Morning Notes

US Futures are slightly lower this morning while European stocks also trade lower by nearly -1% after yesterday’s sharp move lower in result of the FOMC minutes which suggested a rate hike in June. As probability increases of a June rate hike, the dollar strengthened which undercut crude and gold prices into late day trading. Asian stocks closed mostly lower.

Technicals

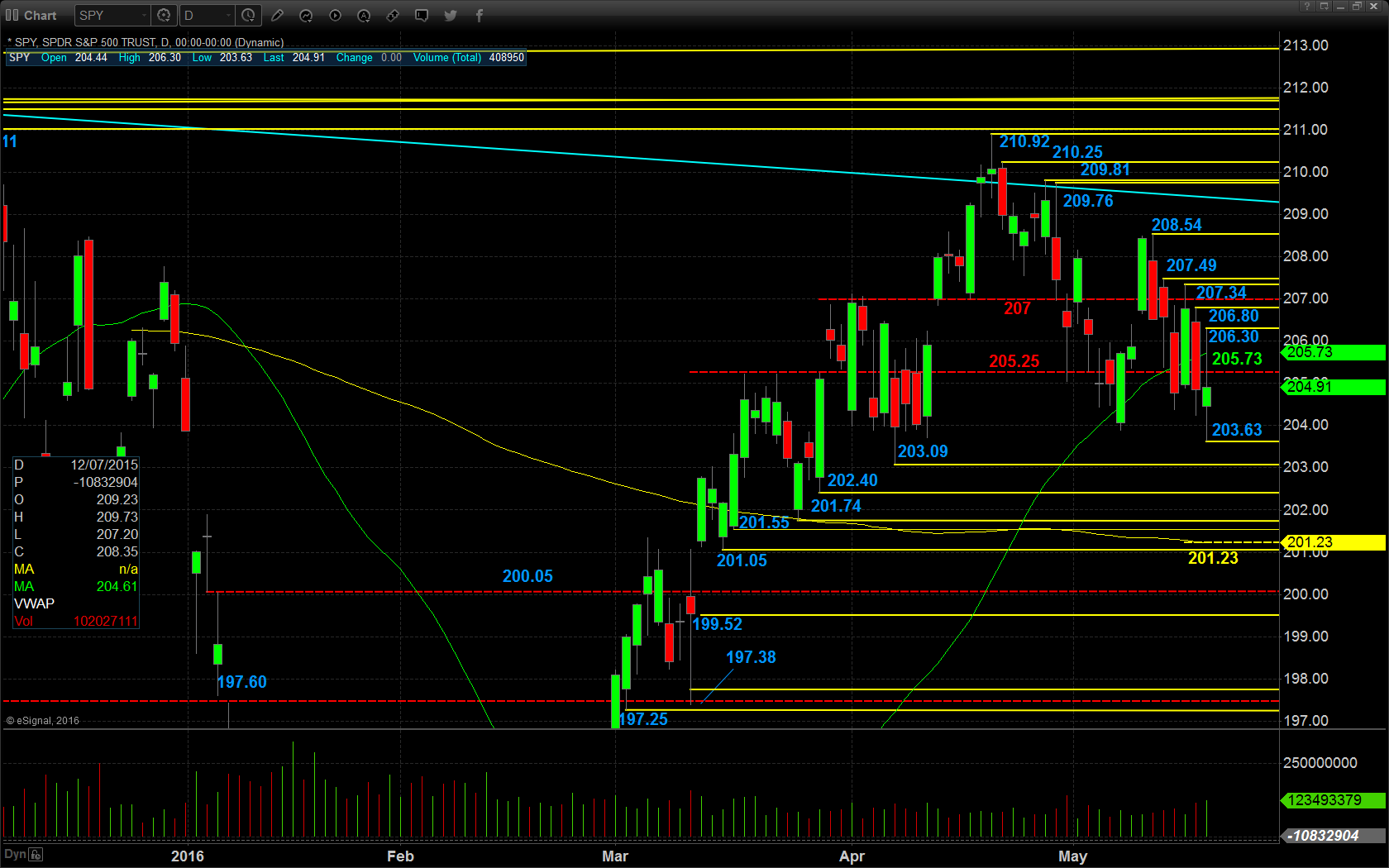

The SPY (NYSE:SPY) sold off in yesterday’s session on increased volume and closed back below the recent support pivot at $205.25. Support will lie at the low of yesterday’s range at $203.63, followed by $203.09, and $202.40. Resistance will first lie at the resistance pivot at $205.25, followed by the 50 day SMA at $205.73, and then the high of yesterday’s range at $206.30.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

Salesforce.com Inc (NYSE:CRM)

L Brands Inc (NYSE:LB)

Dick’s Sporting Goods Inc (NYSE:DKS)

Economic Calendar

8:30 Weekly initial unemployment claims expected -19,000 to 275,000

8:30 Apr Chicago national activity index expected +0.24 to -0.20

8:30 May Philadelphia Fed business outlook survey expected +4.6 to 3.0

8:30 USDA weekly Export Sales

9:15 Fed Vice Chair Stanley Fischer

10:00 Apr leading indicators expected +0.4%

10:30 New York Fed President William Dudley

1:00 Treasury auctions $11 billion 10-year TIPS

Notable Earnings Before Open

AAP: Advance Auto Parts – EPS Est. $2.61, Rev Est. $3.02B

WMT: Wal-Mart (NYSE:WMT) – EPS Est. $.88, Rev Est. $113.14B

Notable Earnings After Close

AMAT: Applied Materials (NASDAQ:AMAT) – EPS Est. $.32, Rev Est. $2.42B

ROST: Ross Stores (NASDAQ:ROST) – EPS Est. $.37, Rev Est. $3.11B

Gap Inc (NYSE:GPS): Gap Stores – EPS Est. $.32, Rev Est. $3.52B

Autodesk Inc (NASDAQ:ADSK): AutoDesk – EPS Est. $(.14), Rev Est. $513.03M

May 19th Swing Watch List

Darling International Inc (NYSE:DAR) – Long entry is over 14.85, add spot at 15. Stop will be 14.50. Target is 15.50-15.70, on this slow mover.

Nationstar Mortgage Holdings Inc (NYSE:NSM) – Long entry is over 12.50, stop 12.00. Room to 13.05 and then 13.50 near the 200 EMA.

DCP Midstream Partners LP (NYSE:DPM)– Short entry is under 32.50, stop 33.25. Room here is to 30 in a short time. I don’t normally trade oil names, but the chart is setup for a short under the 20EMA.