Economic Calendar And Watch List

Morning Notes

US Futures are tracking modestly lower this morning while European stocks also trade lower by -.50%. The Volatility Index (VIX) is approaching 6 month highs as the continued geopolitical developments weigh on global markets. Yesterday, President Trump commented on the US dollar, “the dollar is too strong” and along with that he prefers a “low interest rate policy.” Trading will likely be light as we move into the Easter holiday. Asian stocks closed mostly mixed.

Technicals

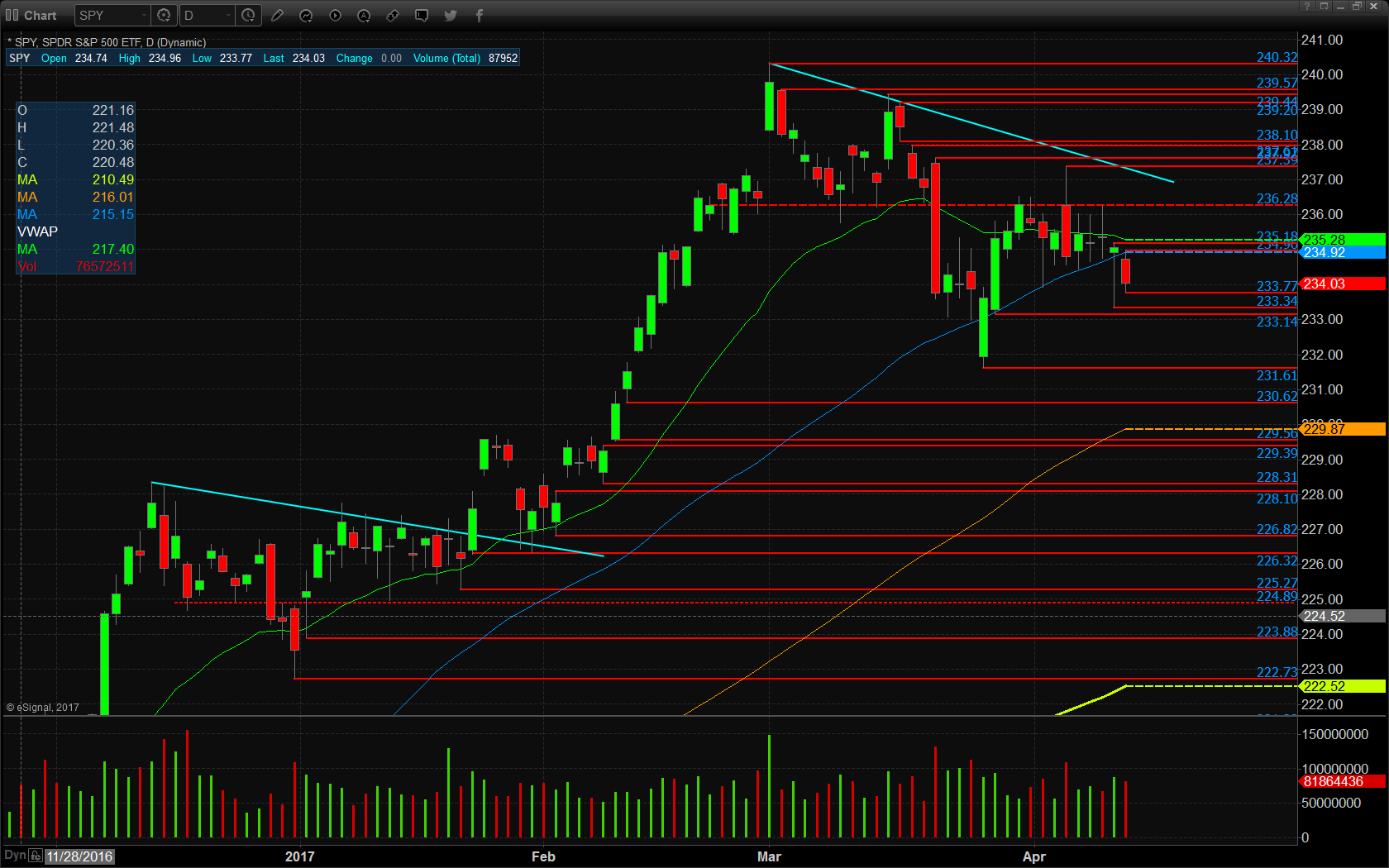

The SPY (NYSE:SPY) edged lower throughout yesterday’s session closing back below both the 50 and 20 day moving averages. Support will at the low of yesterday’s range at $233.77, followed by $233.34, $233.14, $231.61, $230.62, and the 100 day SMA at $229.87. Resistance will lie at the 50 day SMA at $234.92, followed closely by the high of yesterday’s range at $234.96, $235.18, and the 20 day EMA at $235.28, and then the recent pivot point at $236.30. Short term descending resistance falls at $237.25, followed by the remaining levels of resistance at $237.39, $237.97, $238.10, $239.20, $239.44, $239.57, and record highs at $240.32.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

AAOI (NASDAQ:AAOI)

Economic Calendar

8:30 Weekly initial unemployment claims expected +11,000 to 245K

8:30 March PPI final demand expected unchanged

8:30 USDA weekly Export Sales

10:00 Prelim April University of Michigan U.S. consumer sentiment index expected -0.4 to 96.5

Notable Earnings Before Open

Citigroup (NYSE:C) – EPS Est. $1.24

JPMorgan (NYSE:JPM) – EPS Est. $1.52

Wells Fargo (NYSE:WFC) – EPS Est. $0.97

PNC Financial Services (PNC) – EPS Est. $1.83

Notable Earnings After Close

NONE