Morning Notes

US Futures are pointing to a slightly lower open this morning which is being led by a -6% move lower in HPQ after a disappointing earnings report. European stocks are also trading lower by nearly -1% as markets consolidate ahead of Fed Chair Janet Yellen’s speech tomorrow. Asian markets closed mostly lower.

Technicals

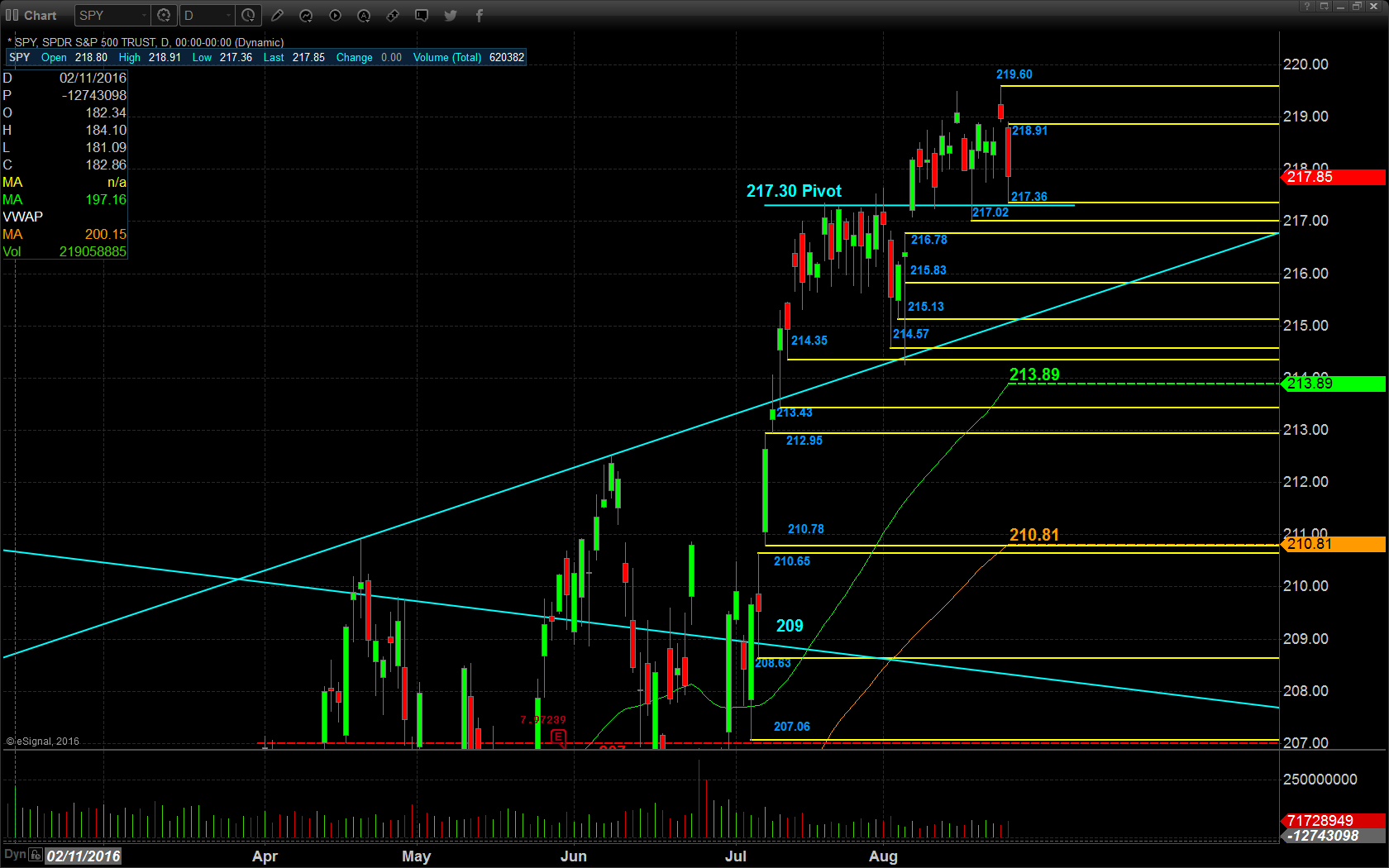

The SPDR S&P 500 (NYSE:SPY) turned lower in yesterday’s session but managed to hold and close back above the upper support pivot at $217.30. Support will lie at the low of yesterday’s range at $217.36, followed closely by the upper support pivot at $217.30, then $217.02, $216.78, $215.83, and $215.13. Resistance will lie at the high of yesterday’s range at $218.91, followed by all time highs at $219.60.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

Dollar Tree Inc (NASDAQ:DLTR)

Workday Inc (NYSE:WDAY)

Economic Calendar

8:30 Weekly initial unemployment claims expected +3,000 to 265,000

8:30 July durable goods orders expected +3.4% and +0.4% ex trans

8:30 USDA weekly Export Sales

9:45 August Markit services PMI expected +0.4 to 51.8

11:00 August Kansas City Fed manufacturing activity survey expected +4 to -2

1:00 Treasury auctions $28B 7-year T-notes

Notable Earnings Before Open

NYSE:BURL: Burlington Stores – EPS Est. $.30, Rev Est. $1.24B

NYSE:DG: Dollar General – EPS Est. $1.09, Rev Est. $5.49B

DLTR: Dollar Tree– EPS Est. $.73, Rev Est. $5.13B

NASDAQ:SAFM: Sanderson Farms – EPS Est. $2.22, Rev Est. $764.65M

NASDAQ:SHLD: Sears Holdings – EPS Est. $.00, Rev Est. $N/A

NYSE:SIG: Signet Jewelers – EPS Est. $1.47, Rev Est. $1.45B

NYSE:TIF: Tiffany & Co (NYSE:TIF). – EPS Est. $.71, Rev Est. $932.91M

Notable Earnings After Close

NASDAQ:ADSK: Autodesk – EPS Est. $(.13), Rev Est. $510.64M

NASDAQ:BRCD: Brocade Communications – EPS Est. $.19, Rev Est. $575.38M

NYSE:GME: GameStop – EPS Est. $.26, Rev Est. $1.74B

NASDAQ:SPLK: Splunk – EPS Est. $.03, Rev Est. $200.56M

NASDAQ:ULTA: Ulta Salon – EPS Est. $1.39, Rev Est. $1.06B

August 25th Swing Watch List

Scorpio Bulkers Inc (NYSE:SALT) – After some good early success on shippers, I like this for a move back toward 3.50, and thensome. Long entry is over 3.31, stop 3.14. Target is 3.50 and then 4.

Nobilis Health Corp (NYSE:HLTH) – Long entry here is over 3.25-3.30, stop 3.10. Target is 3.65-4.00.

Alkermes Plc (NASDAQ:ALKS) – Short entry if IBB continues to fall will be under 44.00, stop 45. Target is 41.00.