Morning Notes

US Futures are relatively flat this morning while European markets trade higher by roughly +1% as markets digest the news of a 25 bp rate hike by the FOMC yesterday afternoon. Asian stocks closed predominantly lower.

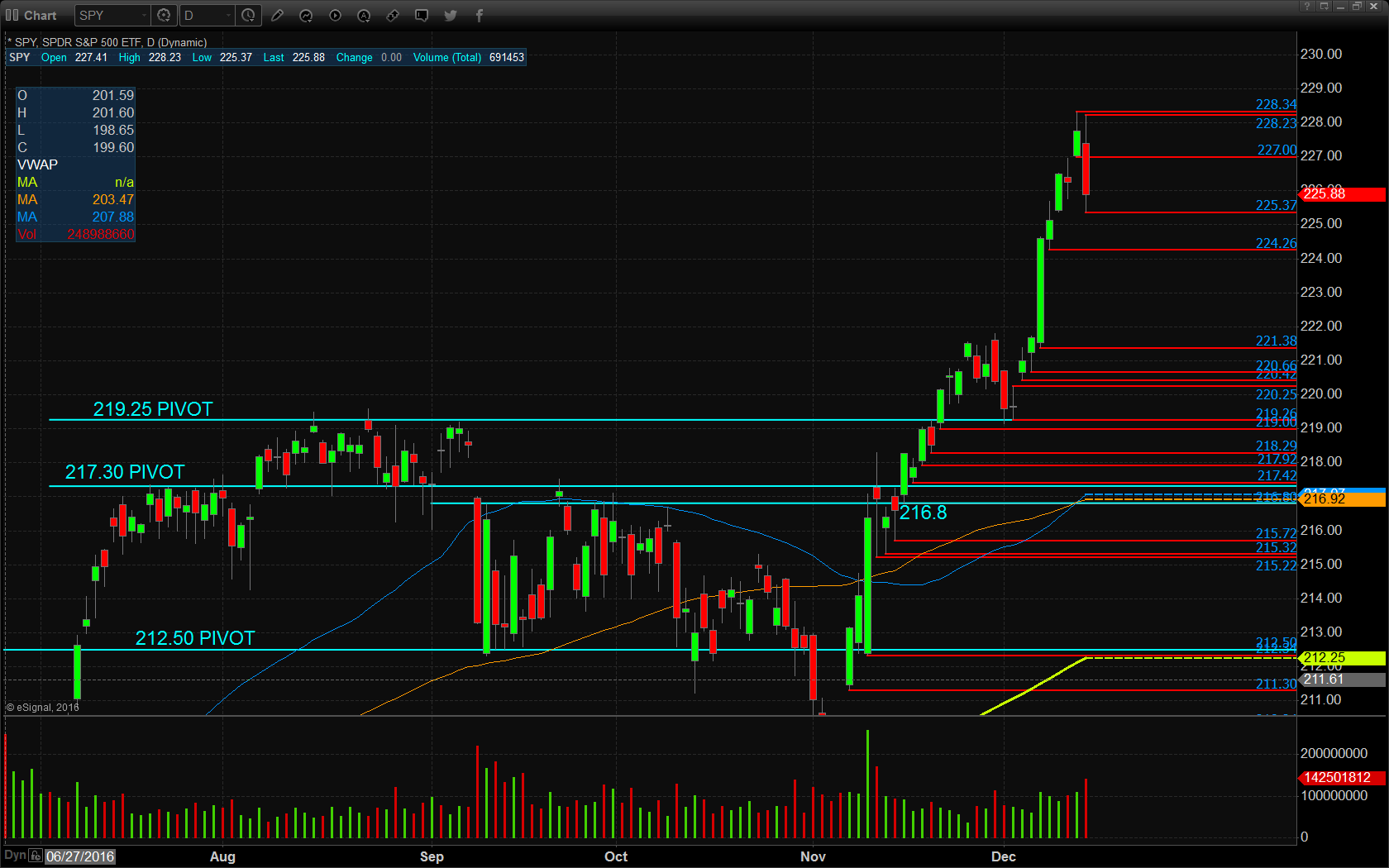

Technicals

The SPY (NYSE:SPY) pulled off record highs throughout yesterday’s session and closed just off the intraday lows. Support will lie at the low of yesterday’s range at $225.37, followed by $224.26 and $221.38. Resistance will lie at the high of yesterday’s range at $228.23, followed closely by record highs at $228.34.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

Eli Lilly and Company (NYSE:LLY)

athenahealth Inc (NASDAQ:ATHN)

Economic Calendar

8:30 Weekly initial unemployment claims expected -3,000 to 255K

8:30 November CPI expected +0.2%

8:30 December Empire manufacturing survey business conditions expected +2.5

8:30 December Philadelphia Fed business outlook survey expected +1.5

8:30 Q3 current account balance expected -$111.6B

8:30 USDA weekly Export Sales

9:45 December Markit manufacturing PMI expected +0.4

10:00 December NAHB housing market index expected unchanged

Notable Earnings Before Open

NONE

Notable Earnings After Close

NONE