Higher Argentine crop forecast bearish for corn prices

Corn prices decline as Argentine crop forecast is lifted. Will the price of corn continue falling?

The Argentine agriculture ministry lifted its estimate for plantings of corn by 520 thousand hectares to 7.95m hectares. 2016-17 corn harvest estimate was revised up by 1.0m tons to 47.5m tons. The harvest estimate exceeds by 7.7m tons the record harvest of last season.

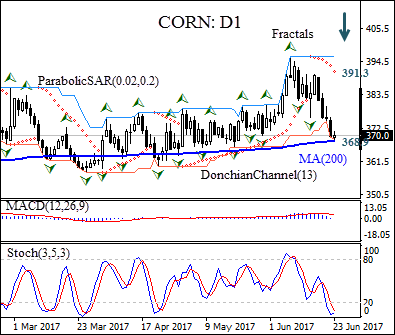

On the daily timeframe CORN:D1 is retracing lower after hitting a one-year high in the beginning of June. The price has fallen to 200-day moving average MA(200).

- The Donchian channel indicates a downtrend: it is tilted downward.

- The Parabolic indicator gives a sell signal.

- The MACD indicator is above the signal line and the gap is falling, which is a bearish signal.

- The stochastic oscillator is rising in the oversold zone, which is a bullish signal.

We believe the bearish momentum will continue after the price breaches below the lower Donchian boundary at 368.9. It can be used as an entry point and a pending order to sell can be placed below that level. The stop loss can be placed above the Parabolic signal at 391.3.

After placing the pending order the stop loss is to be moved every day following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (391.3) without reaching the order (368.9), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position - Sell

Sell stop - Below 368.9

Stop loss - Above 391.3