Wednesday January 25, 2017

Economic Calendar and Watch List

Morning Notes

US Futures are trading at new all time highs while European stocks trade higher by over +1% on a positive global economy after many comments and executive actions by new President Donald Trump. The price of crude is trading lower by roughly -1% after weekly API data showed a rise in inventories. Asian stocks closed mostly higher after better than expected Japanese trade data.

Technicals

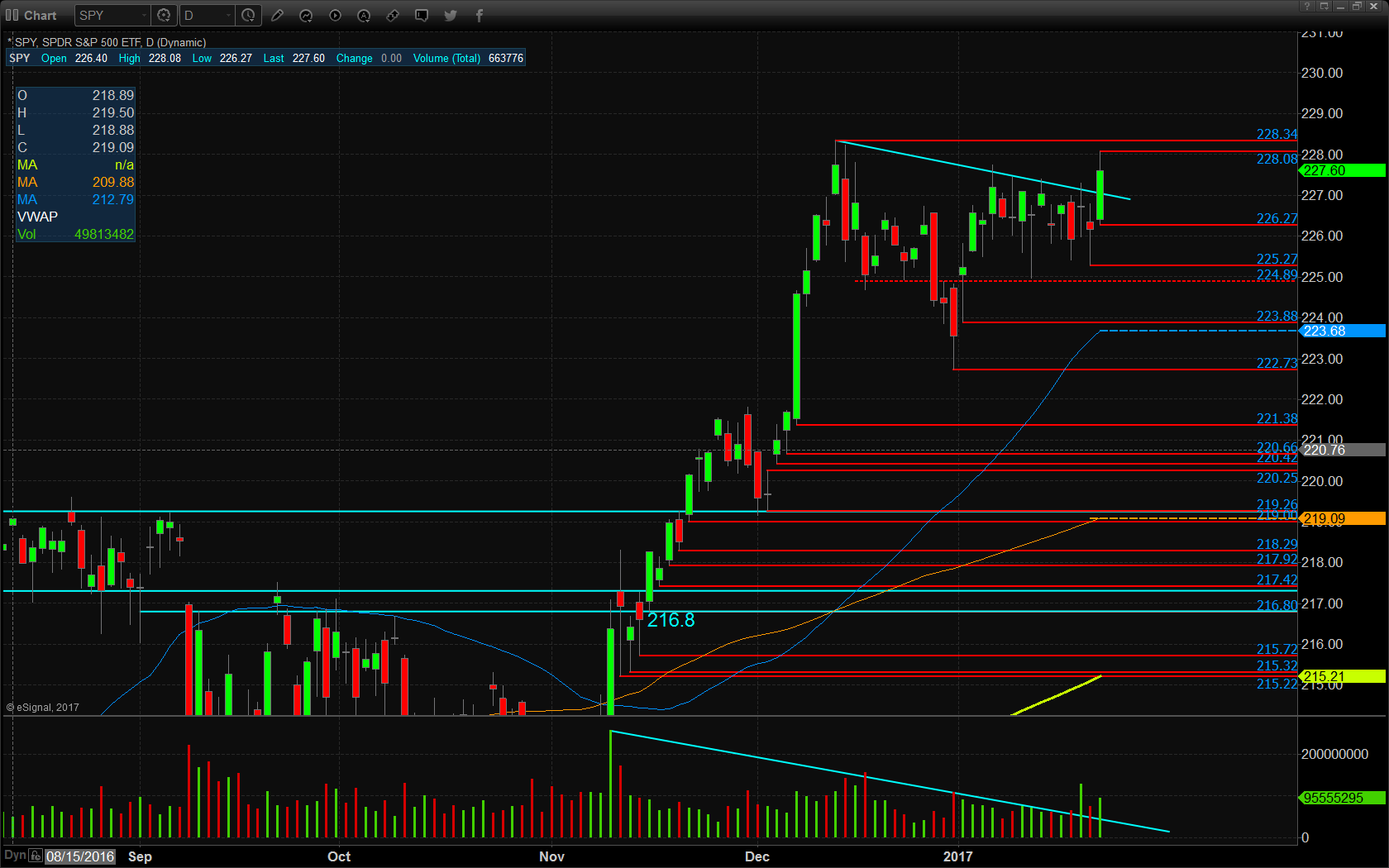

The SPY (NYSE:SPY) pivoted higher out of its recent consolidation on increased volume throughout yesterday’s session. Support will lie at the former descending resistance at $227, followed by the low of yesterday’s range at $226.27, then $225.27 and the recent support pivot at $224.89. Resistance will lie at the high of yesterday’s range at $228.08, followed by all time highs at $228.34.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

STX (NASDAQ:STX)

Economic Calendar

9:00 November FHFA house price index expected +0.4%

10:30 EIA Weekly Petroleum Status Report

Notable Earnings Before Open

Boeing (NYSE:BA) – EPS Est. $2.35

CommVault Systems Inc (NASDAQ:CVLT) – EPS Est. $0.26

Freeport-McMoran (NYSE:FCX) (FCX) – EPS Est. $0.33

Norfolk Southern (NYSE:NSC) – EPS Est. $1.36

United Technologies(NYSE:UTX) – EPS Est. $1.56

Notable Earnings After Close

AT&T (NYSE:T) – EPS Est. $0.66

Citrix Systems (NASDAQ:CTXS) – EPS Est. $1.50

F5 Networks (NASDAQ:FFIV) – EPS Est. $1.94

Las Vegas Sands (NYSE:LVS) (LVS) – EPS Est. $0.66

Qualcomm (NASDAQ:QCOM) – EPS Est. $1.17

United Rentals (NYSE:URI) – EPS Est. $2.24

Western Digital (NASDAQ:WDC) – EPS Est. $2.11