I never understand how "informed" people throw out unvetted statements on the economy. They read a few headlines from a clueless press - and then echo their selective view. Hello, there is no analytical evidence the economy will accelerate.

Follow up:

To begin, even using some of the best forecasting methodology, nothing is certain. Unforeseeable events can be recessionary (or add to existing recessionary dynamics) to trigger a recession or slow down an economy - weather, oil, wars to name a few. Another problem for forecasting is the metric called GDP which is the measure of economic activity. GDP has methodology flaws which work counterintuitively in understanding economic trends:

-

Inventories are considered investments. So if an economy is decelerating, inventories grow, and GDP credits the inventory build as a positive economic factor.

-

In a consumption based economy, economic strength should measure consumption whether the item was made in the USA or not. Yet imports are subtracted removing sensitivity to consumption trends.

-

GDP is never set in concrete. The 2001 recession was revised away if you look at GDP only.

My approach to forecasting the economy is to monitor various elements of the economy which lead consumption - industrial production, transport, commodity sales - and test those against analytically produced long range forecasts (forward forecast periods of 6 months or more). This has proven to be a better forecasting approach as NO forward indicator is perfect. The problem in the December 2007 recession was all leading indicators were a little late in warning.

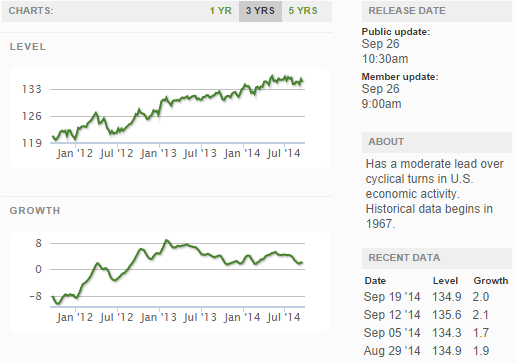

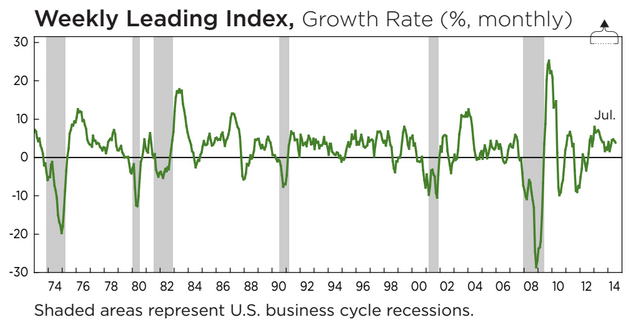

ECRI's Weekly Leading Index went negative on the last day of August 2007 which would indicate a recession was forecast beginning in February 2008.

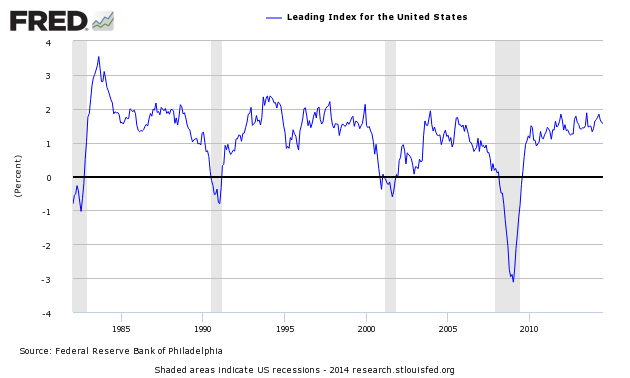

The Philly Fed's Leading Index went negative in March 2008 which would indicate a recession beginning September 2008.

The Conference Board's Leading Index did not start warning of economic difficulties until December 2007 which would peg the beginning of the recession in June 2008. [Note that this index has been completely revamped and its performance in real time is unknown].

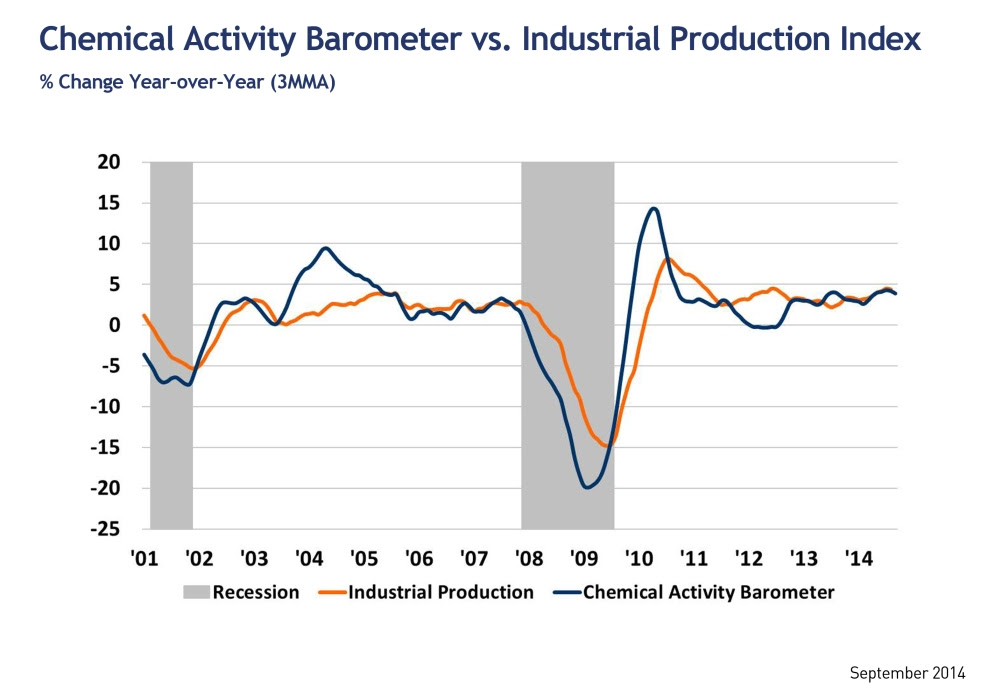

The new kid on the block - the Chemical Activity Barometer was not published in 2007 but its database shows it would have warned of a recession in June 2007 - on the money. However, it is most likely this index was "tuned" to show the proper warning date.

Overall, these leading indices performed well. Whilst the economic community in general was poo-pooing recession talk until late 2008, this leading index group was already on record. Further, the 2007 recession was a financial recession which has a behavior quite different than previous recessions (except for the Great Depression). The December 2007 recession was not called until December 2008 by the National Bureau of Economic Research (NBER).

Yet the transportation volumes (rail, ocean freight, truck) began contracting around the end of the 1Q2007 - and if one understood that the leading indicators were softening - one could easily have believed a recession began in December 2007.

Fast forward to today. Transport volumes are all positive - some strong, others not so strong. No trend lines which point to acceleration or deceleration - just the usual noise. Leading indicators are either flat (Philly Fed's Leading Index for the United States and the Conference Board's LEI), slightly decelerating (ECRI's WLI), or slightly accelerating (Chemical Activity Barometer).

Am I certain the economy will not accelerate shortly - no! But at least there is basis for saying it will not on a snapshot basis. If things change then snapshots will change as time progresses. So keep snapping those pictures.

Other Economic News this Week:

The Econintersect Economic Index for September 2014 is showing our index declined from last months 3 year high. Outside of our economic forecast - we are worried about the consumers' ability to expand consumption although data is now showing consumer income is now growing faster than expenditures growth. The GDP expansion of 4.2% in 2Q2014 is overstated as 2.1% of the growth would be making up for the contraction in 1Q2014, and 1.4% of the growth is due to an inventory build. Still, there are no warning signs that the economy is stalling.

The ECRI WLI growth index value has been weakly in positive territory for almost two years. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

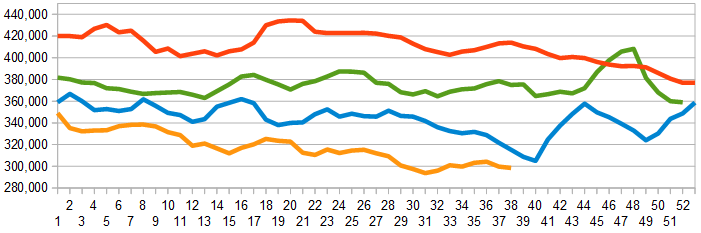

The market was expecting the weekly initial unemployment claims at 299,000 to 310,000 (consensus 300,000) vs the 293,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 299,750 (reported last week as 299,500) to 298,500.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line)

Bankruptcies this Week: Privately-held ITR Concession Company, ISC8 (fka Irvine Sensors Corporation), Vision Industries

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: