Several economic indicators made waves in the currency markets last week. To everyone’s surprise, on Wednesday we learned that Canada’s GDP reading for August was much lower than expected, showing that the Canadian economy had contracted for the first time in six months. On Friday, we learned that only 1,800 jobs were created last month, while economists had expected a figure of 10,000.

Despite this disastrous news, the loonie gathered strength, due to the better-than-expected employment data that were released south of the border. A total of 171,000 jobs were created in the U.S., while expectations had pegged the figure at 125,000. This is sure to give President Obama a few more votes in tomorrow’s election.

Canada

We can expect a quiet week in Canadian news. The only important indicators will be the Ivey Purchasing Managers’ Index for the month of October, expected on Tuesday, and Housing Starts, to be revealed on Thursday. With all the new measures taken by the federal government to try and slow the rise of house prices and, by extension, limit household debt levels, we are anxious to see if this will be reflected in the Housing Starts figure.

United States

An important week in U.S. news begins today, with the release of the ISM Non-Manufacturing Index for October. Economists are forecasting a figure of 54.5, believing that the non-manufacturing sector expanded last month. By the time we settle into bed tomorrow evening, we will know who the U.S. electorate has chosen to be their president for the next four years.

Given that many of you have asked about what impact this choice could have on the U.S. dollar, our section on the loonie provides an analysis of the impacts of a Republican vs. a Democratic victory on the USD/CAD pair. On Thursday the U.S. Trade Balance figure will be revealed, and on Friday we will have the latest Michigan Consumer Sentiment Index figures.

International

The week in international news begins on Tuesday with the Reserve Bank of Australia’s decision on its key interest rate. Later that day, we will have October’s Purchasing Managers’ Indexes for Italy, France, Germany and the Eurozone. This will be followed by Eurozone Retail Sales for September on Wednesday. Thursday will be a very important day with the release of employment data in Australia and the European Central Bank’s decision on its key interest rate.

Naturally, we are looking forward to the press conference that will follow in order to see whether anything new will be said. The week in international news ends with the Consumer Price Index and Retail Sales figures for China. Have a good week!

The Loonie

“It is during our darkest moments that we must focus to see the light.”- Aristotle Onassis

In the current economic gloom, it is not easy for Americans to decide which of the two presidential candidates can do the most for them during their mandate and restore the health of the world’s leading economy. Americans go to the polls to elect their next president tomorrow. The question is: How the markets will react after November 6 if the Democratic incumbent or the Republican candidate wins?

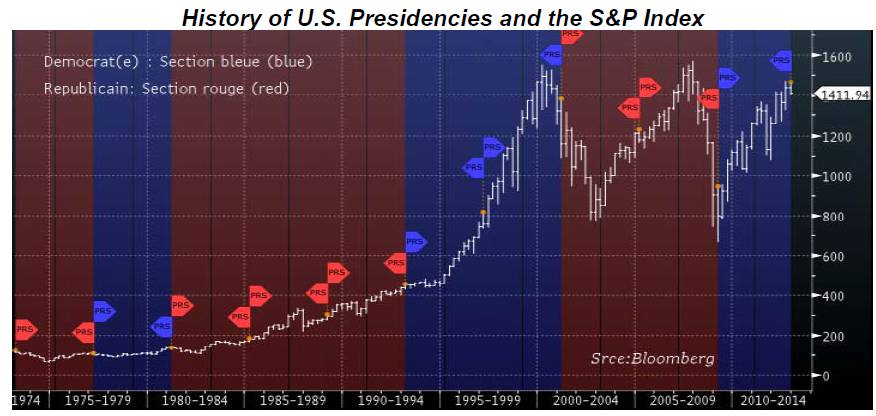

Since 1973, the Democrats have walked away with four elections and the Republicans, five. The following graph clearly shows that when Democrats are in power, there is a greater appetite for risk. In November 1992, following the election of a Democrat (Bill Clinton), the S&P Index rose 250% in the eight years preceding the election of a Republican (Georges W. Bush) in November 2000. During the 8-year Republican period that followed, the Index had fallen 45% by the time another Democrat (Barak Obama) was elected in November 2008.

Since then, the S&P Index has risen 99%. For the last three years, there has been an approximately 75% correlation between the Canadian dollar and the U.S. dollar/S&P Index. One might speculate that, if it could, our loonie – much like The Economist, the British business magazine – would cast its votes for Obama!

In the wake of the first debate, investors began to anticipate a Romney win. A negative sentiment emerged (risk-off behaviour), given that the Republican Party is against a QE3 (monetary easing) and would replace Ben Bernanke, a reputable official. In addition, at the outset of their mandate, Republicans want to accuse China of being a currency manipulator. This would make it more difficult to finance the national debt. Many observers now perceive the Chinese economy as more dominant, ahead of the U.S. economy.

This would put pressure on currencies at risk, such as the CAD and the JPY due to their sensitivity to U.S. financial markets. However, if the Democrats are re-elected, they will have to face the fiscal cliff and a major fight with the Republicans and the Tea Party (their populist faction, which wants to cut taxes and government spending). Furthermore, whether a Republican or a Democrat wins, many challenges lie ahead, such as risks in the Eurozone, China and the emerging countries, geopolitical problems in the Middle East, and lower corporate earnings.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Economic Indicators Make Waves In Currency Markets

Published 11/06/2012, 01:59 PM

Updated 05/14/2017, 06:45 AM

Economic Indicators Make Waves In Currency Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.