Morning Notes

US Futures are currently flat this morning while European markets trade just slightly higher. Gains in Wal-Mart Stores Inc (NYSE:WMT) after earnings are offsetting the losses in Cisco Systems Inc (NASDAQ:CSCO) in early trading. Yesterday’s results of the Fed Minutes further decreased the likelihood of a rate increase anytime soon. Asian stock closed mostly mixed across the board.

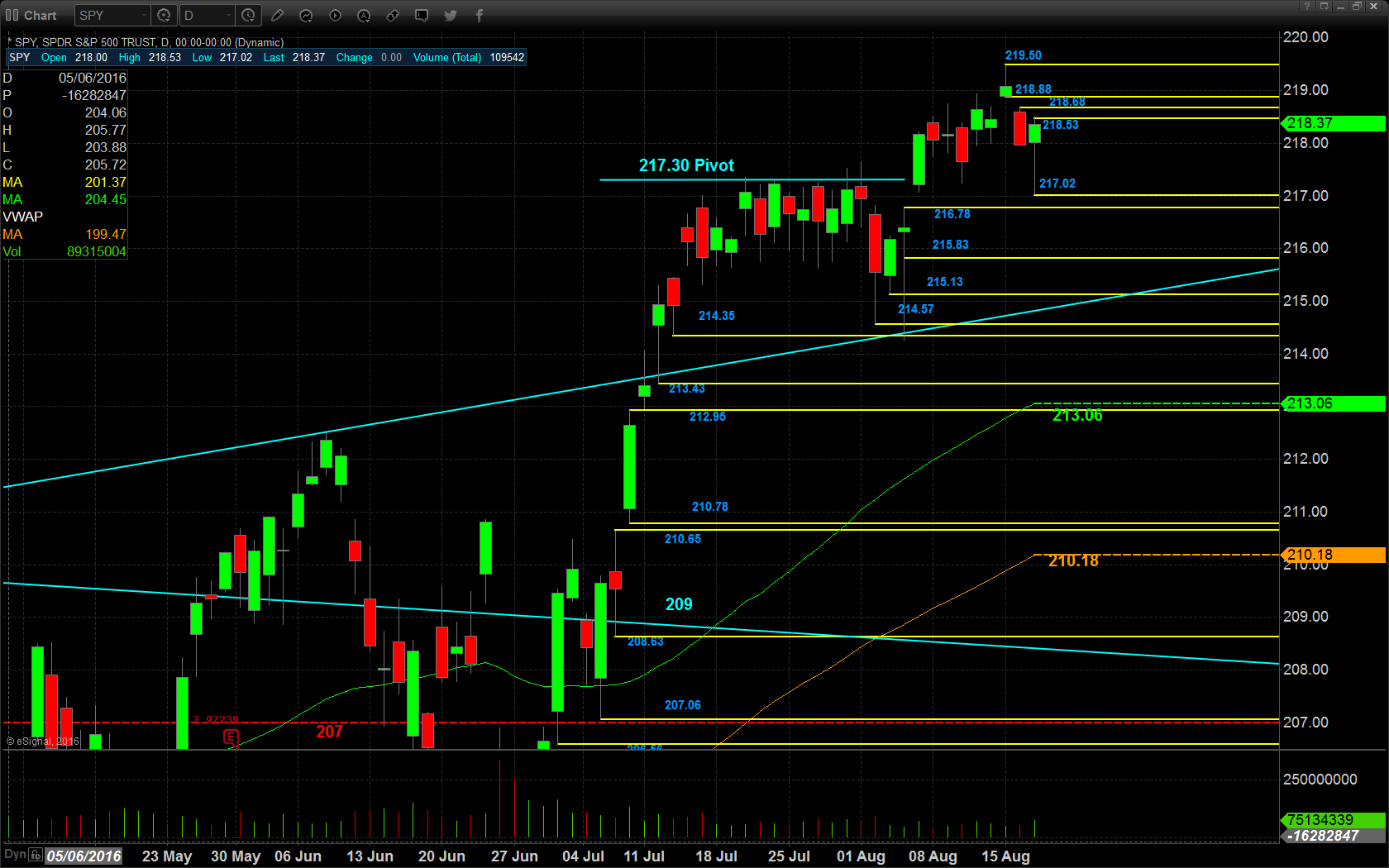

Technicals

The SPY (NYSE:SPY) traded in a wide range on increased volume throughout yesterday’s session due to the release of the latest Fed Minutes. Support will first lie at the upper support pivot at $217.30, followed by the low of yesterday’s range at $217.02, then $216.78, and $215.83. Resistance will lie at the high of yesterday’s range at $218.53, followed by $218.68, $218.88, and all time highs of $219.50.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

Valeant Pharmaceuticals International Inc (NYSE:VRX)

WMT

Economic Calendar

8:30 Weekly initial unemployment claims expected -1,000 to 265,000

8:30 August Philadelphia Fed business outlook survey expected +4.9 to 2

8:30 USDA weekly Export Sales

10:00 July leading indicators expected +0.3%

10:00 New York Fed President William Dudley

1:00 Treasury auctions $14B of 5-year TIPS

Notable Earnings Before Open

WUBA: 58Com Inc Adr (NYSE:WUBA): 58.com – EPS Est. $0.00, Rev Est. $N/A

CSIQ: Canadian Solar Inc (NASDAQ:CSIQ): – EPS Est. $.40, Rev Est. $701.23M

WMT: Wal-Mart (NYSE:WMT) – EPS Est. $1.02, Rev Est. $120.09B

Notable Earnings After Close

AMAT: Applied Materials (NASDAQ:AMAT) – EPS Est. $.47, Rev Est. $2.84B

August 18th Swing Watch List

ADPT: Adeptus Hea (NYSE:ADPT)– A reversal setup. Long entry is off the 40.00 area or over 42.50. Will stop out under 39.00. Target here is 46.

SPY – On short watch for a move lower from here. The SPY is flirting with the 9 EMA and pretty top heavy. Would like to use a bear put spread here. Sept16 220/215 for a debit of 2.00 or better.