Investing.com’s stocks of the week

Italy will begin selling 5 billion euros' worth of 1-year bonds today to test investors' appetite. The country will also begin selling 5-year bonds on monday. It should be noted that the yields, seen recently (7.25% on 10-year bonds), are the same level at which Greece, Portugal and Ireland requested aid from the EU and the IMF. However, at 1900 billion euros, Rome's debtt is too large for a wide scale bailout to be possible.

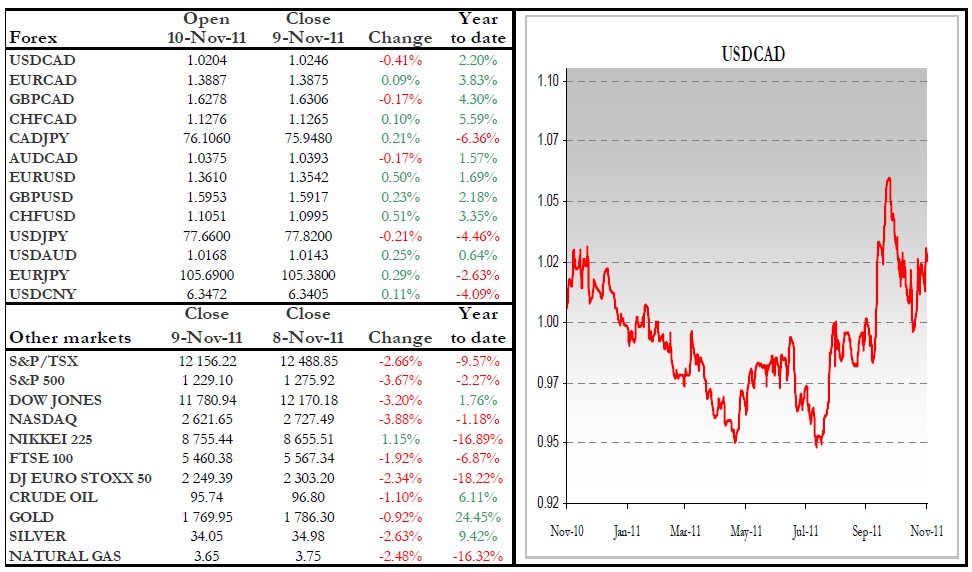

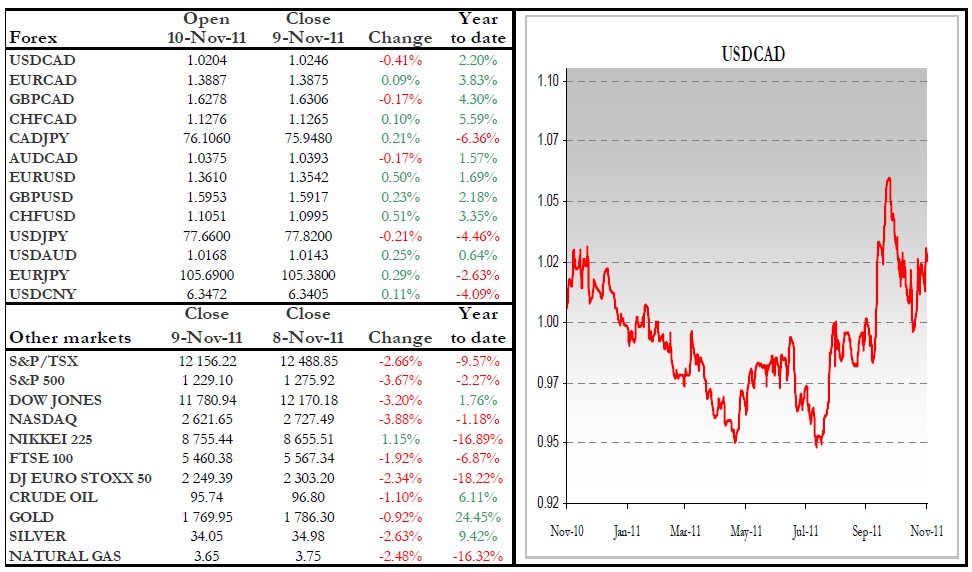

Equities once again ended the trading day in the red due to the critical situation in Italy. The U.S dollar consequently rose against most currencies, given its status as a safe haven. Further worsening of conditions in Italy will no doubt push the USD higher. We strongly recommend that USD sellers place orders at technical levels to take advantage of the potential turmoil.

Meanwhile in Greece, the new coalition government, Lucas Papademos, was named.He had previously worked at the European Central Bank as the Vice-President to Jean-Claude Trichet.

Equities once again ended the trading day in the red due to the critical situation in Italy. The U.S dollar consequently rose against most currencies, given its status as a safe haven. Further worsening of conditions in Italy will no doubt push the USD higher. We strongly recommend that USD sellers place orders at technical levels to take advantage of the potential turmoil.

Meanwhile in Greece, the new coalition government, Lucas Papademos, was named.He had previously worked at the European Central Bank as the Vice-President to Jean-Claude Trichet.