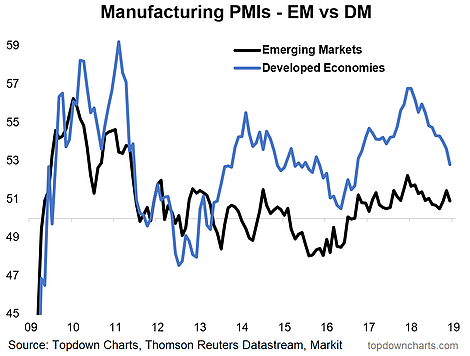

We look at the global manufacturing PMIs, and specifically at the somewhat divergent trend seen in Emerging Markets vs Developed Markets. Basically, EM appears to be starting to stabilize or at least, for now, has stopped softening, meanwhile DM economic momentum has slowed markedly - 'catching down' toward EM.

Being diffusion indicators, the PMI or Purchasing Manager's Index has as its delineation between expansion vs contraction the 50-point line. So it's important to note what we're actually dealing with here: at this stage, both EM and DM are in aggregate still undergoing economic expansion, it's just the pace of improvement has eased off. Having said that, it still is the momentum/direction that counts - particularly for those interested in anticipating what comes next (i.e. turning points).

In this regard, and going back to the previous post on global deflation risks, the path that the black line (emerging markets) takes is arguably going to be the most important. Emerging economies now account for the dominant share of world GDP, so if EM can indeed stabilize and even strengthen from here it could well be the key factor that drives a broader stabilization and improvement in the global economy. So it's not a chart to be taken lightly.

The economic divergence is also key for asset markets, particularly as last year brought about much cheaper valuations for emerging market equities (and currencies), both in absolute and relative terms. Thus this chart is also going to be key for the path of EM equities.

So keep this one on your radar if you care about the global economy or EM equities.