- The ECB cut the deposit rate by 10bp to -50bp, leaving the MRO and MLF unchanged, while also linking it to the inflation outlook.

Open-ended QE but no full commitment The long-awaited ECB meeting did not bring the full commitment from the ECB that the market was hoping for. Although policymakers surprised the market on the dovish side with the decision to complement a 10bp rate cut in the depo rate to -0.5% with an open-ended restart of the QE programme at a monthly pace of EUR20bn (starting in November), Draghi’s lack of clarity and commitment on questions about increases in the ISIN/issuer limits or the possibility of other non-standard monetary policy tools left some question marks about the commitment to do ‘whatever it takes’. After the press conference, some sources indicated German, Dutch, French, Austrian and Estonian opposition to restarting QE.

One note-worthy change in the ECB communication was a change in the rates forward guidance, which now only incorporates a state-based element to leave the ‘key ECB interest rates at present or lower levels until a robust convergence in the inflation outlook to a level sufficiently close to, but below, 2%’ is visible – also in terms of the underlying inflation dynamics.

A particular sense of urgency to act came from the fact that inflation expectations have started to ‘re-anchor at levels around 1-1.5%’, which is not consistent with the ECB’s aim. In light of the increased prominence of the inflation commitment, we also took note Draghi’s comment about a strategic review of the monetary framework, which will continue under the new ECB President Lagarde. It is difficult to say whether this review should be seen as dovish or hawkish by the market, but it will be very important to monitor going forward.

Furthermore, to complement the package, the ECB also introduced a tiered deposit rate system which at first glance seem to tighten the money market conditions. Euro area banks are now able to place six times its minimum reserve requirements, although the multiplier will be set without unduly influencing the money market, about which we will write later.

The initial reaction led to a sharp repricing of the money market rates.

Lastly, as the economic outlook has become even more clouded since the June meeting (more below), the terms of the TLTROIII operations were made even more favourable and their maturity extended from two to three years.

ECB rate cut will not kick-start the economy

The new ECB staff projections presented a gloomy picture, which, according to Draghi, justified full action. Draghi stressed the protracted weakness in the euro area outlook with persistent downside risks. Global uncertainties continue to weigh on manufacturing, while services and construction are still seen as holding up, limiting the recession risk, though it has increased as of late.

Overall, the ECB’s growth outlook remains on the optimistic side in our view (we expect GDP growth at 0.9% in 2020), as we think the impact of the ECB’s easing measures on the real economy will be relatively limited in the current environment. Private savings have already started to creep up despite lower borrowing costs and companies will remain reluctant to step up investments in the current hostile global trade environment. In that light we agree with Draghi that fiscal policy needs to step up its game, but as discussed in Research Germany: Loosening the brake, 5 September, the prospect of any sizable stimulus package in Germany remains dim for now.

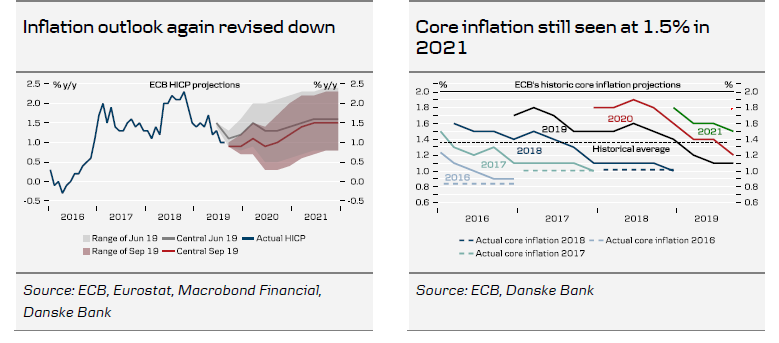

During the press conference Draghi stressed that the continued short-fall of inflation hasbeen a major factor behind the decision to strengthen the state-dependent forward guidance by linking policy measures more stringently to the inflation horizon. HICP inflation is now seen only at 1.0% in 2020, both due to lower energy prices and the weaker growth environment. At the same time, the ECB core inflation confidence remains alive, with core seen converging to 1.5% in 2021. In our view, core inflation rates will remain in a 1-1.2% range over the coming six months as companies remain reluctant to pass on higher wage/input costs to consumers in the current environment to protect their market share. We see few arguments why ECB policy measures announced today should change that dynamic in the near-term.

Strong forward guidance a game changer for EUR/USD over the medium-term

The ECB meeting proved a rollercoaster ride for EUR/USD – as it usually is when the ECB changes interest rates. The pair initially jumped as the ECB only cut 10bp, but sold off immediately afterwards on the open-ended QE programme and strong forward guidance. During the press conference, the market got cold feet as ECB President Draghi sidestepped questions about QE details and addressing negative side effects. Finally, when tiering details were published EUR/USD rallied back to levels from before the meeting.

In the short term, the combination of the rate cut and tiering could cause volatility in the shortterm EUR money market, which could spill over to EUR/USD. Over the medium-term, we think that the ECB regained some credibility today with its strong forward guidance, which makes EUR a more two-sided bet. We keep our forecast on 1-3M of 1.10. The Fed meets next week, where we look for a 25bp cut in line with market expectations, but likely no strong pre commitment to further easing which will could weigh on EUR/USD.

Fixed income markets: German curve 2-10y to flatten further

For the fixed income market today has been very eventful and volatile. Initially, the market rallied in both Germany and periphery. The decision to make the new APP open-ended with EUR20bn a month and the state-dependent forward guidance was received well by investors.

However, during the press conference it became clear that very little monetary manoeuvre room is left for the ECB and Draghi was clear that fiscal policy has to take over. But the big market impact came when the tiering details were published. It pushed the short-end higher for two reasons in our view:

1. The average deposit rate actually rose as more than 40% of excess liquidity can now be placed at 0%.

2. The incentive to hold negative-yielding short-dated bonds may drop as banks can now be exempt from negative rates for a sizeable amount. The latter effect is visible in the Schatz asset swap spread that tightened almost 4bp today. The bund spread moved 1bp wider on the APP programme.

The curve 2s10s flattened strongly today as the two effects (tiering and QE) pushed shortand long-dated yields in different directions. We believe that the curve flattening has room to continue. We see a clear risk that the market will conclude that this is not enough to revive inflation expectations and growth and together with the open-ended QE programme is keeping a downward pressure on the long end – at least until sizeable fiscal easing is announced, about which we are doubtful.

On the other hand the tiering system might still have ripple effects for the short end of the curve. Furthermore, the market might lose faith in further rate cuts given Draghi’s comments that monetary policy has now done what it can.

In respect of semi-core and periphery, we still see room for further tightening given the QE programme. We stick to the 10Y segment. Given the risk of unknown effects from the tiering system we would for now stay away from the short end in periphery.

There was no indication of ISIN limit changes.