Key Points:

- ECB Nowotny suggests rate hikes on the way for the Eurozone.

- Central Bank may increase deposit rates but leave prime unchanged.

- QE program likely to continue regardless of policy tightening.

The last 24 hours has been an interesting watershed moment in monetary policy as the U.S. Federal Reserve raised the FFR 25bps and purportedly is now embarking on a cycle of tightening. In addition, the Bank of England, although holding rates steady at 0.25%, also heralded a significantly more hawkish than expected view. However, it was a surprising statement from the European Central Bank that caught the market by surprise as the ECB’s Nowotny suggested that rate hikes could be on the way for the Eurozone.

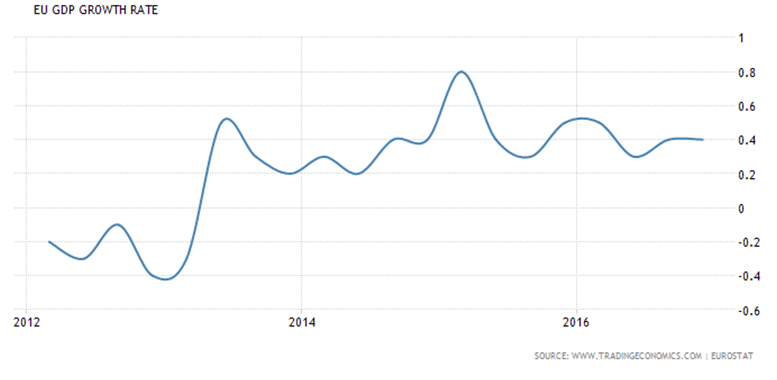

Subsequently, it would appear that after years of an extraordinary stimulus package that the Eurozone may be resuming a period of building inflation pressures. Certainly the latest round of CPI data seems to concur with the overall view that strong inflation is on the way with January and February posting 1.8%, and 2.0% gains respectively. However, GDP growth is still languishing behind the curve, with last quarter’s anaemic 0.4% print, and will have to increase significantly to see the sort of gains that could support genuine inflationary pressures.

In addition, the EU’s quantitative easing (QE) program is still ongoing and this is likely distorting much of the CPI data as the central bank continues to pump large amounts of money into the economy via bond markets. Subsequently, it would make little intuitive sense to raise rates whilst at the same time the ECB continues stimulating the economy.

The reality is that what most concerns the ECB currently is the malaise within the Eurozone’s banking sector and potential risk that is ever present. Currently, most continental bank’s margins are being squeezed by the central bank's negative interest rate policy. The deposit rate presently sits at -0.40% and this is a cost that is typically unable to be passed on to consumers and is therefore absorbed. Subsequently, any move by the ECB to raise rates could help alleviate that profit gap for the big banks and allow them to recapitalise over a period of time, without the need for bailouts.

However, this sort of monetary policy mix of QE and rate hikes is not without its risks as expectations play a critical role in the central bank’s ability to shape forward expectations. In fact, any move to undertake a rate hike by stealth could back fire dramatically if the ECB gets the tone of their message wrong and business and consumer confidence takes a dive. Any such misfire of the policy mix could see things turn relatively toxic for the ECB and damage their ability to shape forward guidance in the future.