Eckoh reported a strong H114 and has seen continued contract momentum since period end, with particular success from its channel partner strategy. The integration of the newly acquired Veritape is progressing as expected, with a strong level of new/follow-on business and promising signs of cross-selling potential. As we recently upgraded our estimates to reflect the 10-year contract win, we leave our revenue and earnings forecasts substantially unchanged.

H114 results: Strong for Eckoh and Veritape

Eckoh reported 24% H114 revenue growth y-o-y, with strong underlying revenue growth of 12% augmented by the inclusion of Veritape since June. EBITDA margins grew 73bp y-o-y, helped by the higher-margin Veritape business. The underlying Eckoh business saw a 100% contract renewal rate and benefited from the ramp-up of contracts signed in earlier periods. The Veritape business continued to trade well and sold its first contract into Eckoh’s customer base; there is also potential to sell Veritape products via Eckoh’s channel partners. Even after paying for Veritape and paying a dividend, the company ended H114 with net cash of £4.3m.

Outlook and changes to forecasts

Eckoh is typically an H2-weighted business, and this trend will be more pronounced with a full six months of Veritape business to be reported in H214. With a strong sales pipeline, the company expects growth experienced in recent periods to continue and highlights that it could even accelerate. The company also continues to look for strategic options to accelerate growth further. As we recently upgraded our estimates to reflect the 10-year contract with a telecoms operator, we leave our revenue and earnings forecasts substantially unchanged.

Valuation: Upgrades to drive upside

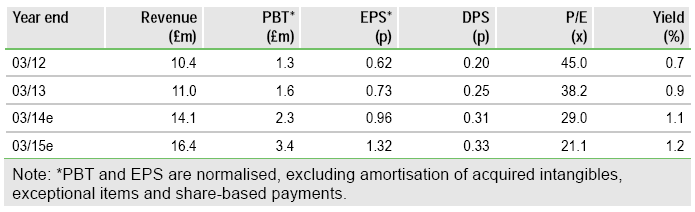

The stock trades above its peers on a P/E basis, although on an ex-cash basis (24.5x FY14e and 16.6x FY15e) it trades in line despite strong growth prospects and cash generation. We expect the recent contract wins and future potential wins from Eckoh’s sales partnerships to drive strong growth, providing scope for further earnings upgrades. Eckoh has a progressive dividend policy, with a dividend yield of c 1% in FY14/FY15. We forecast net cash to increase to £6.3m by end FY14 and £8.4m by end FY15, providing ample funds for future acquisitions.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Eckoh Interim Results

Expanding the offering

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.