Ecolab Inc. (NYSE:ECL) has recently acquired New York-based Cascade Water Services Inc. The company will be integrated in Ecolab’s Water Business, which is a part of its Global Industrial segment. Further, terms of the deal have been kept under wraps.

Ecolab’s Global Industrial segment primarily provides water treatment and process applications. In third-quarter 2017, revenues from this segment grew 3.8% on a year-over-year basis, to almost $1.25 billion.

Cascade Water is a privately-held company that provides water treatment and services to the U.S. institutional market, primarily in New York and Florida. In 2017, the company reported revenues of approximately $35 million. Post completion of the deal, Ecolab will leverage Cascade’s highly exclusive water-treatment technologies.

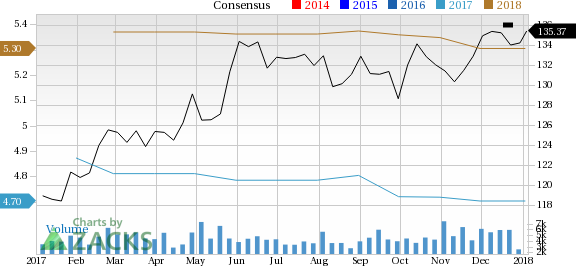

Ecolab Inc. Price and Consensus

Lucrative Prospects in the Niche Space

Considering the increasing trends of detrimental water-related diseases like Legionnaires’ disease into consideration, we believe that the latest buyout will provide Ecolab with significant opportunities to fortify footprint in the water treatment services space.

Per a research by Markets and Markets, North America-based water treatment services are expected to grow significantly in the next five years. Precisely, the water treatment market across regions like North America, Europe, Asia-Pacific, Middle East and Africa is projected to grow above $8 billion by 2019 at a CAGR of around 5%.

Ecolab’s Solid Acquisition Portfolio

In Dec 2017, Ecolab announced the acquisition of three U.S. pest services companies which provide specialized capabilities in food storage. The transactions were worth $36 million. The acquisitions boosted the company’s offerings in the food and beverages market.

In Sep 2017, the company signed an agreement to acquire the paper chemicals business of Georgia Pacific.

Earlier, Ecolab, Trucost and Microsoft (NASDAQ:MSFT) initiated a strategic collaboration to introduce Water Risk Monetizer, the industry’s first publicly available financial modeling tool that allows businesses to understand the impact of water risks.

Considering Ecolab’s strong commitment towards health factors, it may be concluded that the current acquisition too will help Ecolab gain market traction.

Shares Shine Bright

Over the last year, Ecolab has been performing above the industry. The stock has rallied an impressive 13.9% compared with the industry’s gain of 8.9%.

Zacks Ranks & Key Picks

Ecolab Inc. currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader chemical-specialty space are DAQO New Energy Corp. (NYSE:DQ) and Ferroglobe PLC (NASDAQ:GSM) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank Stocks Here.

DAQO’s projected long-term growth rate is 7%. The stock has rallied a whopping 109.9% compared with the industry’s gain of 2.1%, in the last 3 months.

Ferroglobe’s expected growth rate for the first quarter of 2018 is an impressive 750%. The stock has rallied 23.1%, outperforming the industry over the last 3 months.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Ecolab Inc. (ECL): Free Stock Analysis Report

Ferroglobe PLC (GSM): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research