Last night, the European Central Bank tightened the screws on Greece by cancelling the facility that allowed Greek banks to post Greek government debt as collateral on loans. This sounds a lot scarier than it looks however and is by no means the European Central Bank choking off funding for Greece and throwing it to the wolves.

The European Central Bank has kept open another funding avenue for Greek banks in what is called the Emergency Liquidity Assistance program that allows the Greek Central Bank to borrow funds from the ECB, albeit it a slightly higher rate, and then disburse to the banks as is needed. Hopefully this is understood as such in Greece and does not trigger a run on the banks.

Some estimates through January said the amount of money that was being transferred out of Greece was something like EUR700m a day. Banks cannot continue without funds of course and a run will heighten the urgency of both Tsipras and Varoufakis’s negotiations. Varoufakis meets with German Finance Minister Wolfgang Schäuble today; if the Greek Fin Min is looking for a hug and a pat on the back then he is sorely mistaken.

Hopefully a run does not occur but one could easily lead to capital controls on Greek money– similar to what happened in Cyprus – to ensure that capital flight diminishes. As we noted when controls were imposed on Cypriot account holders back in 2012, this creates a two-tier Europe that is inconsistent with a currency union, marking Greek banks, account holders and their euros as second class citizens.

Euro is unsurprisingly a little lower this morning on the announcement but this is not a body blow to the Greek negotiations. This is the mark of a central bank stepping out of the political limelight for now but also letting Greece know that its debt is not worthy as collateral without the Greek state being in an austerity program with the wider EU.

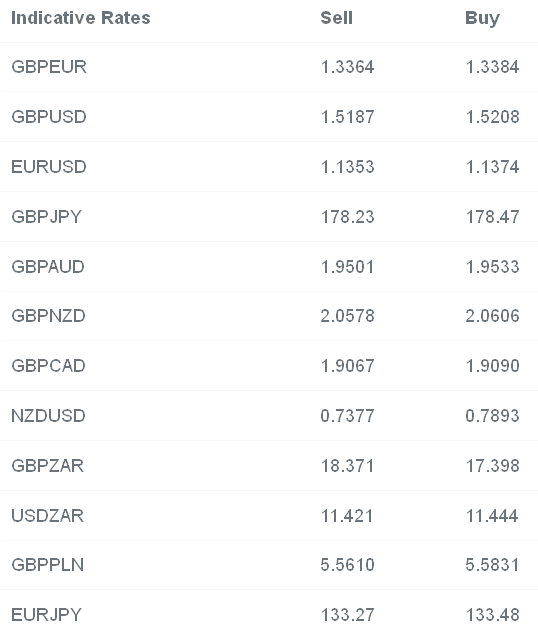

GBP/EUR has recovered as well following a strong services PMI announcement yesterday. The negativity of December’s bigger than expected PMI has swiftly been forgotten about with service sector companies bouncing back in the first month of 2015. January was the 25th month of growth for the UK service sector and comes alongside strong indications that future strength is also being predicted. Jobs are being increased to clear backlogs now but also to take on new orders in the longer term. If the reported upturn in wages is continued then the UK economy could easily be on to a winning start to the year. In the short term, input prices continue to fall, suggesting that further pressure on inflation is likely in the coming months.

Today’s Bank of England meeting will once again be a damp squib with next week’s Inflation Report the more important announcement. In March it will be six years that rates in the UK have been 0.5% and swaps markets are now showing an almost equal chance of a rate cut to a rate hike by the end of 2015; the Bank is caught with a new communications problem.

In the short term, the focus is very much on whether we will see inflation fall below 0% in the coming months – it will likely do so in Feb/March. The longer term issues surround the expectation of when CPI will start returning towards its 2% target. Within that will lie interest rate increase expectations but with everyone staying loose Carney does not strike me as the guy to lead the charge over the top.

Today also sees speeches from ECB Members Weidmann and Praet at 09.45 and 11.30 respectively before the latest round of jobless claims numbers at 13.30.