All eyes are on the ECB Council’s meeting next Thursday and the meeting of EU heads of state and government which begins on Thursday eve-ning. Given the escalation of the situation in fi-nancial markets and the significant slowdown of economic activity in the eurozone, the markets are – yet again – hoping that policymakers will come up with a comprehensive solution. At least there are signs that government heads and central bank are not coming empty-handed. In anticipa-tion of this, the euro has strengthened by 2 to 3 US cents to around 1.35; towards the end of the week, yields on Italian, Spanish and French bonds have fallen markedly, spreads versus Ger-man Bunds have narrowed; equity markets have posted significant gains too – the Dax, for exam-ple, has risen almost 12% during the course of the week.

The change of mood began last Wednesday when it was announced that the major central banks – ECB, Fed, BoJ, BoE and SNB – were taking co-ordinated action to provide liquidity in foreign currencies; at the same time, conditions under which banks obtain US dollars – the only swap agreement currently in use – were improved. The premium on the relevant US dollar overnight index swap (OIS) rate, used by the ECB for its weekly and 3-month foreign currency transac-tions, was reduced by 50 basis points to 50 basis points.

This measure in itself is not particularly signifi-cant. The ECB’s foreign currency lending is cur rently less than $2bn – peanuts compared to the extent of its euro refinancing operations. The main reason for the markets’ extremely positive reaction is the fact that the central banks are will-ing to provide foreign currency refinancing at all – and to a substantial extent if necessary. The step was interpreted as a signal that the central banks are now taking a more active role in com-bating the eurozone debt crisis. And last but not least, the swap agreement was seen as part of a more extensive package of ECB measures.

A batch of upbeat economic data from the US probably also helped to brighten the mood. The data, and the Fed’s latest Beige Book, show a sustained, albeit only moderate, recovery of eco-nomic activity. Consumer confidence improved, consumer spending – as reflected in current car sales figures – is increasing; the ISM index indi-cates relatively stable growth in the manufactur-ing sector, and employment is rising, particularly in the private sector. There was even a glimpse of hope in the housing market and the construction sector, as pending home sales increased signifi-cantly and construction spending was also up. Provided that the contagion from the European financial markets does not spread across the At-lantic in the coming months, the economic recov-ery is set to continue in the US.

Further ECB measures

How long the brighter mood in Europe will last remains to be seen. However, we are expecting the ECB to unveil further measures next week. Apart from an interest rate cut of up to 50 basis points, the “XXL refi operations” with maturities of two and more years could be decided. Addi-tionally, rules for collateral could be eased, as banks must be able to collateralise the increasing amount of refinancing from the ECB. It is also feasible that the ECB is planning to extend its purchases of sovereign bonds; if we are interpret-ing the ECB president’s statement to the EU par-liament correctly, such a step, if taken at all, would depend to some extent on the outcome of the EU summit.

EU government leaders are discussing ways and means of monitoring and improving budget dis-cipline. The problem is how to achieve effective and credible supervision of budget management without unduly curtailing national parliaments’ budget sovereignty. One plan apparently under consideration is to appoint a central institution with the right to veto and impose sanctions which would carry out a sort of preliminary assessment of budget plans. This could be either an inde-pendent (but then not democratically legitimised) or political authority (close to the EU Council).

Political implementation of such concepts for a fiscal union becomes increasingly difficult the more authority is to be transferred to the central institution. Changes to the EU Treaty take time and can easily fail due to the resistance of some national parliaments; but concepts which do not require treaty changes are presumably less sweeping and less credible.

However, in our view, the successful appoint-ment of a central institution to ensure budget discipline would not be enough to stabilise the financial markets in the long term and to stem the debt crisis. Market participants, particularly the banks, must be able to rely on the refinancing of the more problematic eurozone countries being safe for a reasonable length of time. In view of the extent of the crisis, this “guarantee” could only be given by the central bank. And the ECB is hesitant to do so – at least not before policy-makers have taken sufficient steps to ensure the long-term sustainability of public debt.

We are hoping that the meeting of EU heads of state and government and the ECB Council will provide a breakthrough. But after the experiences of the last two years and given the difficult coor-dination and clashes of interests within the euro-zone, we are not all that optimistic. The ECB measures – if announced as expected – could stabilise the markets for a while and support the euro, which has seemed a bit down for the count of late.

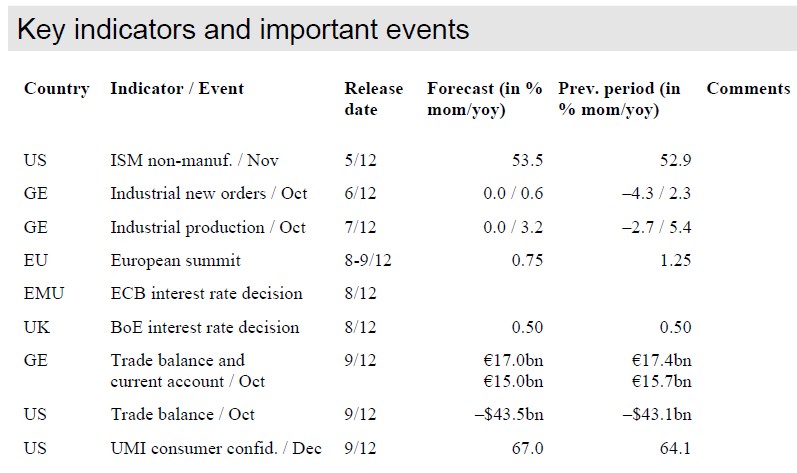

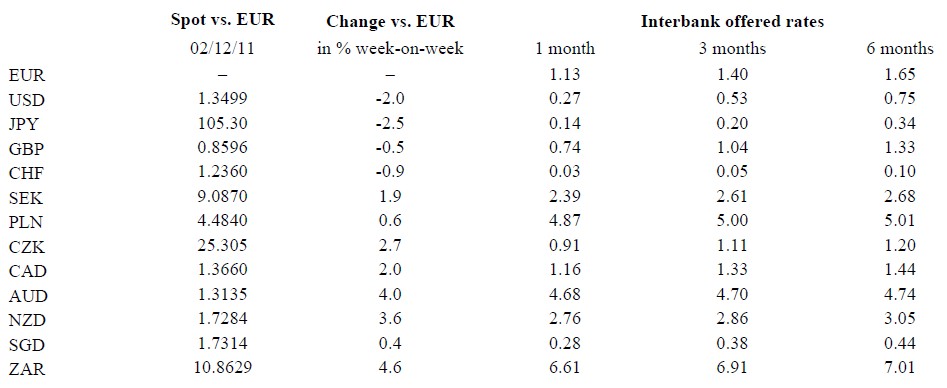

Money and foreign exchange market quotations

Disclaimer:

This report has been prepared by BHF-BANK Aktiengesellschaft on behalf of itself and its affiliated companies (together "BHF-BANK Group") solely for the information of its clients.

The information and opinions in this document are based on sources believed to be reliable and acting in good faith, but no repre-sentation or warranty, express or implied, is made by any member of the BHF-BANK Group as to their accuracy, completeness or correctness. Opinions and recommendations are given in good faith but without legal responsibility and are subject to change with-out notice. The information does not constitute advice or personal recommendation, for which the duty of suitability would be owed, but may facilitate your own investment decision. Moreover, you should seek your own advice as to the suitability of an investment matter mentioned herein. Investors are reminded that the price of securities and the income from them can go down as well as up and that the past performance of an investment or a market is not necessarily indicative for future results.

This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete, and this document is not, and should not be construed as, an offer to sell or solicitation of any offer to buy the securities mentioned in it.

BHF-BANK Group and its officers and employees may have a long or short position or engage in transactions in any of the securi-ties mentioned in this document, or in any related securities.

This publication must not be distributed in the United States.

This document is published by us in German and English only. Publications in other languages have not been authorised by us.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ECB Steps Up its Efforts

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.