EUR/USD" title="EUR/USD" height="242" width="474">

EUR/USD" title="EUR/USD" height="242" width="474">

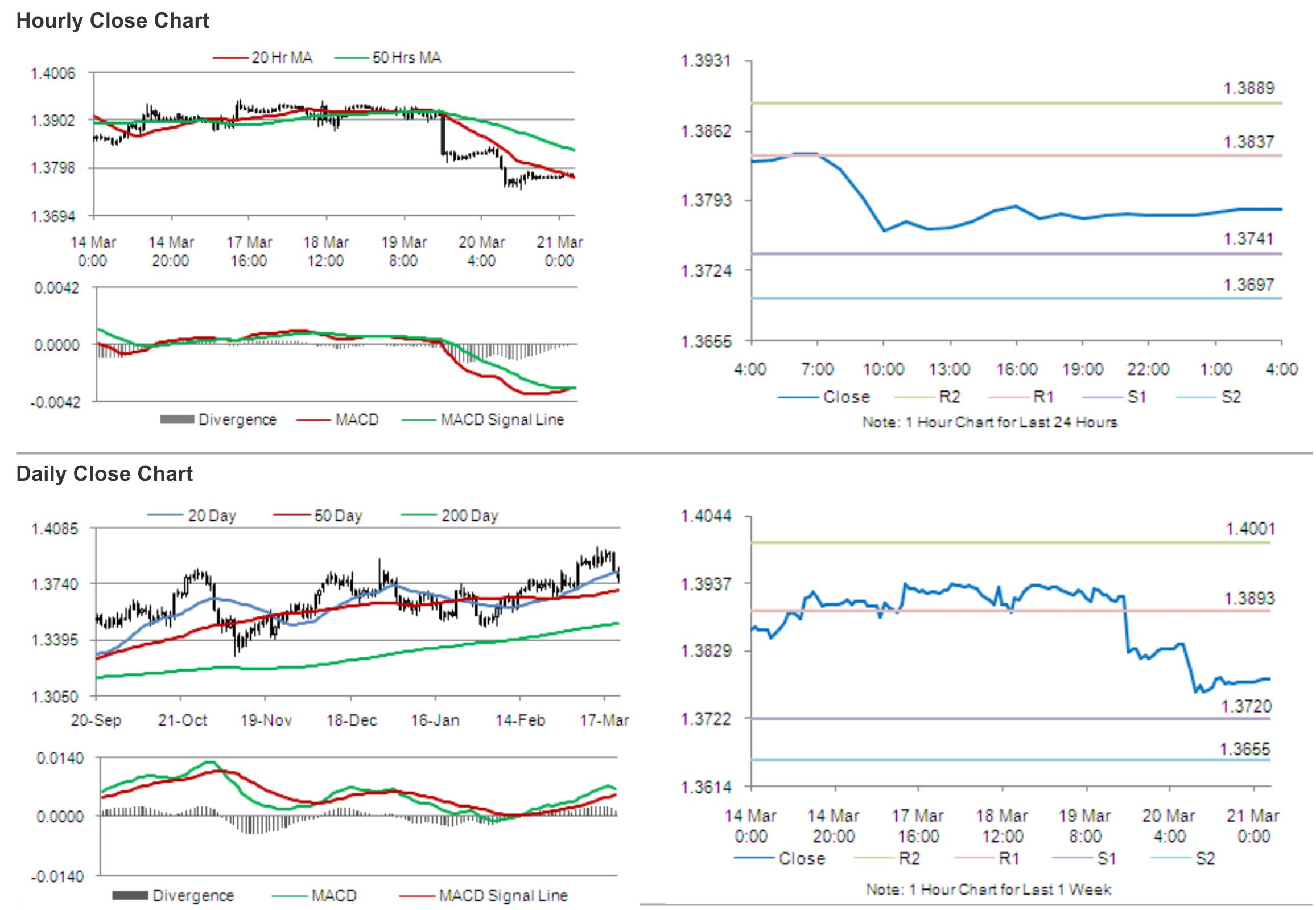

For the 24 hours to 23:00 GMT, EUR declined 0.28% against the USD and closed at 1.3779.

The US Dollar continued to benefit from the Fed Chief, Janet Yellen’s Wednesday’s forecast for an earlier-than-expected hike in the nation’s key interest rate by the mid of 2015, while further tapering its monetary stimulus. Meanwhile, yesterday’s upbeat jobless claims data also supported the demand for the greenback. Data showed that initial jobless claims in the US increased to 320,000 for the week ended 14 March, but less than analysts’ expectations for a rise to 322,000 and compared to 315,000 jobless claims registered in the previous week. Positive sentiment for the greenback also fuelled after the US leading indicators rose more-than-forecast 0.5% in February and after the Philadelphia Fed’s manufacturing index rebounded to a reading of 9.0 in March from a negative 6.3 reading in February. However, another report showed that existing home sales in the US fell to their lowest level since July 2012.

Separately, the Fed, in its annual test report of big banks’ financial health, revealed that 29 out of the 30 major banks in the nation met the minimum hurdle to withstand a severe economic downturn.

In the Euro-zone, an ECB Executive Board member, Sabine Lautenschlaeger, indicated that the central bank would start raising its interest rates only when the economic condition of the region improves to a proper level but until then the interest rates would remain at current low level or go even lower for an extended period.

In economic news, on a month-on-month basis, Germany’s producer price index came in at a flat reading in February, contradicting market estimates for a 0.1% rise and compared to a 0.1% fall registered in the preceding month.

In the Asian session, at GMT0400, the pair is trading at 1.3785, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.3741, and a fall through could take it to the next support level of 1.3697. The pair is expected to find its first resistance at 1.3837, and a rise through could take it to the next resistance level of 1.3889.

Traders are expected to keep a tab on the Euro-zone’s consumer confidence and current account balance data, slated for release later today. Meanwhile, the Dallas Fed President Richard Fisher’s would also gain prominence who would shed light on the Fed’s recent decision in its monthly monetary policy meeting.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.