Is The ECB Looking To Steal The Spotlight This Week?

The ECB meeting on Thursday just got a lot more interesting, with markets pricing in a high probability of a rate cut despite a previously widely held belief that it won’t come until September.

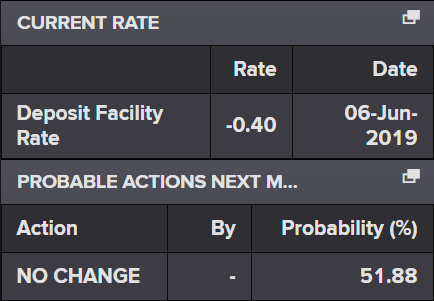

Odds for a 10 basis point rate cut rose to 48% according to Reuters, a day before the decision is due to be announced and following the release of some pretty woeful manufacturing data.

Source – Thomson Reuters Eikon

While this is still below the threshold that is usually associated with a move being highly probably, it is still very significant and puts additional focus on the decision and press conference that follows.

Surprise July Rate-Cut Odds Rise

The manufacturing data on Wednesday was particularly poor, with the eurozone PMI slipping to a more than a six-year low, at 46.4, which unfortunately is not a blip and instead the continuation of a very worrying trend. Germany saw its reading fall to an even more pitiful 43.1, the lowest since the global financial crisis.

Obviously, this one release alone isn’t going to be hugely influential but it is one of many indicators that the ECB will be worried about, including persistent below-target inflation and growth that has been on a downward trajectory since the start of last year.

Unemployment is one bright spot, standing at its lowest level since the middle of 2008, but with certain indicators offering red flags and the global economic outlook being a cause for concern, it wouldn’t be a shock for the central bank to consider acting early.

Only last week, the New York Fed President John Williams gave a speech about the benefits of preventative action in avoiding a downturn and having to rely on much less firepower than central banks have had in the past. If this is true of the US then it’s frighteningly so in the eurozone.

One thing that may encourage the ECB to hold off on a rate cut beyond September is that Mario Draghi’s term as president ends in September so it would allow his successor to be the one that steers the central bank in a new direction.

That said, Draghi’s predecessor raised interest rates a couple of times leading up to his departure, which were quickly reversed after his appointment. Perhaps Draghi and his colleagues will decide to wait before embarking on a new course this time around.