If tomorrow is ‘Payrolls Friday’ then today is surely ‘Central Bank Thursday’; both the ECB and the Bank of England finish their latest meetings today although both are unlikely to change policy this month.

This Bank of England meeting is Mervyn King’s last as Governor, with July’s taking place under the new governorship of Mark Carney. King himself has been a steady voter for further QE over the past few months and we suspect that he and the other doves aboard the MPC will not sway from their course this month. They will, however, remain outvoted and we foresee no change in rates or asset purchases on Threadneedle St this lunchtime.

The reason why? The data.

Yesterday’s services PMI data from the UK was the highest since January 2012 and gave the UK three out of three on the recent run of PMI numbers, providing an important boost for the valuable services industry. Jobs numbers were higher, prices lower and sales higher in what we hope will act as a bedrock for a recovery in the services industry through the summer. Retailers seem to be suggesting that the recent improvement in the weather will also improve prospects.

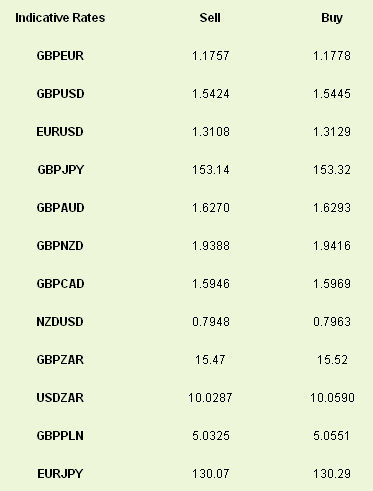

The combination of growth in manufacturing and services and increased activity in construction will give policymakers cause for confidence in the coming months. This should limit the Bank of England’s plans for further ‘monetary activism’ in the short-term. It now seems that, unless we see a very poor June, that the UK is likely to post two consecutive quarters of growth since Q2/Q3 of 2011. The surprise improvement was a rocket for GBP as it clattered through the 1.54 level in GBPUSD and towards 1.18 against the euro.

We also expect no change in policy from the ECB although the chatter around the meeting is a lot more interesting courtesy of a comment made by Mario Draghi at last month’s press conference. The ECB Chair mentioned at the May press conference that the ECB was ‘technically ready’ to cut the bank’s deposit rates into negative territory – charging banks to lodge cash with the central bank.

That being said I suspect, that while discussion of it may happen during the committee’s meeting, the likelihood of the vote going in favour is minute. Members Constancio, Asmusson, and Noyer have all gone on the record to express disapproval given their fears around bank funding and the damage that negative rates would cause.

Draghi will likely wheel the threat of further cuts out throughout the summer’s ECB meetings but I believe this is as low as rates go in the Eurozone. Given the focus on Friday’s payrolls number, I think that the euro will trade sideways through the decision and Draghi’s press conference.

Yesterday’s dollar movement was largely negative following a below par ADP jobs number. Only 135,000 jobs were added in May against a market expectation of 165,000. Add that miss to Monday’s manufacturing ISM reading below 50 and we see no chance of Fed tapering policy any time soon.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ECB To Shy Away From Negative Rates, USD Remains Offered

Published 06/06/2013, 07:14 AM

Updated 07/09/2023, 06:31 AM

ECB To Shy Away From Negative Rates, USD Remains Offered

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.