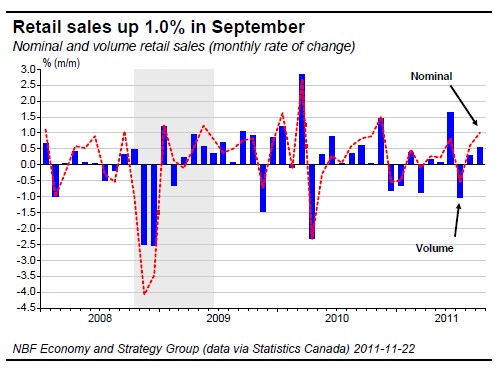

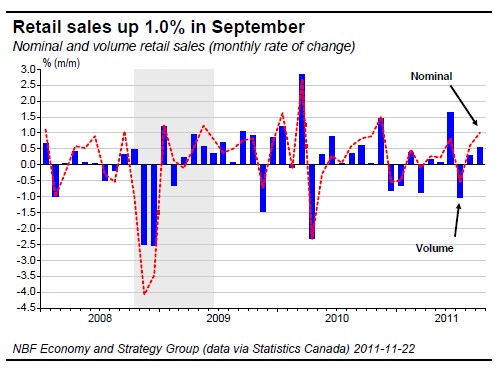

Canada – In September, retail sales increased 1.0% after rising 0.6% in August. Sales were up in 9 of 11 retail industries. Motor vehicle and parts dealers saw sales spring 2.8% after registering a 1.2% gain in August. Excluding this subsector, retail sales advanced 0.5% with the strongest push coming from sporting goods, hobby, book and music stores (+1.7%) and from electronics and appliance stores (+1.2%). The month’s worst performers were furniture and home furnishings stores (-0.5%) and health and personal care stores (-0.4%). On a regional basis, all provinces rolled forward. Leading the lot were Nova Scotia (+2.4%) and Newfoundland and Labrador (+2.1%), with British Columbia (0.2%) and Manitoba (+0.6%) bringing up the rear. Volume retail sales grew 0.6% on the month after swelling 0.3% in August.

The month’s performance, the best in 10 months, easily topped consensus expectations. Moreover, gains were broad based and all provinces were in positive territory. It is true that 61% of the gains in September came from a sharp increase in sales at motor vehicle and parts dealers and that some people could view this negatively. However, to our eyes, the fact that sales of motor vehicles, the ultimate discretionary item, reached a new high in the present cycle and are now almost back to their pre-recession peak suggests Canadian consumers are in fine form. With September's strong input, retail volumes progressed 1.9% annualized on the quarter, outpacing Q2 in this regard, which heralds a healthy contribution from consumption spending to GDP in Q3.

Still in September, wholesale trade came in below expectations, climbing only 0.3% (consensus was calling for +0.7%). Agricultural supplies and food, beverages and tobacco products provided most of the thrust, but many other subsectors recorded decreases, including machinery and equipment, and personal and household goods. In real terms, wholesale trade was down 0.5% on the month.

The Province of Ontario published its Economic Outlook and fiscal review. Here are the highlights:

• For 2011-12 the Ontario government now expects a deficit of $16 billion, $0.3 billion less than budgeted last March.

• Revenues are projected to fall $443 million short of the 2011 budget forecast. Excluding a loan repayment from Chrysler Canada and other first-quarter changes, the shortfall would have been $778 million.

• The 2011 Budget plan included a $700-million reserve for 2011-12. The reserve has been reduced by $500 million to counter the impact of slower economic

growth on fiscal performance.

• Program spending is consistent with the 2011 budget. Debt service is expected to cost $193 million less than budgeted.

• Deficit projections for the next two fiscal years are unchanged from the March budget. The effect of lower revenues and higher program spending is offset by a decrease in debt service cost.

• Real GDP growth is now projected at 1.8% in both 2011 and 2012, down from 2.4% and 2.7 % in the 2011 budget. The projection for 2013 is 2.5% and for

2014 it is 2.6%.

• The borrowing requirement is projected at $35 billion in 2011-12, $37.2 billion in 2012-13 and $40.0 billion in 2013-14. As of November 15th, 70% of the required 2011-12 borrowing had been completed.

• Debt resulting from accumulated deficits is estimated at 25.2% of GDP at the end of the current fiscal year and is projected to peak at 27.7% in 2014-15.

According to the Institut de la statistique du Québec, in August, real GDP at basic prices contracted 0.6% in the province (Canada +0.3%) after expanding 0.4% in July. Some 60% of the decline was due to a 2.3% drop in manufacturing output. Pulling back on the month were 13 of 20 industry groups accounting for 51% of production. With reports in for two months of Q3, GDP is on track for a quarterly expansion of 0.7% annualized.

United States – The BEA revised Q3 GDP growth down from 2.5% to 2.0% on its second estimate. Most of the adjustment was due to a $14-billion downward revision in inventories, which trimmed 1.55 percentage points off growth. State and local governments once more provided a small measure of drag. By contrast, personal consumption and fixed investments added 1.63% and 1.45%, respectively. Once again, net exports contributed positively to the cause (0.49%).

In October, existing-home sales shot up 1.4% to the rate of 4.97 million units. This came as a surprise as pending home sales, which had fallen over the previous three months, suggested the movement would have been in the opposite direction. Distressed transactions were down from their level a year earlier but still accounted for 28% of sales.

October durable goods orders fell 0.7%, reflecting a significant drop in the aircraft industry. Excluding transportation, orders rose 0.7%. Still, orders sagged in numerous categories as evidenced by the 1.8% decline in new orders for non-defence capital goods excluding aircraft. Moreover the September gain, originally estimated at 2.4%, was revised down to just 0.9%. Despite growing at a slower pace, core goods orders were nonetheless up 4% on an annualized basis.

In October, personal income rose 0.4% while consumption expenditures increased 0.1%. The personal consumption expenditure (PCE) price index slipped 0.1% from the month before. Lower energy prices contributed to the drop, the first in the index since June. Excluding food and energy, the index was up 0.1% on the month and 1.7% on the year.

The Congressional Joint Select Committee on Deficit Reduction failed to reach an agreement on how to cut $1.2 trillion from the federal deficit from 2013 to 2021. However, there is still time left to do so (including a presidential election) before automatic spending cuts kick in across the board as stipulated under the Budget Control Act passed this summer.

The month’s performance, the best in 10 months, easily topped consensus expectations. Moreover, gains were broad based and all provinces were in positive territory. It is true that 61% of the gains in September came from a sharp increase in sales at motor vehicle and parts dealers and that some people could view this negatively. However, to our eyes, the fact that sales of motor vehicles, the ultimate discretionary item, reached a new high in the present cycle and are now almost back to their pre-recession peak suggests Canadian consumers are in fine form. With September's strong input, retail volumes progressed 1.9% annualized on the quarter, outpacing Q2 in this regard, which heralds a healthy contribution from consumption spending to GDP in Q3.

Still in September, wholesale trade came in below expectations, climbing only 0.3% (consensus was calling for +0.7%). Agricultural supplies and food, beverages and tobacco products provided most of the thrust, but many other subsectors recorded decreases, including machinery and equipment, and personal and household goods. In real terms, wholesale trade was down 0.5% on the month.

The Province of Ontario published its Economic Outlook and fiscal review. Here are the highlights:

• For 2011-12 the Ontario government now expects a deficit of $16 billion, $0.3 billion less than budgeted last March.

• Revenues are projected to fall $443 million short of the 2011 budget forecast. Excluding a loan repayment from Chrysler Canada and other first-quarter changes, the shortfall would have been $778 million.

• The 2011 Budget plan included a $700-million reserve for 2011-12. The reserve has been reduced by $500 million to counter the impact of slower economic

growth on fiscal performance.

• Program spending is consistent with the 2011 budget. Debt service is expected to cost $193 million less than budgeted.

• Deficit projections for the next two fiscal years are unchanged from the March budget. The effect of lower revenues and higher program spending is offset by a decrease in debt service cost.

• Real GDP growth is now projected at 1.8% in both 2011 and 2012, down from 2.4% and 2.7 % in the 2011 budget. The projection for 2013 is 2.5% and for

2014 it is 2.6%.

• The borrowing requirement is projected at $35 billion in 2011-12, $37.2 billion in 2012-13 and $40.0 billion in 2013-14. As of November 15th, 70% of the required 2011-12 borrowing had been completed.

• Debt resulting from accumulated deficits is estimated at 25.2% of GDP at the end of the current fiscal year and is projected to peak at 27.7% in 2014-15.

According to the Institut de la statistique du Québec, in August, real GDP at basic prices contracted 0.6% in the province (Canada +0.3%) after expanding 0.4% in July. Some 60% of the decline was due to a 2.3% drop in manufacturing output. Pulling back on the month were 13 of 20 industry groups accounting for 51% of production. With reports in for two months of Q3, GDP is on track for a quarterly expansion of 0.7% annualized.

United States – The BEA revised Q3 GDP growth down from 2.5% to 2.0% on its second estimate. Most of the adjustment was due to a $14-billion downward revision in inventories, which trimmed 1.55 percentage points off growth. State and local governments once more provided a small measure of drag. By contrast, personal consumption and fixed investments added 1.63% and 1.45%, respectively. Once again, net exports contributed positively to the cause (0.49%).

In October, existing-home sales shot up 1.4% to the rate of 4.97 million units. This came as a surprise as pending home sales, which had fallen over the previous three months, suggested the movement would have been in the opposite direction. Distressed transactions were down from their level a year earlier but still accounted for 28% of sales.

October durable goods orders fell 0.7%, reflecting a significant drop in the aircraft industry. Excluding transportation, orders rose 0.7%. Still, orders sagged in numerous categories as evidenced by the 1.8% decline in new orders for non-defence capital goods excluding aircraft. Moreover the September gain, originally estimated at 2.4%, was revised down to just 0.9%. Despite growing at a slower pace, core goods orders were nonetheless up 4% on an annualized basis.

In October, personal income rose 0.4% while consumption expenditures increased 0.1%. The personal consumption expenditure (PCE) price index slipped 0.1% from the month before. Lower energy prices contributed to the drop, the first in the index since June. Excluding food and energy, the index was up 0.1% on the month and 1.7% on the year.

The Congressional Joint Select Committee on Deficit Reduction failed to reach an agreement on how to cut $1.2 trillion from the federal deficit from 2013 to 2021. However, there is still time left to do so (including a presidential election) before automatic spending cuts kick in across the board as stipulated under the Budget Control Act passed this summer.