Today's ECB meeting just seems to have a different feeling about it. It’s not just the normal expectations for the path of monetary policy from the central bank, but the complete lack of faith that markets have in the policy available to central banks now, let alone the equally complete lack of faith that markets have in the word of the ECB themselves.

While market consensus seems to be taking Mario Draghi at his word that there will be no more interest rate cuts (well at least taking his word that it wont be at this particular meeting), the way that he delivers his comments during the accompanying press conference is going to be key for price direction of the euro.

Remember back in March when Draghi and the ECB last met to decide interest rates? The decision should have actually been very negative euro, with cuts to interest rates and QE stimulus galore. But all their work on getting the euro lower was undone by just one line in Draghi’s press conference when he alerted markets that he didn’t expect to cut rates again.

Of course since then, the ECB have backpedaled on this line, but looking at the EUR/USD chart says that markets don’t care what they say now because they trust is gone. The damage has been, Draghi is the boy who cried wolf.

Before we get into some euro charts, I wanted to include this line from Pimco’s Andrew Bosomworth, head of their German portfolio management team:

“We’re clearly getting to the point where each additional dose of easing is not bringing much in term of economic outcome.”

Negative rates, currency wars, even helicopter money for god’s sake. HELICOPTER MONEY! If that’s not a central bank running past their limits, then I don’t know what is. Scary.

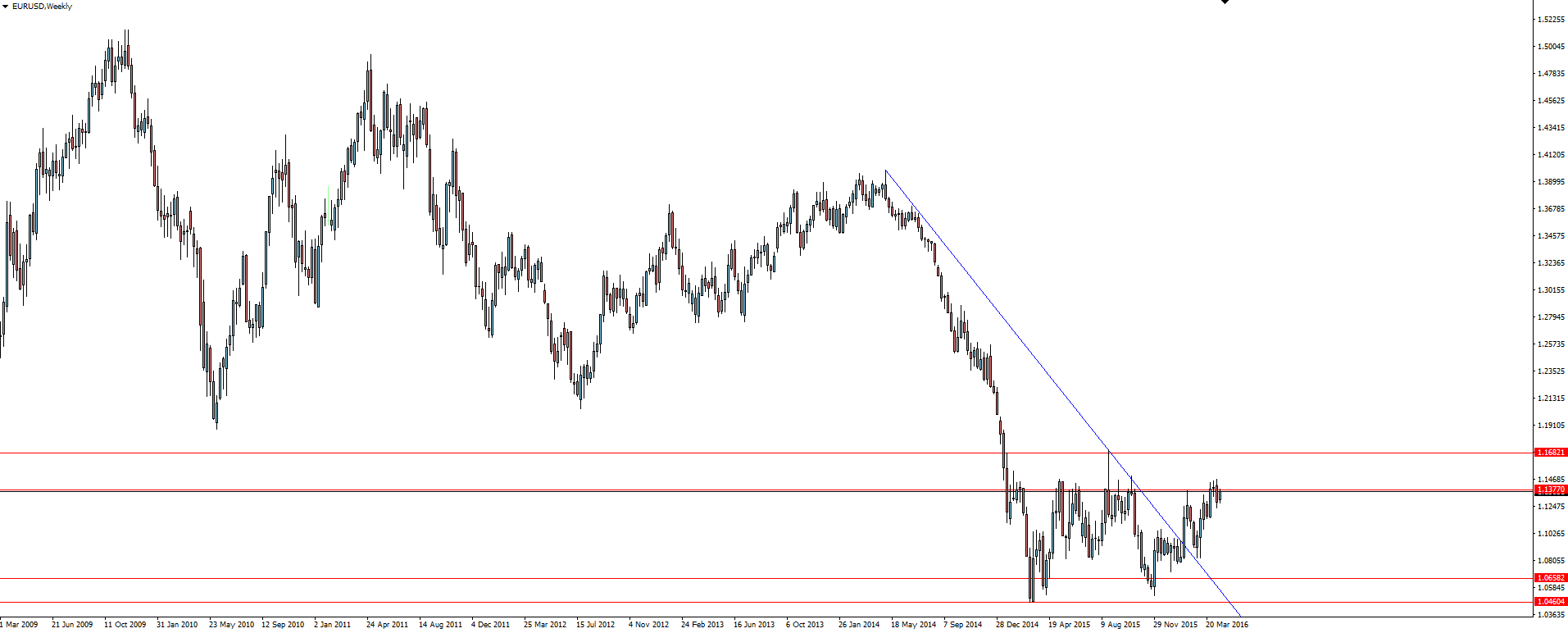

EUR/USD Weekly:

Heading into the ECB rate decision, the EUR/USD weekly chart sits just at the top of the zone that price has printed over the past year or so.

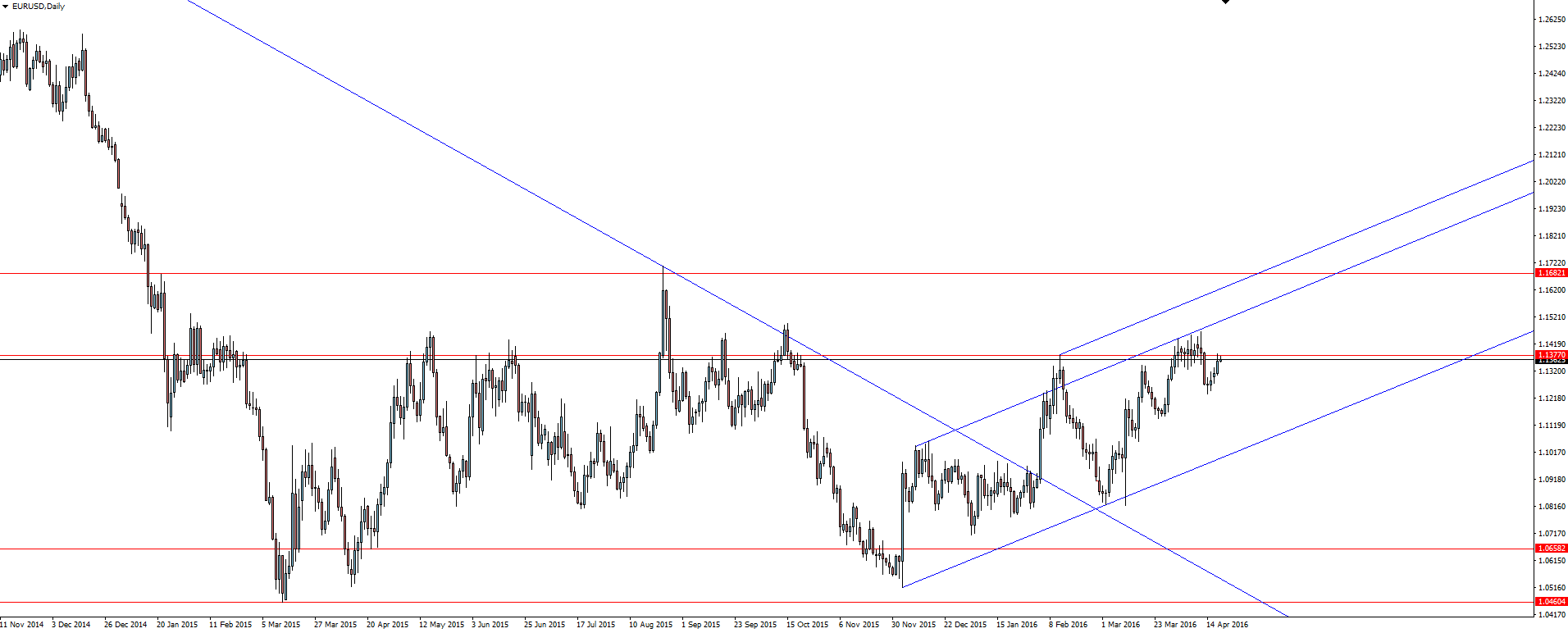

EUR/USD Daily:

Zooming into the daily chart and I really like the look of this short term bullish channel. With the previous channel touch just happening to coincide with the weekly horizontal line from the above chart, a pop up toward channel resistance looks like a huge possibility here again.

With expectations and trust at all time lows, any ‘boring’ or tow the line rhetoric by Draghi tonight could be the catalyst needed for a pop.

While finding trading opportunity around possibly mismatched market expectations is tough tonight, the meeting is sure to bring volatility which any good Forex trader can use to their advantage if they have their risk management levels drawn out beforehand.

Chart of the Day:

Something else worth noting is that Barack Obama is in London for talks with British Prime Minister David Cameron. With Obama expected to lend his support to staying in the EU, some headline driven chop could be in store for all things GBP.

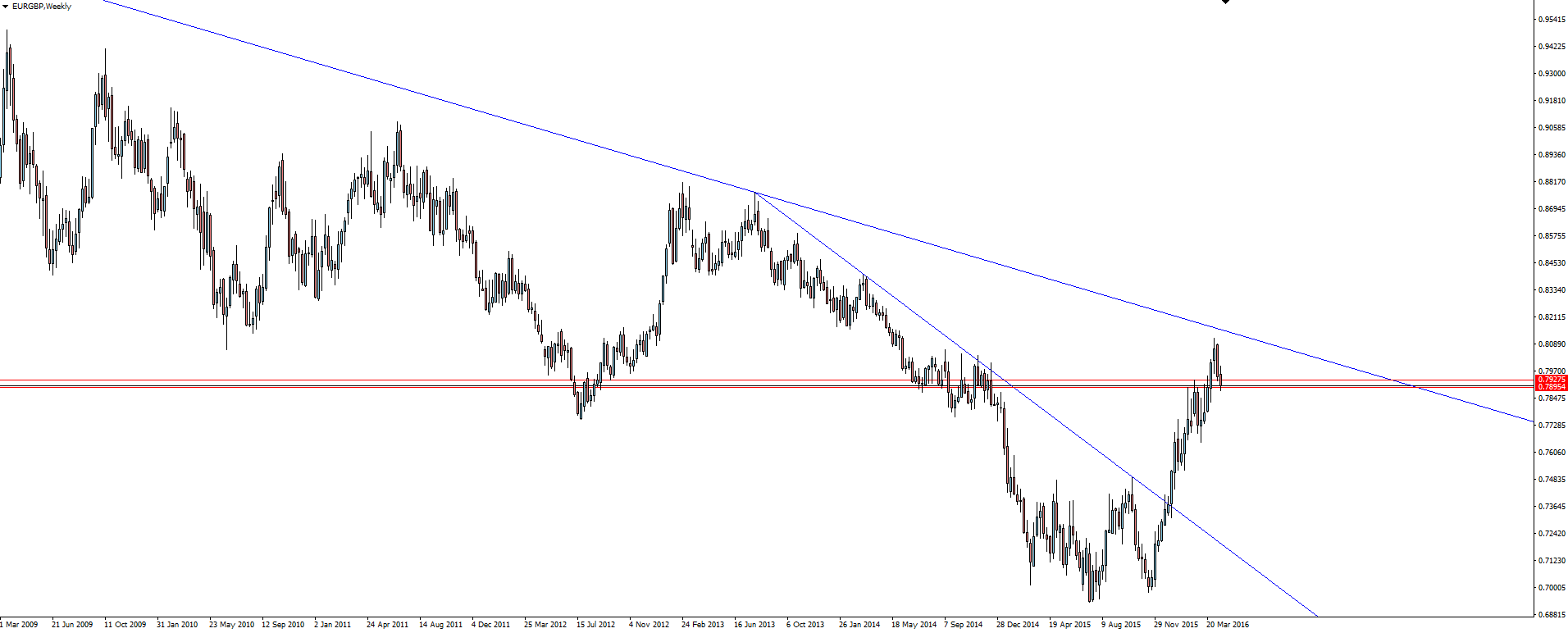

EUR/GBP Weekly:

Taking a look at EUR/GBP, I’ve highlighted a weekly level worth noting on your charts here. The zone could have been drawn bigger with the bottom line much lower to line up with those swing lows off the left, but I chose to keep it current and use those recent spikes where price stalled on the way up.

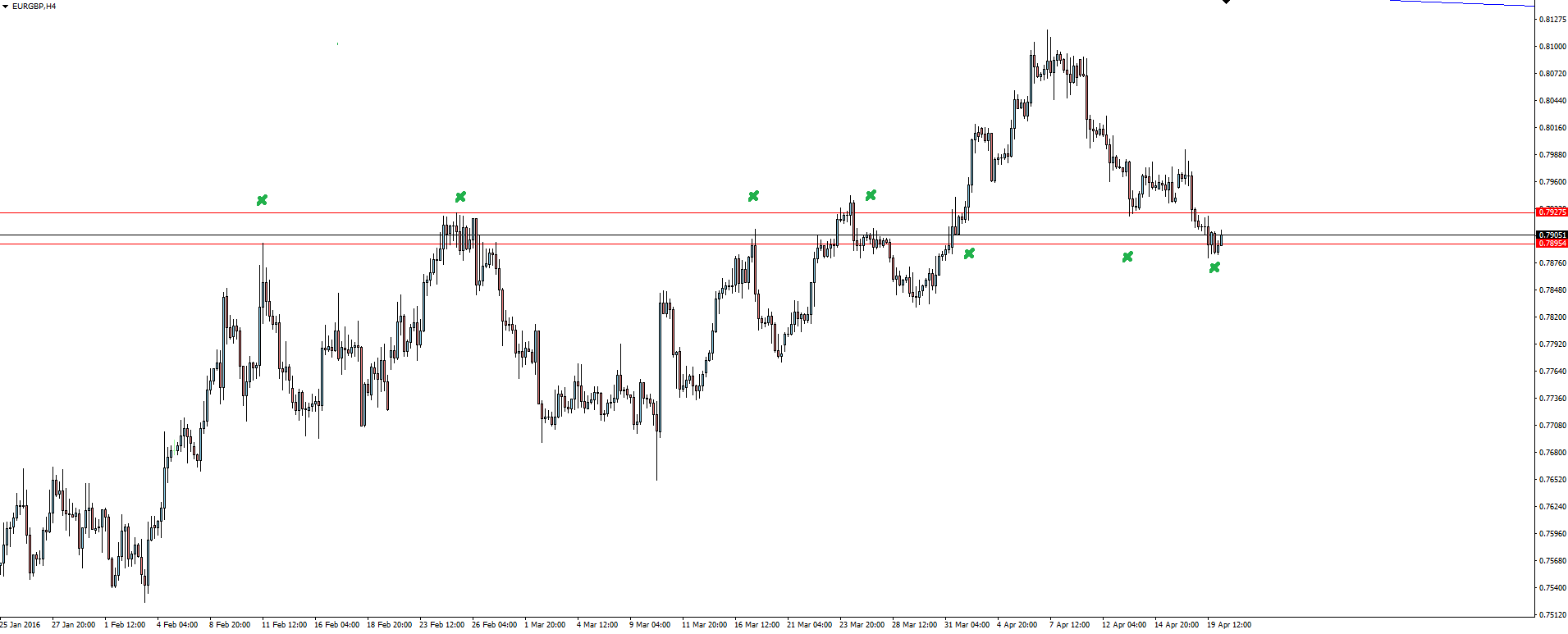

EUR/GBP 4 Hourly:

I say this because I’m not expecting anything clean on the 4 hourly chart, and as I write this I can already see that price action is hinting that this isn’t an exact level to blindly get long off.

Let price dip through it and see how it reacts. The level is there, now just let price do its thing.

On the forex calendar Thursday:

GBP Retail Sales m/m

EUR Minimum Bid Rate

EUR ECB Press Conference

USD Philly Fed Manufacturing Index

USD Unemployment Claims

GBP BOE Gov Carney Speaks

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex Broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, Forex Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.