Here we go again. Election season is here and all we hear is how the incumbent or the challenger is off base and leading the U.S. to disaster. The two biggest campaign talking points are unemployment and the U.S. budget deficit.

Unfortunately, there is no candidate out there who has any espoused solutions which will solve the root cause of unemployment or government spending.

Watch the video below if you believe it is possible to balance the budget. Do you agree with the video maker’s view of the problem?

Whether you agree with the video or not, let me ask you to consider further:

Do you believe that there is a way to balance the budget with any of the following assumptions?

- The U.S. government budget works the same as business or Joe Sixpack;

- There is a method to tax your way to balancing a budget without killing the economy;

- The current entitlements can be altered enough without significant reduction in benefits.

It is my belief that if you sign up for any one of the above premises you are not living in the world of reality.

There is a saying in construction that “when there is no solution possible, then one of the impossible solutions will result“. How the USA got to this point can be blamed on every voter and politician in the last 50 years for not monitoring the economic situation and not making changes to avoid the growing deficit cliff.

A this point, decisions must be made based on where the U.S. is, not where we think the U.S. should have been or where the U.S. should be now.

Many politicians and economists spout about jobs creation – and use infrastructure as the solution. Yes, USA infrastructure needs upgrading – and yes, there are a lot of unemployed. But in this case, killing two birds with one stone is very inefficient.

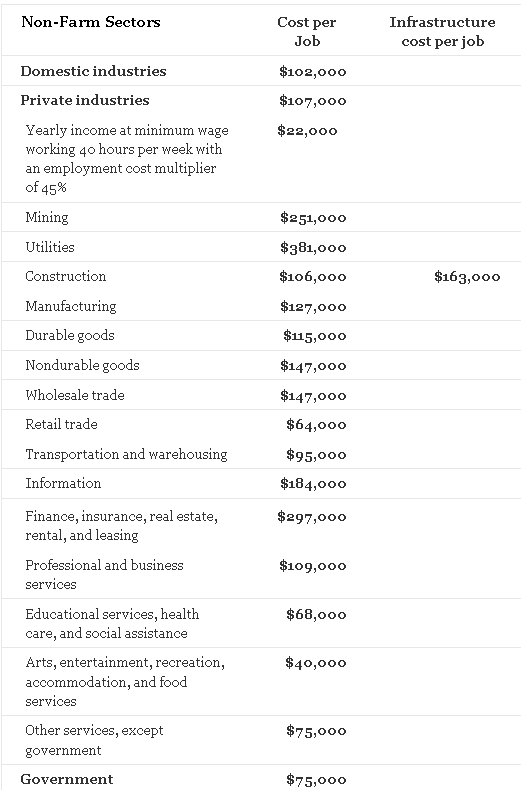

Source: BLS, BEA NIPA table 6.1D (all numbers rounded to nearest thousand)

The bottom line here is that if one wants to create work (but also do the things that need to be done), you get over 2.5 times more bang for your buck by employing health or education assistants. There are very negative social effects from endemic unemployment. Yet, could a government program (stimulus or direct programs) be a solution?

- where is the money?

- would the program remove potential jobs growth from the private sector?

- as there are no significant job growth dynamics in play, how is this not a permanent program?

All I am hearing are economic short term band-aids, laced with false solutions. I will leave the gauntlet on the field. What are the real solutions?

Other Economic News this Week:

The Econintersect economic forecast for August 2012 continues to show moderate growth. Overall, trend lines seem to be stable even with the fireworks in Europe, and emotionally cannot help thinking this is the calm before the storm. There are no recession flags showing in any of the indicators Econintersect follows which have been shown to be economically intuitive. There is no whiff of recession in the hard data – even though certain surveys are at recession levels.

ECRI stated in September 2011 a recession was coming, and now says a recession is already underway. The size and depth is unknown. A positive result is this pronouncement has caused much debate in economic cyberspace.

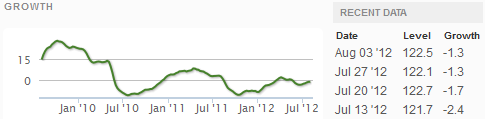

The ECRI WLI growth index value remains in negative territory – but this week is unchanged. The index is indicating the economy six month from today will be slightly worse than it is today. As shown on the graph below, this is not the first time since the end of the Great Recession that the WLI has been in negative territory, however the improvement from the troughs has been growing less good.

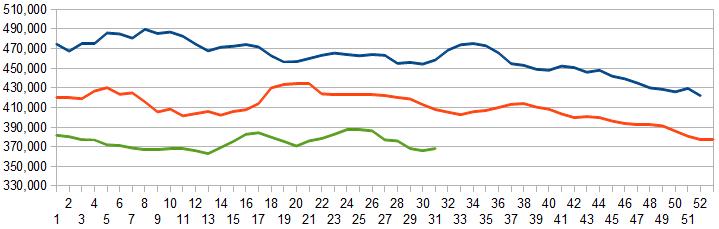

Initial unemployment claims declined from 365,000 (reported last week) to 361,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – declined from 365,500 (reported last week) to 368,250. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2010 (blue line), 2011 (red line), 2012 (green line)

Data released this week which contained economically intuitive components(forward looking) were

- Rail movements (where the economic intuitive components continue to be indicating a moderately expanding economy.

- Trade Balance which shows intuitive imports down – but the decline is entirely due to a dramatic month-over-month and year-over year decline in oil imports. Overall this data looks good.

All other data released this week does not have enough historical correlation to the economy to be considered intuitive, or is simply a coincident indicator to the economy.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks

Bankruptcies this Week: Genta, Omega Navigation Enterprises, Legends Gaming, K-V Pharmaceutical, Tri-Valley Oil, AcuNetx (dba Intellinetx, Eyedynamics, Visiontex and Orthonetx), Conversion Services, Passionate Pet, Capitol Bancorp and Financial Commerce

The Video: