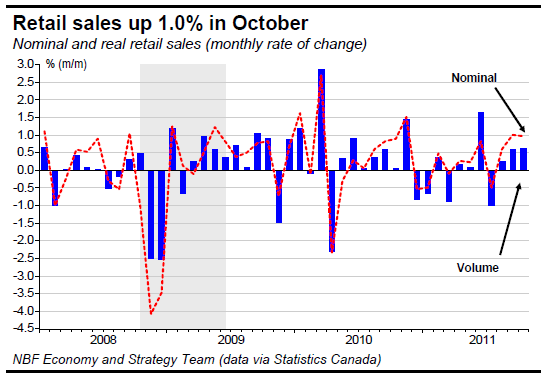

– In October, retail sales increased 1.0%, double the consensus forecast. The result was all the more impressive coming as it did on the heels of a 1.0% advance in September. Sales were up in 7 of 11 retail industries. Motor vehicles and parts sales jumped 2.0% after springing 3.3% the month before. Excluding this last segment, retail sales rose 0.7%, with the largest gains registered by clothing and clothing accessories stores and gasoline stations (+1.8%). The month’s worst performers were furniture and home furnishings stores (-0.8%) and miscellaneous store retailers (-0.8%). On a regional basis, sales progressed in 8 provinces with Ontario lagging (-0.1%). Volume retail sales grew 0.6% after swelling as much the previous month. Early in Q4, volume sales are expanding at the rate of 4.4%, up markedly from 1.9% in Q3.

The recent softening in labour market notwithstanding, Canadian households continue to spend at a very robust pace in Q4. Growth in discretionary spending, which we define as sales excluding groceries, gasoline and healthcare, is currently tracking at 8.8% in nominal terms on the quarter, its best showing in almost two years. This is clearly not sustainable, all the less so because part of this growth is most certainly being achieved at the expense of a higher debt load (motor vehicles sales hit a new record high in October in dollar terms). Canada will need to find other vectors of growth going forward. For the time being, however, GDP seems set to expand just shy of 2% in Q4.

In November, headline CPI remained unchanged at 2.9%. Core CPI held steady as well at 2.1%. On a monthly basis, headline CPI eked up 0.1%, after rising 0.2% in October. Core prices edge up 0.1% after climbing 0.3% the month before. Four of the eight broad CPI categories moved higher on the month (food, household operations, transportation, health and personal care) while three sagged (shelter, clothing/footwear, recreation/education) and one stayed flat (alcohol/tobacco). The month’s report contained no major surprises.

In October, wholesale trade shot up 0.9%, overshooting the consensus forecast of 0.1% by a long stretch. There was broad-based growth across the subsectors, including autos, machinery and equipment, food and beverage, and farming product. In real terms, wholesale trade expanded 0.5%. Again in October, the Teranet–National Bank National Composite House Price Index™ kept level for the second month in a row. Nationally, this two-month pause in homeprice inflation follows five abnormally steep increases (1% or more monthly). Barring a recession, there is no reason why the situation in these markets should deteriorate substantively. However, price declines are a possibility, especially if access to mortgage credit were to be restricted by additional regulatory measures. In any event, home prices still have some ways to go before the spread between cost of renting and cost of owning returns to being more in line with its average since 1995.

In October, Canadian GDP was flat, following four consecutive monthly increases. . Weakness in mining, utilities and construction more than offset the surprising increase in manufacturing, causing the goods sector to register a 0.2% drop. Services saw a 0.2% offsetting increase in output driven by retailing. Autos production contracted for the second consecutive month. So, after seeing a rebound in Q3, autos production is moderating in Q4. In contrast, oil and gas (output rose 0.1% in October) look set to extend the rebound seen in Q3 to the final quarter of the year. October's GDP is consistent with a deceleration in Canadian economic growth after a very hot third quarter. Nonetheless, the good handoff from September (+0.2%) and the decent start to Q4 puts Canada on track for growth of just under 2% annualized in the final quarter of the year.

United States – GDP growth was revised down to 1.8% annualized in the third estimate for Q3. This was still better than the growth seen in the first half of the year. The main reason for the revision was a downward revision in personal consumption expenditure from 2.3% to 1.7%. Business investment and exports were revised up but did not provide enough offset as real final sales were revised down four ticks to 3.2% (still the best this year).

The downward revision to GDP was not good news, but it is behind us. More importantly, things are looking up in the present quarter, with consumer spending bouncing back and housing seeming to stabilize. In November, housing starts rebounded sharply 9.3% to 685K from 627K the preceding month, thus reaching their highest mark in a year and a half. The gains were driven by multi-family homes (up 25.3% on the month), though singles were up as well. Building permits, too, have attained their highest level in a year and a half, which should provide starts with some impetus in the months ahead. Unless Congress decides to play spoilsport, momentum should carry through to 2012 on the back of revived consumer spending, business spending and inventory refills.

US durable goods orders rose 3.8% in November, thanks to Boeing’s strong order books. That more than offset the small drop in vehicles and parts orders. Extransportation, the numbers were milder with orders growing 0.3%. Non-defence capital goods orders excluding aircraft (a gauge for future investment spending) fell 1.2%. Total shipments of durable goods fell 1.4% but rose 0.2% excluding transportation. Looking at the headline number, November’s durables report looked stronger than expected particularly with the upward revisions to October orders. But considering the milder extransportation print and the drop in non-defence capital goods orders ex-aircraft, the report wasn't that impressive. Separately, US personal spending grew only 0.1% in November. Personal income also rose 0.1%. The savings rate fell one tick to 3.5%. The core PCE deflator rose 0.1% in November leaving the year-on-year rate unchanged at 1.7%. Elsewhere, weekly initial jobless claims were much better than expected by consensus, falling to 364K from an upwardly revised 368K. This was the best initial claims figure since April 2008. For November, the Chicago Fed National Activity Index came in at -0.37 after reading -0.11 a month earlier (a negative number indicates below-trend growth). The CFNAI 3- month average remained unchanged at -0.24, well above the -0.7 mark, which tends to be associated with recession.

Euro area – The European Central Bank provided commercial banks with €489 billion in three-year money. In all, 523 banks participated in the operation. Among these, 123 availed themselves of the possibility to replace €45.7 billion of 12-month LTRO allotted in October with the new 36-month LTRO. Consequently, if we take into account previous refinancing operations maturing on December 22 and the roll-out, the ECB provided roughly €200 billion in new financing on a net basis. This should go a long way towards easing imminent bank refinancing activities, as €200 to €230 billion in debt is slated to mature in 2012Q1. The ECB, then, is fulfilling its role of

lender of last resort to the banking system pre-emptively.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Economic indicators Review

Published 01/02/2012, 03:24 AM

Updated 05/14/2017, 06:45 AM

Economic indicators Review

Canada

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.