- SNB coordinating damage control

- Draghi cannot afford to waiver

- Will the ECB “do whatever it takes”?

- China’s Q4 growth a little suspect

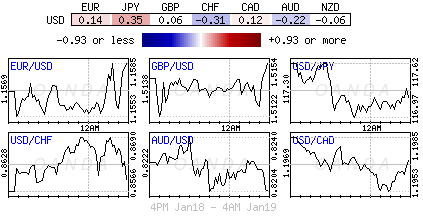

Rate divergence is a major trading theme for 2015. Yet, no one expected the imminent impact of varying rate policies so early in the new calendar year. For so long, the market has been focusing on a Fed or BoE hike (which are being pushed further out the curve), with the possibility of an ECB QE policy or two being thrown into the mix. Now investors have to broaden their horizons to include Tier II CB bank policy, to innovative and proactive measure undertaken by the SNB, and the impact that the Swiss action s may have on other National Central Banks in the euro-region. Currently, Scandinavian banks are joining the Danish government in trying to persuade offshore investors that the Nordic countries are not about to copy the Swiss and drop its euro peg – the diverging rate story line has just got far more reaching.

Markets await ECB decision on QE

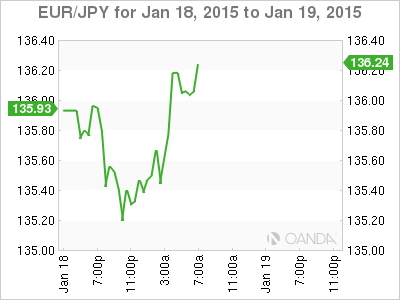

The next five trading sessions are dominated by Central Banks, as various governors, presidents and policy makers remain “front and center” throughout the week. While the Banks of Japan and Canada take the lead in the first-half, investors will be focusing intently on Draghi and the European Central Bank this Thursday January 22, where the possible introduction of a sovereign debt-buying program tops their agenda.

Although the consensus is for ECB interest rates to remain unchanged, the market has been pricing for expectations that the bank will extend its program of asset purchases to include sovereign as well as corporate bonds. Well let’s hope so, especially after the SNB’s independent and market costly actions that did away with the CHF currency cap last week. It was a non-transparent policy move, whose costly repercussions will be felt for many weeks and months to come. The surprise Swiss decision indicates that investors cannot afford to be complacent with rate decision and policy-making any more.

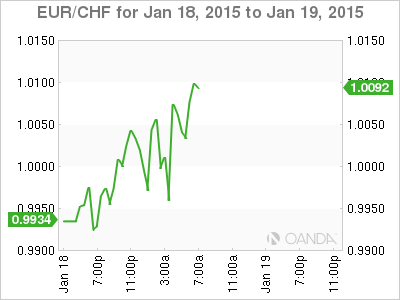

SNB’s damage control ongoing

Investors were side swiped not once, but twice last Thursday when a number of Central Bank’s altered their policies. The Reserve Bank of India (RBI) eased monetary policy by -25bps to +7.75% just two-weeks before its regularly scheduled meeting and has set off expectations of more cuts to come. At the same time, the SNB removed the three-and-a half-year old currency cap of €1.2000. President Jordan’s actions (an about turn from all public rhetoric) shocked markets and had a massive global impact. Swiss officials have been in damage control ever since, and expect markets to stabilize, adding the cap on the franc was no longer justified as Swiss economy was improving. Jordan also said the “exchange-rate situation will remain under consideration in future decisions, and the minimum rate risked loss of monetary conditions through inflated balance sheet.” Can anyone safely decipher this cryptic message?

The SNB undertaking was an historic outcome and move, which both dealers and investors will be tallying the costs for weeks to come. The lack of transparency by the SNB’s decision has unnerved investors and possibly changed the CB rules for the lesser know National Central Banks. The SNB has lost much street credibility and their actions still raise the possibility of future unanticipated moves by other central banks.

Draghi to follow through on “whatever it takes”

The European Central Bank faces a crucial test of its resolve to do “whatever it takes” to preserve the EUR when it decides this week on buying government bonds to combat deflation and revive the economy. Lat week the European court of justice over came the final legal hurdle to smooth the way for quantitative easing (QE), but opposition from Germany’s Bundesbank, German politicians and public may yet derail the ECB’s best of intentions. At issue, is how the program is designed and whether it is seen as credible and sufficient?

The QE announcement is expected following Thursday’s meeting, supported by German policy members (optics) as well as dovish ECB members. This market requires at the very least a perception of “consensus.” Compromises will be made behind closed doors – results the markets will never be privy to.

The announcement is not expected be an open ended QE, but at least €500b. Do not be surprised to see Draghi use the post meeting press conference to talk about the size and whether it’s fixed – a good politician will talk up an open-ended solution. There is a possibility that the ECB might go for a mix with the programme containing corporate and government bonds – on Thursday we will know.

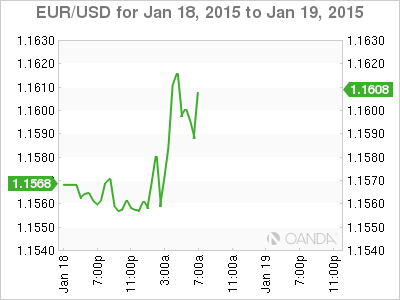

How will the market react? There is little consensus on how investors and dealers are going to react. No matter what, everyone should be expecting plenty of market volatility, with the risk that the market having “brought the rumor will now want to sell the fact.” Follow bund yields – they may experience a major correction just like the Fed and BoE announcements did to their sovereign debts. If at current levels, the single unit (€1.1598) looks oversold outright- a crowded and tired trade. Nevertheless, there is the risk that “downside” could still support the pace for further EUR weakness, down to the revised technical levels just ahead or €1.1000.

Investors will not be able to rest on their laurels for long. A Greek election in six-days is threatening to hand a share of power to a party wanting to renegotiate the “austerity measures” on which the nation’s bailout is based. The political voting outcome will have a direct impact on other peripheral Euro countries like in Portugal and Spain, potentially reviving the talk of a euro exit.

Will China come in from the cold?

Europe is not just in the cross hairs. Asia will be required to brace for more volatility this week as the world’s second largest economy, China, releases a string of monthly indicators, alongside keenly anticipated central bank policy decisions in Japan. China is due to release a plethora of data tomorrow, including retail sales, fixed asset investment and industrial output for the month of December, but the focus will fall on the Q4 GDP. Analysts expect Chinese Q4 economic growth to have slowed to +7.2%, y/y (+7.3%), which would be the slowest reading since Q1 five years ago. On Wednesday it’s the BoJ turn to face the music. No disrespect to Governor Kuroda, but most of the market will be focusing their energies on Draghi and his press conference.