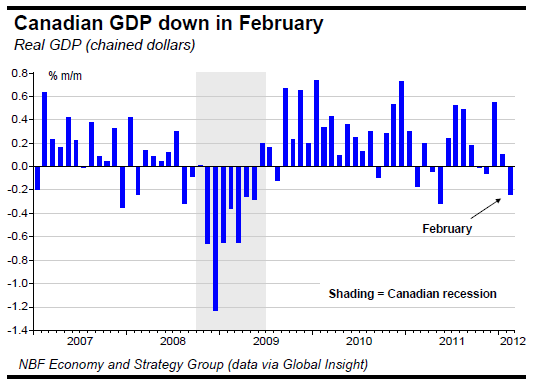

– In February, real GDP shrank for the first time in three months. Activity fell sharply in the goods producing sector (-1.0%) after rising 0.1% the previous month. With the exception of construction (+0.5%), all ofthe sector’s industries retreated. Of these, utilities (-1.9%) and mining and oil and gas extraction together (-1.6%) registered the steepest decline. Industrial production was down 1.4% after ticking up 0.1% in January.

Pullbacks were experienced in the manufacturing of both durables(-0.9%) and non-durables (-1.4%). Energy production slipped 1.0% after inching forward 0.1% the month before. In the service sector, activity was up for a tenth consecutive month (+0.1%). Wholesale trade (+1.5%) and finance and insurance (+0.4%) posted the largest advances while transportation and warehousing (-0.9%)and accommodation and food services (-0.5%) brought upthe rear. Though it is true that the economy’s poor performance in the month was attributable in part to temporary closures in mining and other goods-producingindustries, the weakness was nonetheless broadly based.

Indeed, only 4 out of the 18 sectors expanded, a situation observed only once before in the past 15 years and that was during the last recession. As a result, Q1 GDP is now tracking at below 2%, in line with the modest increase in total hours worked but well under the Bank of Canada’s latest forecast of 2.5% GDP growth in the quarter. For 2012, we continue to expect the Canadian economy to expand by about 2% (vs. 2.4% for the BoC).

United States – In April, the U.S. labour market added just 115K jobs, well short of the 160K expected by consensus. However, there were upward revisions to the prior two months, which added 53K jobs overall. Private sector employment expanded by 130K jobs, the weakest monthly gain since August 2011. Payrolls in the manufacturing sector continued to swell (+16K) albeit at amore modest rate than before.

Retail employment, however, bounced back following the purge in March. Government continued to reduce payrolls, shedding 15K jobs, compared with an average 3K per month in Q1. The only silver lining in this report was the rebound in the retail sector, which employs more people than does the manufacturing sector. Average hourly earnings held steady, as did average hours worked per week at 34.5. Separately, the household survey revealed a net loss in April of 169K jobs, a second consecutive monthly decline. However, the unemployment rate actually fell one tick to8.1%.

Even if we consider the upward revisions to the prior months, April's employment reports were not good. Our disappointment stems from the fact that full-time employment gave back all of the previous month’s gains. Plus, the employment-population ratio dropped to 58.4% and the participation rate slid to 63.6%, a new cyclical low and its lowest mark since 1981. This was the only reason the jobless rate sank this month.

The concern at this point is that the outlook for the next few months is not very promising and that the U.S. labour market is going through a soft patch. Indeed, the Monster Employment Index, abroad measure of U.S. online job demand, recorded its biggest decline since 2010. Aggregate hours are trackingat just 0.8% annualized so far in Q2 (vs. 3.9% in Q1) and wages at 1.5% (vs. 5% in Q1), which is consistent with a slowdown in the current quarter. The fear, of course, is that this will take the spring out of consumption spending, particularly as the savings rate is already quite low.

Real after-tax disposable income climbed 0.2% in the month after sagging 0.1% in each of January and February. Personal spending was up 0.3%. In real terms, it crept up 0.1% after jumping a solid 0.5% the prior month. With income rising faster than spending, the savings rate added a tick to 3.8%. Yet, on a quarterly annualized basis, the savings rate slumped to 3.9% in2012Q1 from 4.5% in 2011Q4.

Still in March, the core PCE deflator rose 0.2% month-over-month, lifting the year-on-year rate one tick to 2%.

The ISM Manufacturing Index confounded consensus expectations for a drop by rising to 54.8 in April from 53.4 the preceding month. The improvement was broad based across the sub-indices. The production index climbed to 61, its highest level in over a year, while the employment index shot up to 57.3, its top mark since last June. The new-orders index moved higher to 58.2, another multi-month pinnacle. The national ISM Manufacturing Index contrasted with the disappointing readings on the Chicago Purchasers’ Index (down 6 points) and the softer ISM Non-Manufacturing Index (down 2.5 points to 53.5), which suggested some moderation in growth in the current quarter.

Again in March, construction spending rose 0.1% to an$808.1 billion annual pace after receding 1.4% inFebruary. We expect further improvement in this regard inthe quarters ahead.

Factory orders fell 1.5% in March, roughly in line with consensus. However, the prior month was revised down two ticks to +1.1%. Orders ex-transportation were flat aftergaining 1% the month before. Durable goods orders dropped 4%, a touch better than the -4.2% initial estimated in the advance report. Non-defence capital goods orders excluding aircraft pulled back just 0.1%instead of 0.8% as initially expected.

Total factory shipments progressed 0.7%. The shipments data aresecondary data, as Q1 U.S. GDP data are alreadyavailable. Still, the orders data provides some idea of Q2growth, but it is not exactly exhilarating. The slight decline in orders of non-defence capital goods excluding aircraft heralds stagnation in investment spending, which would be consistent with moderation of U.S. GDP growth in the current quarter.

Business nonfarm labour productivity fell 0.5%annualized in 2012Q1, roughly in line with consensus expectations. This represented its first drop in three quarters. The prior quarter was revised up three ticks to1.2%. The drop in Q1 was the result of output (+2.7%) growing slower than hours worked (+3.2%). Unit labour costs rose for a third quarter running with a +2% print.

Euro Area – At its latest rate-setting meeting, the ECBleft its key policy rate unchanged. The central bank considered its accommodative policy stance appropriate in light of the increasingly uncertain economic outlook the area was facing. Bank President Mario Draghi pointed out that the second LTRO only settled in March and more time was needed to gauge its impact on the economy. However, the final April reading for service activity in the area indicated a worse-than-expected showing. The service PMI dropped to its lowest level since last fall when credit stress was acute in the eurozone. Weakness in France was particularly evident as the service PMI lost 5 points in the month to 45.2.

According to Eurostat, retail trade grew 0.3% by volume in March in the euro area after contracting 0.2% in February. Though retail sales were stronger than expected, they were overshadowed by the final April PMI release.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Economic Indicators Review

Published 05/08/2012, 07:34 AM

Updated 05/14/2017, 06:45 AM

Economic Indicators Review

Canada

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.