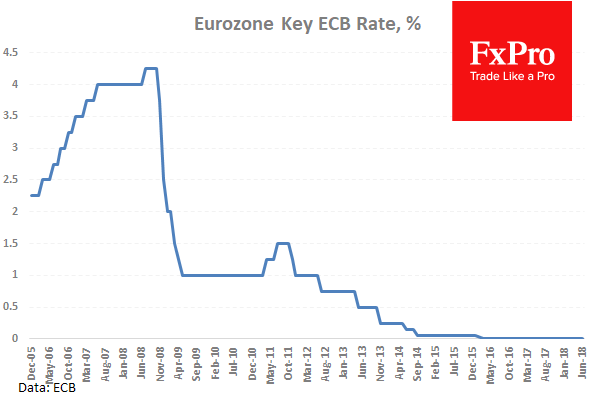

The ECB dominated markets yesterday as they shifted their policy stance and signaled their exit from QE. The Bank is looking to reduce its bond buying by 15Bln euro from September and terminate the program completely by December provided market conditions support the move. The Bank also wished to maintain rates at their current levels until Summer 2019 at which point, if the data and the market allows, rates can be adjusted. ECB President Draghi set a cautious tone in his press conference in order to temper the Hawkish stance the bank is adopting, saying that the ECB would keep their options open.

The Euro sank versus the USD moving from 1.18510 to a low overnight of 1.15547, just above the low of November 2017. EUR/GBP sold off from 0.88194 to 0.87187.

European stocks rallied hard with the German Dax moving from 12800.00 to levels close to 13200.00. The moves rippled across other markets with the USD boosted higher.

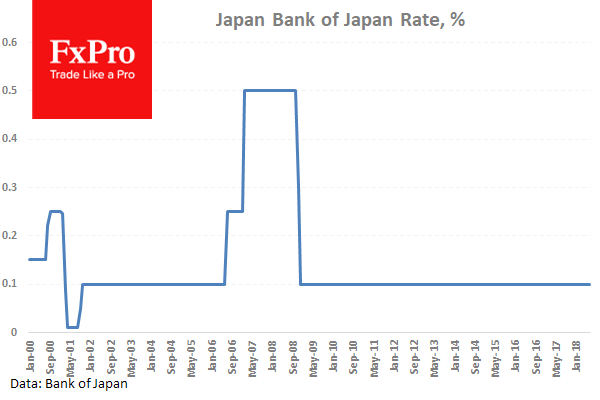

The BOJ has left rates on hold at -0.1% during their meeting today. The Bank also decided to keep monetary policy unchanged which was the expected outcome, but their consumer inflation assessment was downgraded. USD/JPY continued the uptrend following the ECB decisions, with a move from 110.492 up to 110.887.

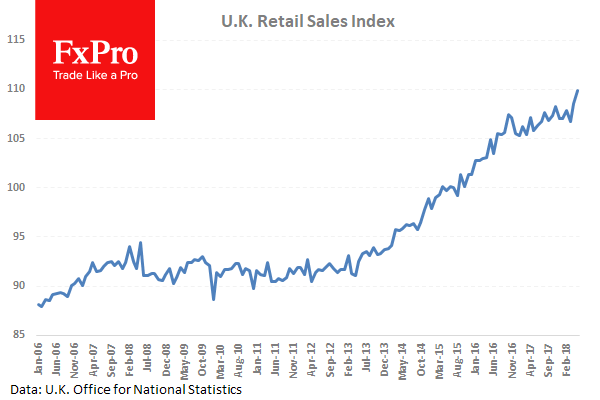

UK Retail Sales (May) were 1.3% (MoM) and 3.9% (YoY) against an expected 0.5% (MoM) and 2.4% (YoY) from 1.6% (MoM) and 1.4% (YoY) previously. Retail Sales ex-Fuel (May) were 1.3% (MoM) and 4.4% (YoY) against an expected 0.3% (MoM) and 2.5% (YoY) from 1.3% (MoM) and 1.5% (YoY) previously. Retail sales beat expectations in every category showing a strong consumer segment of the economy. This is a volatile data set but it does give a view on consumer spending. GBP/USD moved higher from 1.34037 to 1.34462 following this data release.

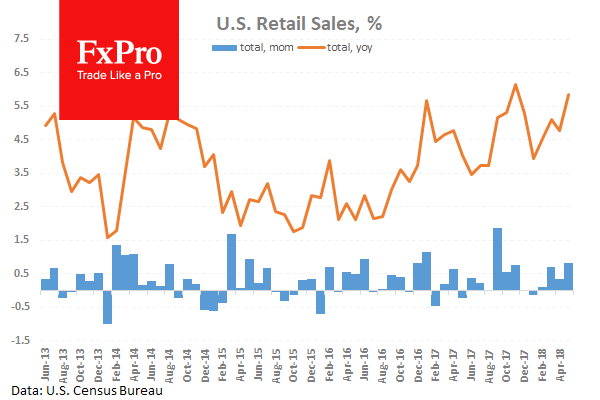

US Retail Sales (MoM) (May) were released coming in at 0.8% against an expected 0.4% from 0.4% previously which has been revised up from 0.3%. Retail Sales ex Autos (MoM) (May) were 0.9% against an expected 0.5% from 0.3% prior which was revised up to 0.4%. Retail Sales Control Group (May) was 0.5% against an expected 0.4% from 0.6% prior which has been revised up from 0.4%. Sales increased to beat expectations this month in all the data measures.

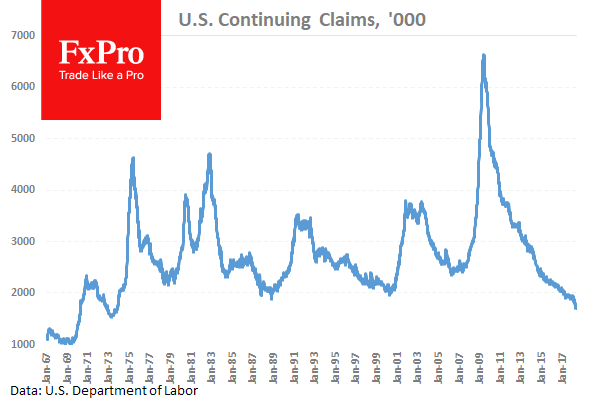

US Continuing Jobless Claims (June 1) were 1.697M against an expected 1.737M against 1.741M previously which was revised up to 1.746M. Initial Jobless Claims (June 8) were 218K against an expected 224K against 222K previously. This data is showing a small decline in the number of continuing claims and new claims. USDJPY moved higher from 110.111 to 110.380 after these data releases.

EUR/USD is down -0.03% overnight, trading around 1.15628.

USD/JPY is up 0.22% in the early session, trading at around 110.865

GBP/USD is down -0.13% this morning trading around 1.32411

Gold is down -0.14% in early morning trading at around $1,300.63

WTI is down -0.33% this morning, trading around $66.69

For more in-depth analysis and market forecasts visit our FxPro Blog