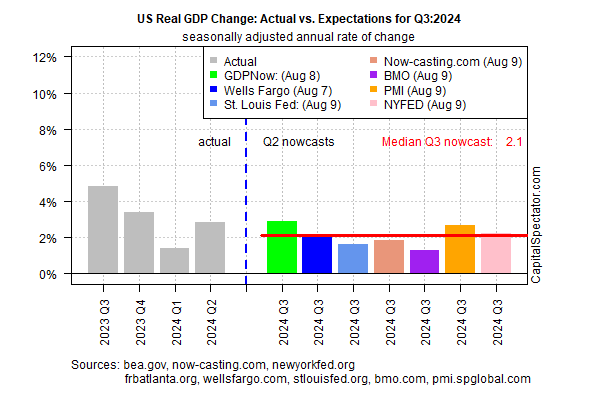

Early assessments of third-quarter economic activity for the US point to a slowdown vs. Q2, based on the median nowcast for estimates compiled by CapitalSpectator.com.

The downshift is prominent, but the estimate still points to low recession risk. The economy is on track to increase at a real 2.1% annualized pace in Q3, according to the median projection.

Assuming the nowcast is accurate, the growth will reflect a moderately slower expansion compared with Q2’s solid 2.8% increase. The Bureau of Economic Analysis is scheduled to publish its first round of Q3 data on Oct 30.

The obvious caveat: it’s still early in Q3 so the current nowcasts should be viewed cautiously. A lot can, and probably will, happen between now and late October, when the government publishes the initial Q3 GDP report. For now, however, the preliminary review provides a relatively upbeat outlook.

Today’s data also offers pushback to recent fears that a US recession has started or is imminent. In addition to today’s Q3 nowcast, a series of other business-cycle metrics support the case for downplaying recession fears in the immediate future.

As reported on these pages a week ago (Aug. 7), “the case for assuming that recession risk has spiked still looks weak.”

Yet it’s also short-sighted to assume that recession risk will be low for Q4 and beyond. Looking beyond a month or two for assessing US economic conditions is highly speculative, but for scenario-analysis purposes it’s reasonable to consider what may happen and monitor the key triggers for assessing the assumptions through time.

There’s also a view in some circles that expect a sluggish growth rate will keep the US out of a formal recession but at the same time deliver subpar results that may feel like a mild downturn.

Bank of America analysts predict “we go to 2% growth, then 1.5% growth over the next six quarters and kind of bump along at that growth rate plus or minus,” says the bank’s CEO Brian Moynihan.