now, however, is the fact that weakness has become much more pervasive. As the chart below shows, exports to both the euro zone and Japan are shrinking and those to the United States are on the verge of contracting as well.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Economic Indicators Review

Published 08/14/2012, 07:00 AM

Updated 05/14/2017, 06:45 AM

Economic Indicators Review

Canada

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.