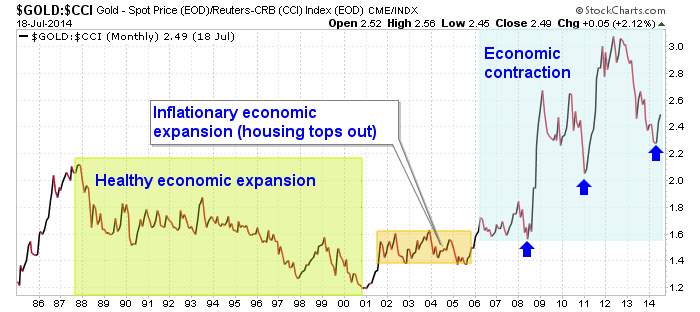

Just a friendly reminder that we are in an economic contraction, not an expansion when viewing the big picture. Indeed, it is this site that has highlighted the little post-2012 expansion more vigorously than any other bearish-leaning entity that I have seen, and earlier than most bullish entities I might add.

That was because of the Semiconductor Equipment ramp up → Palladium-Gold ratio → ISM upturn → Jobs upturn continuum we have been on. But that is a positive cycle within a much larger cycle that is very negative. Here’s the updated view of counter cyclical gold vs. cyclical commodities, which may be starting its next up turn.

If I am right to be using this road map then I am also right in thinking that lots of people are going to find out one day what a bill of goods they bought when they (finally) bought this cyclical recovery sold to them by conventional analysis from the conventional financial services and media complexes.