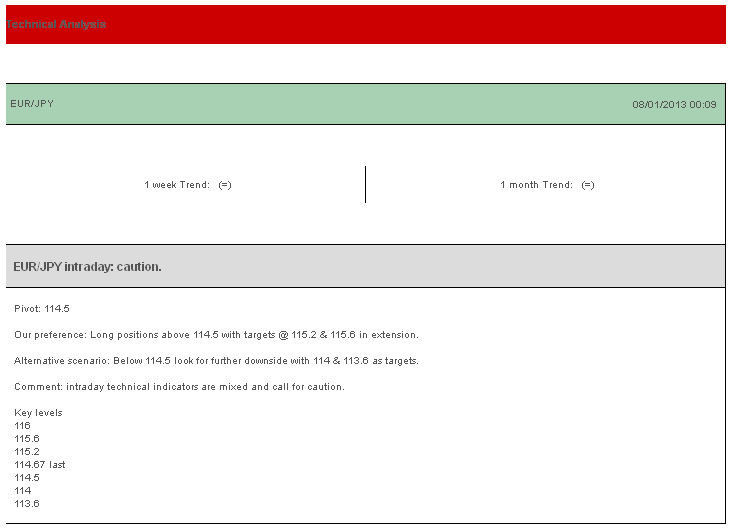

The USD/JPY opened the week above Y88 with Yen on the backfoot with heavy interference from the newly elected Government is expected in 2013. PM Abe wants the BOJ to target 2% inflation via increased bond purchases and monetary easing. With Japan suffering from deflation the market expects the BOJ to announce major new programs to meet the Governments demands. EUR/JPY is critical failing at Y116 but well supported on pullbacks so far.

The EUR/USD was under heavy pressure last week after failing to break 1.3300 once again we turned our focus to the downside. After the FOMC minutes gave traders a reason to buy USD the EUR/USD sank to 1.3010 on Friday. While the major is range trading in the 1.3300-1.3000 range we prefer to buy dips rather than sell rallies with the burden of proof still on the dollar bulls in 2013.

Currency Movement last week

EUR/USD was down -1.15% closing at 1.3067, after opening the week at 1.3217.

USD/JPY was up +2.43% closing at 88.14, after opening at 86.00.

GBP/USD was down -0.60% closing at 1.6070 after opening at 1.6167.

AUD/USD was +1.03% closing at 1.0478 after opening at 1.0370.

This Week’s Trading Preview

Forex Economic Data Preview

In the States: On Wednesday, Crude Oil Inventories. On Thursday, Weekly Jobless Claims forecast at 361k vs. 372k previously. Also FOMC Member George and Bullard Speaks. On Friday, November Trade Balance forecast at -41.1bn vs. -42.2bn previously.

In the Eurozone: On Tuesday, November Eurozone Retail Sales forecast at 0.3% vs. -1.2% previously. Also November Unemployment Rate forecast at 11.8% vs. 11.7% previously. On Wednesday German industrial Production forecast at 1.1% vs. -2.6% previously. On Thursday, ECB Rate decision forecast at 0.75% vs. 0.75% previously. Focus on the press conference afterwards.

In the UK: On Wednesday Trade Balance forecast at -9bn vs. -9.5bn previously. On Thursday, Official Bank Rate forecast at 0.5% vs. 0.5% previously. Also the Asset Purchase Facility is forecast to remain at 375bn.

In Japan: On Friday, November Current Account forecast at 0.31T vs. 0.41T previously.

In Australia: On Tuesday, November Trade Balance forecast at -2.64bn vs. -2.21bn previously. On Wednesday, November Retail Sales forecast at 0.3% vs. 0.0% previously.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ECB Rate Decision Ahead, President Draghi’s Turn?

Published 01/08/2013, 04:32 AM

Updated 03/09/2019, 08:30 AM

ECB Rate Decision Ahead, President Draghi’s Turn?

Last week’s currency trading review

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.