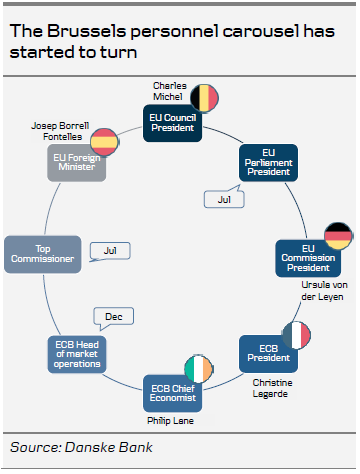

Following intense negotiations, EU leaders have struck an agreement on the succession race for the EU Commission and ECB presidency. German defence minister Ursula von der Leyen will take over the reins at the Commission, while French IMF chief Christine Lagarde is succeeding Mario Draghi at the ECB. Other EU top posts have also been filled with Belgium's Premier Charles Michel scheduled to take over as President of the European Council and Spain's Foreign Affairs minister Josep Borrell Fontelles becoming the EU's new foreign policy chief.

Lagarde has not given monetary policy speeches worth highlighting here, however she is open to unconventional monetary policy and does not rule out new economic thinking. Her reliance on IMF staff implies no imminent change in ECB monetary policy . We see no reason to change our call for a broad stimulus package expected in September.

Draghi's term ends 31 October 2019.

Likely monetary policy continuation beyond Draghi but potential toolbox enlargement

It came as a surprise to most ECB watchers, including ourselves, that one of the dark horses for the ECB presidency, the current IMF Managing Director Christine Lagarde was nominated in the end. Although she is not formally appointed, it is a formality in our view, as ultimately the heads of state confirm her nomination (the ECB has to provide an opinion on her qualifications first as well as the European Parliament. Detailed outline of the process is similar to ECB VP, see ECB Research - The road to becoming VP).

Upon confirmation, Lagarde will be one of the two ECB top officials without any formal central bank experience (Lagarde is a lawyer by training, similar to Fed Chair Powell). VP de Guindos was a minister of Economy before joining ECB. That said, she does not join ECB without some monetary policy experience. In her role during the past 8 years at the IMF she has been involved in monetary policy deliberations but the new challenge will also be to guide markets knowing that her every single word will be weighted by market participants.

Lagarde has not provided independent views on her monetary policy stance in past years besides official IMF comments (which have been well prepared by staff). However, we have reason to believe that she supports the IMF line, as she has been conveying the usual openness to the unconventional monetary policy of the IMF at several occasions. She supported Draghi and the ECB’s decision to launch QE in January 2015 and also called for other policy actions to play their role. She has also praised Draghi for his ‘whatever it takes’ commitment in 2012. That is a continuation of the ECB’s narrative.

Interestingly, in a sign of openness to new economic thinking and potential ways to stimulate / keep easy monetary policy conditions, she said during the IMF spring meetings this year that MMT ‘could possibly work for a short period of time’ in situations such as if there is deflation, however, she also stressed clear caveats with MMT.

As the monetary policy toolbox is looking rather challenged at this stage, and before fully endorsing MMT, she has the political knowhow and gravitas to build bridges across the political landscape, collaborate with policy makers in various institutions, to the right policy mix. In other words, her experience and collaboration with other institutions may speak to her advantage and be exactly what Europe needs at this stage. At the same time, we will likely hear continued questioning about central bank independence as not central bankers of background, but politicians of background will head the ECB (other major central banks, c.f. Powell versus Trump jitters). We will likely hear an intensification of that theme in the coming weeks and months.

Finally, in a show of continuation beyond Draghi, the ECB has called for structural reforms and other policy areas to step up their effort to bring inflation higher since the sovereign debt crisis erupted. However, politicians have not listened to Draghi, leaving upside to Lagarde in delivering this. Lagarde welcomes further deepening of the EMU.

No need to change our ECB call

With the nomination of Lagarde as new ECB president, we see no reason to change our ECB call for a package deal in September consisting of 20bp cut, QE restart of EUR45- 60bn, tiering and extended forward guidance, more in ECB Research - New ECB call - rate cut and restart of QE. We still expect ECB to open the door for easing in the July meeting as near-term macroeconomic momentum is challenged and inflation expectations continue to fade. Even Lagarde taking office in November after the announcement and implementation of a package deal, she will still have the ‘one of the most difficult jobs’ as she called Draghi’s job in 2015.

ECB board change almost complete

With the nomination of Lagarde and her subsequent appointment on 1 November 2019, there is still one seat to be filled to complete a large change in the ECB board that started just one month ago. Coeuré’s term ends in December and is the last guardian of the Draghi/Praet/Coeuré team who shaved monetary policy for years. The process to find Coeuré’s replacement has not started yet, but will likely start in the course of Q3.

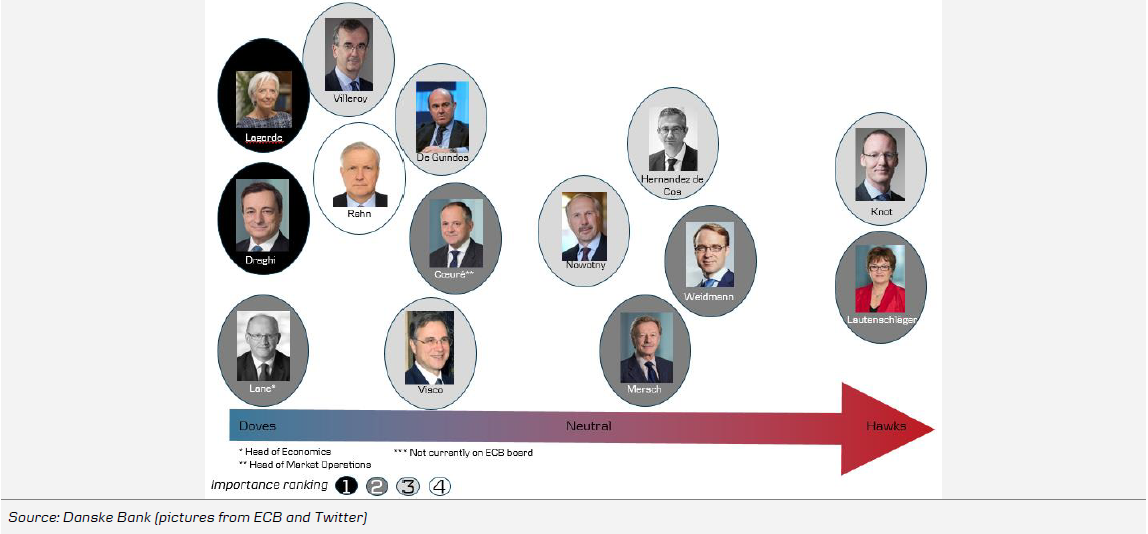

The appointment of Lagarde makes us conclude that we will still have a relative dovish leaning composition of the governing council (dove-hawk meter in appendix).

A Franco-German pas de deux

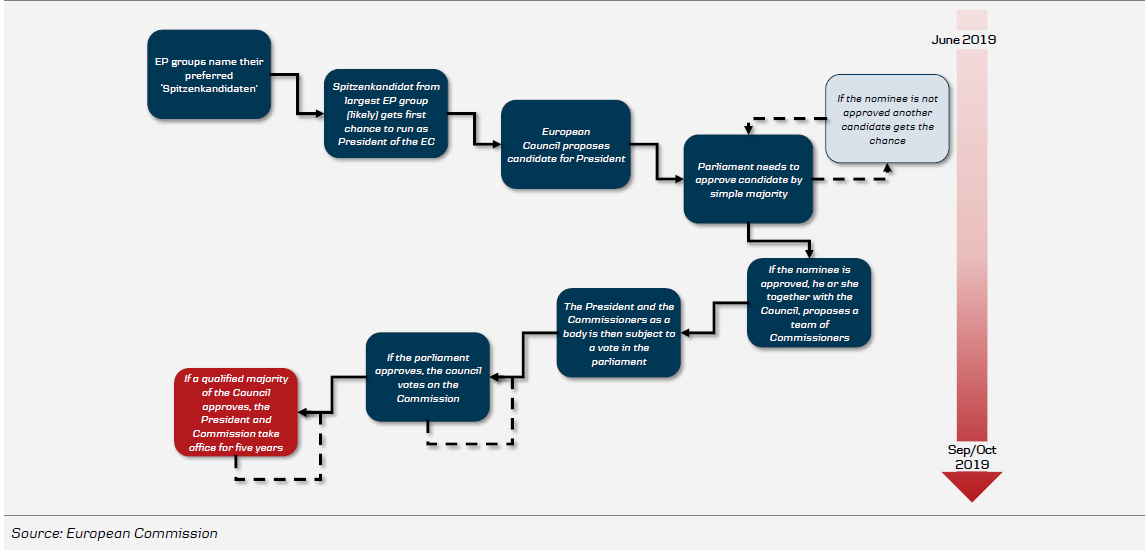

While the EU parliament will chose its President – likely amid the Social Democrats - already on 3 July, the Commission President appointment follows a more entangled process (see below), which could see the Parliament cast a vote of confidence on the appointment in mid-July. Opposition in some parliament groups to the Council deal and the ‘death’ of the Spitzenkandidaten system is starting to grow, hence the appointment of the Commission president could still prove a rocky road. While the fact that two out of four top posts went to women could appease the Parliament somewhat as it chimes in with its call for more gender diversity, the geographical concentration – with all posts going to Western European countries - might prove a further issue during the appointment process.

Once Ursula von der Leyen - a seasoned centrist politician from Angela Merkel’s CDU party - has been confirmed by both Council and Parliament, a team of Commissioners will need to undergo a similar procedure of appointment – a process that could well drag out in the autumn, before the new EU Commission is scheduled to take office on 1 November. At the current stage, it is difficult to draw strong conclusions on the impact of the personnel changes on European policymaking, but we think the appointments are unlikely to rock the boat. As defence minister, Ursula von der Leyen pushed for closer European cooperation and she has previously expressed support for the idea of a federalist Europe (i.e. ‘United States of Europe’). Hence, we think she could be a Commission President that strives to unite the different factions in the EU and – wherever possible – try to support Macron’s agenda of building a closer and more integrated Europe.

ECB dove-hawk meter

Commission appointment will drag out into the autumn