It was widely expected that the ECB would extend the bond-purchasing program by 6 months, instead it was extended by 9 months until December 2017 “and beyond if necessary” with a reduction of EUR20 billion for the extension period of April to December 2017. Thus, the ECB will keep the current QE steady, buying EUR80 billion in bonds every month until March 2017 and then the ECB will purchase EUR60 billion in bonds from April 2017 until December 2017. Of course, the rates remained steady at -0.4%, 0% and 0.25% for deposit facility rate, interest rate and marginal lending facility rate respectively, which didn’t catch us by surprise.

At the time of the announcement, the EUR/USD recorded a session high at 1.087 which had proven to be a spike since it managed to fall back to the 3-day low level of 1.059 during the day. Investors misrepresented the announcement of the extension of the QE, since they thought that the “tapering” of the program is near due to the reduction of the purchases for the 3 quarters of 2017. However, during his press conference, President Mario Draghi made it clear that no “tapering” of the program was discussed or announced.

Mario Draghi also paid attention to the likelihood of more stimulus if

the outlook becomes less favorable or if financial conditions become inconsistent with further progress towards a sustained adjustment of the path of inflation

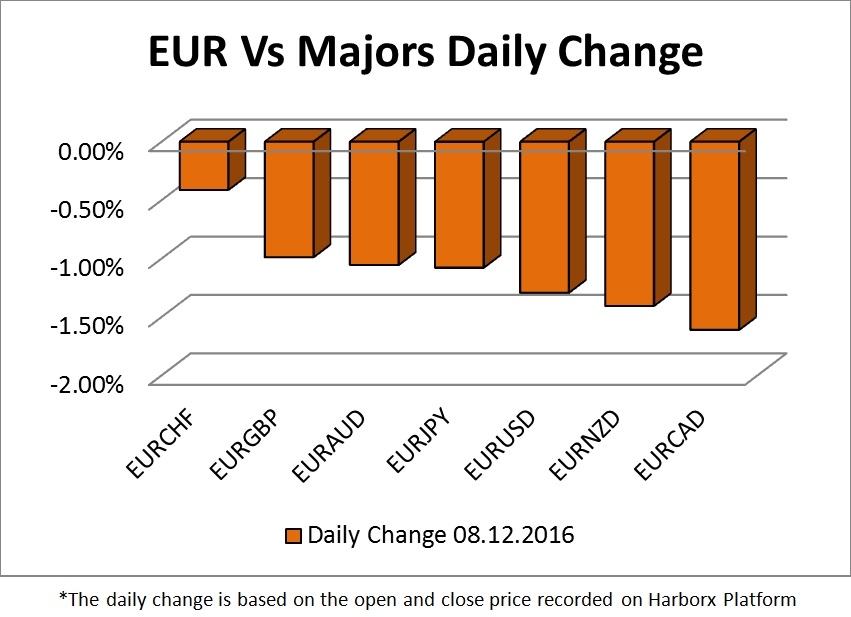

This made his speech quite dovish. The biggest winner of the day was the Canadian dollar which keeps on rising after the OPEC deal and especially EUR/CAD which was boosted 1.6% higher due to ECB announcement and oil's rising prices.

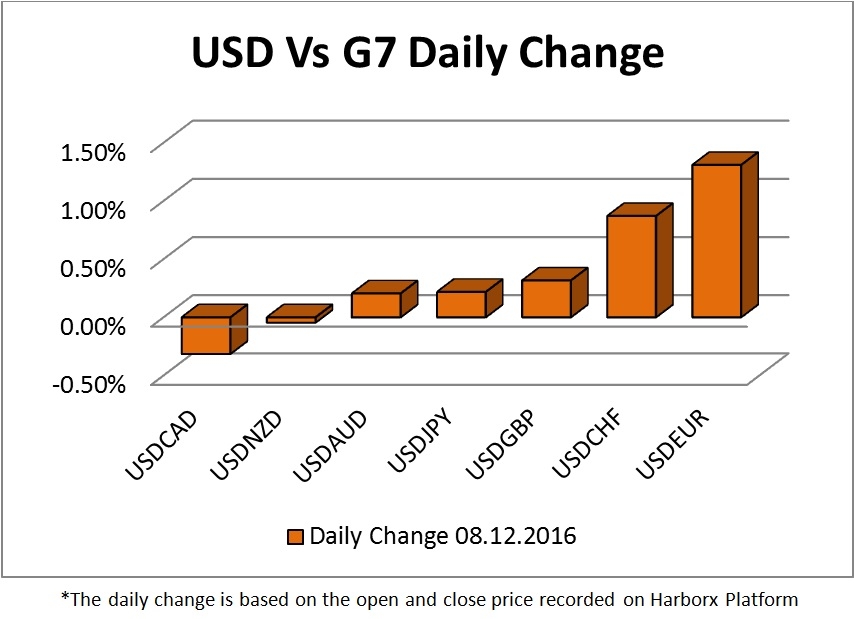

US Dollar Daily Performance

The US dollar also benefitted from the ECB decision, since it closed the day higher against most of the majors, especially against EUR/USD and USD/CHF. The only pair standing strong against the US dollar yesterday was the loonie, which is rising since the OPEC deal day. The next big event that will determine greenback’s direction is the Fed policy meeting on December 14th where we widely expect to increase the rates by 25 points, but we should closely watch the Fed's plans for the next year, now that the data have changed.

Technical View

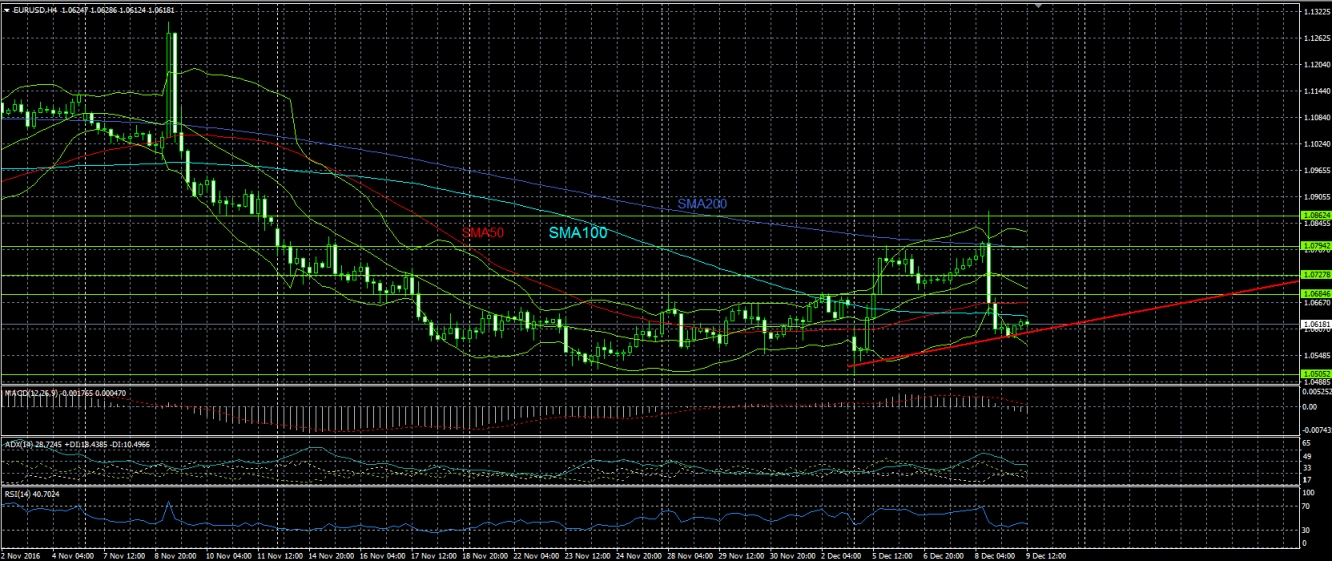

EUR/USD

The main currency’s strength was defeated yesterday since it fell sharply from 1.0872 to 1.0588 breaking the triple SMAs to the downside. The pair is consolidating between 1.058 and 1.063 while the Bollinger’s Band® have been narrowed waiting for the next expansion. On the one hand, EUR/USD fell by approximately 280 pips within some hours, on the other hand the pair did not manage to create a new low level and it actually created a higher low than the previous one.

This can be clearly seen on the 4-hour chart where the reversal of the sharp downtrend has not yet been canceled. Moreover, MACD and RSI are sloping upwards and ADX still indicates a healthy positive direction with the positive Directional index laying above the negative DI. We would expect the pair to correct up to at least SMA200 which coincides with the resistance level of 1.066. On the flipside, if the pair crosses the support of 1.057 to the downside then we would expect further bearish movement down to 1.054.

GBP/USD

The Cable confirmed the short-term downtrend with a new session low at 1.255 and a cross below SMA200. We would expect the pair to test the support of 1.255 again today and signal further downside momentum upon penetration of it. Meanwhile, ADX indicates no clear directional movement while RSI is slopping downwards and MACD is on bearish levels below its equilibrium line.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.