Gold has jumped at $1,974.40 today amid expectations of new stimulus, worries about the pace of economic recovery, and concerns about rising tensions between the U.S. and China.

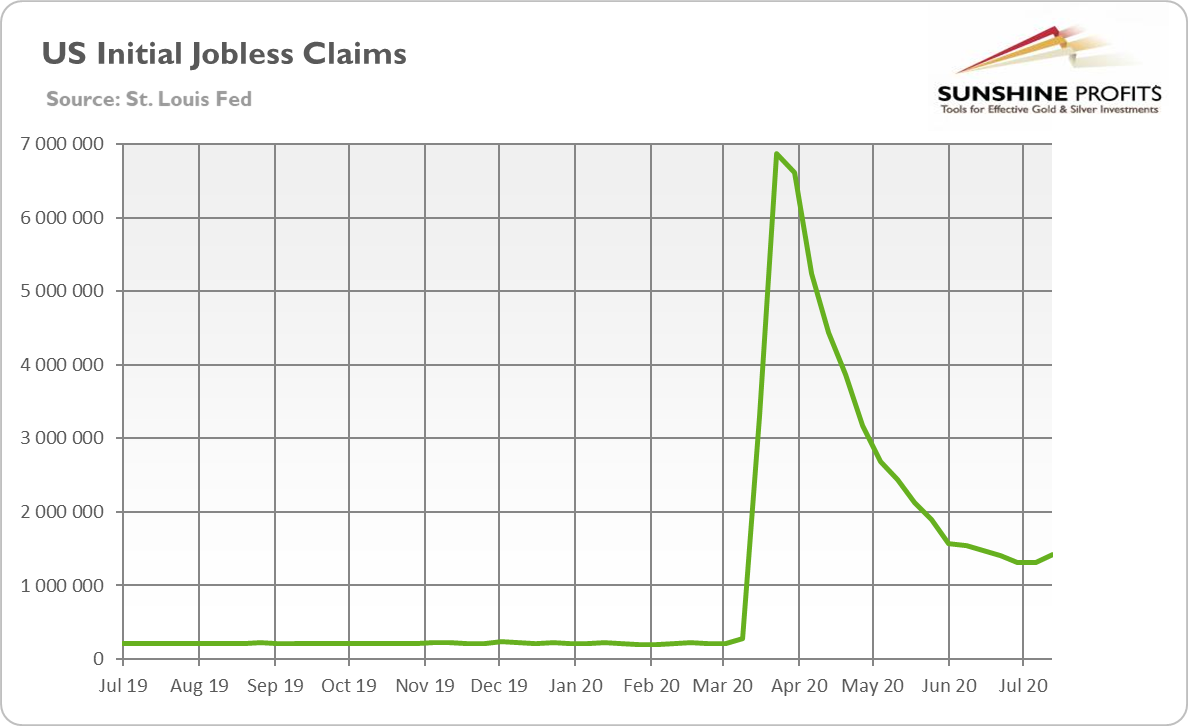

Houston, we have a problem! Please take a look at the chart below that presents the U.S. initial jobless claims. What do you see?

The number of people claiming unemployment benefits has recently risen. To be precise, in the week between July 11 and July 18, initial jobless claims increased from 13.1 million to 14.2 million. Instead of falling, they went up!

Surely, we should never read too much into a single report. However, the increase in the number of applications for unemployment benefits is not something we should expect during firm, V-shaped recovery. The decline in initial jobless claims was already very sluggish, and the recent reversal in trend will only add to worries that the second wave of coronavirus is slowing down the economy. In other words, the recovery could be more fragile and less vigorous than many people hoped for. As I write in the August edition of the Gold Market Overview, "forget about the V-shaped rebound - the economic recovery could look more like W or like the Nike's swoosh." Indeed, the spread of the COVID-19 makes the V-shaped cycle less likely, while the double-dip recession is more probable. Increased worries about the pace of recovery are positive for gold prices. The yellow metal should then gain not only as a safe haven but also thanks to the expectations that sluggish rebound would force the Fed and Treasury to another round of monetary and fiscal stimulus.

Increased Tensions Between U.S. And China Also Support Gold

Geopolitical concerns are another factor that supports gold prices right now. The already heightened tensions between the United States and China have recently escalated to a new level recently. Both superpowers are at odds on almost every front, from still unresolved trade wars to Taiwan, the COVID-19 pandemic, China's human rights abuses in Hong Kong and Xinjiang, and South China Sea. The latter issue has become a flashpoint amid an increasing number of naval drills and encounters. On July 13, the U.S. Secretary of State Mike Pompeo signaled a tougher stance, rejecting in a statement most of China's claims to the South China Sea. He said:

We are making clear: Beijing's claims to offshore resources across most of the South China Sea are completely unlawful, as is its campaign of bullying to control them (...) The world will not allow Beijing to treat the South China Sea as its maritime empire."

And, last week, the U.S. ordered China to close its consulate in Houston, Texas, following accusations of spying. It was called by the Chinese Foreign Ministry an "unprecedented escalation" in recent actions taken by Washington. According to some analysts, the risk of an unplanned confrontation is growing as relations worsen very quickly, which could push both countries closer towards war. Such fears increase the safe-haven demand for gold.

Implications for Gold

What does it all mean for the gold market? Well, both the increase in the initial jobless claims (against the markets' expectations) and the rising tensions between China and the U.S. are positive for the yellow metal. They fueled the recent surge of momentum that pushed gold prices all the way up to $1,974.40 already today.

Last week I wrote that low real interest rates, ample liquidity from the Fed and expected new round of fiscal stimulus are driving gold prices further north. The concerns about the spread of the coronavirus and the pace of the economic recovery, as well as worries about the U.S.-China relations, can only add to the gold's rally.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.